Gold price (XAU/USD) climbed above the $2,000 mark on Monday and are currently trading at $2,014 in the indices. The precious metal spiked nearly 18% in the last 30 days delivering decent returns to investors. The price of gold is reaching new highs as the US dollar is weakening due to the Fed’s hawkish stance. Institutional investors are exiting US treasuries and entering the commodities markets investing heavily in gold.

Also Read: Gold To Become Expensive & Reach $3,000: Best Time To Invest?

The development is making the precious metal’s price rise as it’s attracting heavy bullish sentiments worldwide. In this article, we will highlight a price prediction made by an AI for gold (XAU/USD) for December 2023.

Also Read: Gold Prices To Rise $700 Per Ounce As U.S. Debt Spirals

Gold Price Prediction (XAU/USD): December 2023 Made By AI

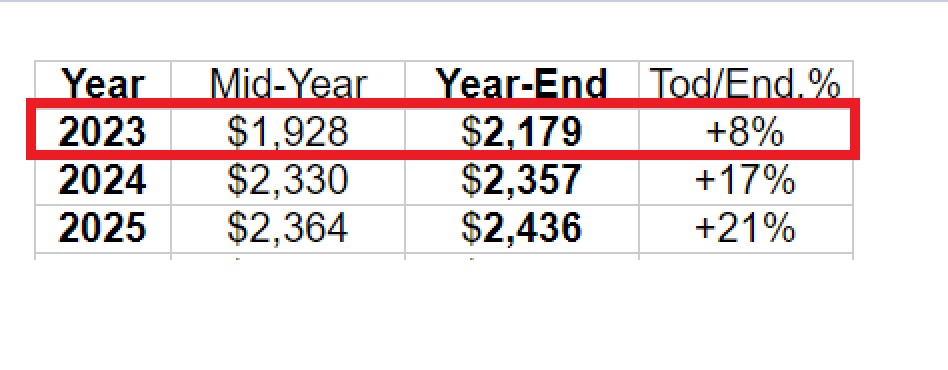

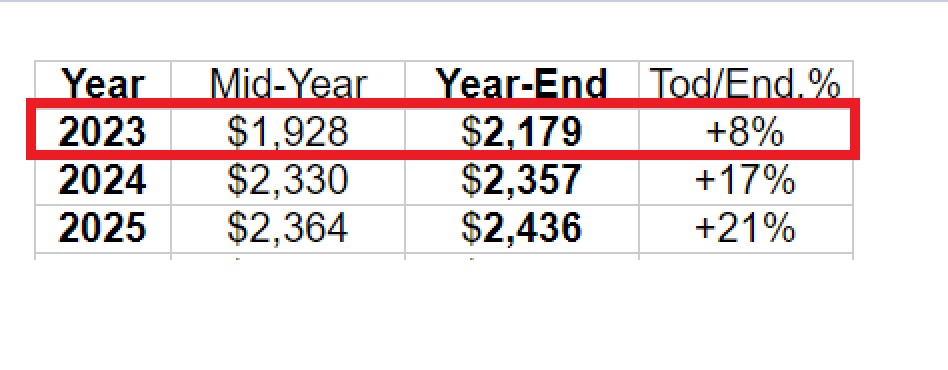

CoinPriceForecast, a machine-learning AI algorithm has predicted gold prices (XAU/USD) for December 2023. The prediction is bullish and could deliver decent returns to investors in the next 30 days.

According to the price prediction, gold could end the year reaching a new high of $2,179 next month in December 2023. That’s an uptick and return on investment (ROI) of approximately 8% from its current price of $2,014. Therefore, an investment of $10,000 in gold today could turn into $10,800 next month if the price prediction turns out accurate.

Also Read: Gold Prices Forecasted To Rise 50% In 2024, Reach $3,000

Nonetheless, the commodities and gold markets are volatile and could change depending on global macroeconomic situations. There is no guarantee that the precious metal could reach the $2,179 target next month in December. The conflict in the Middle East could pull the markets down leading to severe losses in the commodity markets.

The Israel and Palestine conflict is among the top reasons why investors exited the equity markets and entered gold. If the tensions between the two nations escalate, the markets could be under tremendous pressure and begin to print losses. Therefore, it is advised to do thorough research before taking an entry position into gold and commodities at the moment.