The prices of gold are skyrocketing due to the ongoing conflict in the Middle East between Israel and Palestine. Gold prices spiked double digits this month rising by 12% in November. The precious metal was at $1,815 at the end of October and reached a high of $1,968 last week.

However, its price saw a pullback due to the Fed’s hawkish stance on the US dollar on Friday. The precious commodity is now at $1,938 and remains briefly in the red at the start of the trade on Monday.

Also Read: BRICS Looks to Ditch US Internet Services & Create New Alternative

However, the conflict in the Middle East could escalate further as the US did not support a ceasefire in Gaza. Israel and the US are committed to engaging in the Gaza Strip indicating that the conflict could go on further.

The development adds to the burden on the already suffering global stock market which remained bearish this year. In this article, we will highlight how high gold prices could go next year in 2023 reaching a new all-time high.

Also Read: BRICS: Russia Outperforms US Dollar by Dumping Yuan & Ruble Currencies

Gold Prices Estimated To Spike 50%, Touch $3,000 in 2024

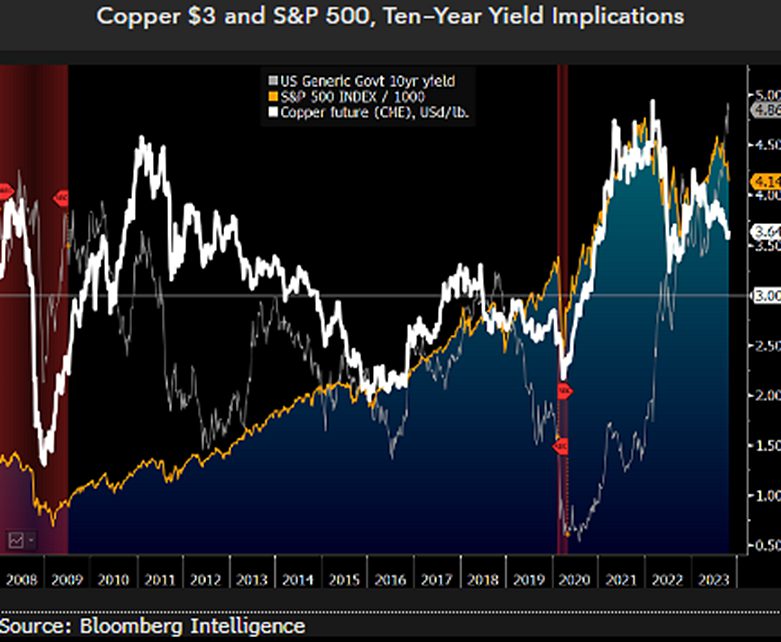

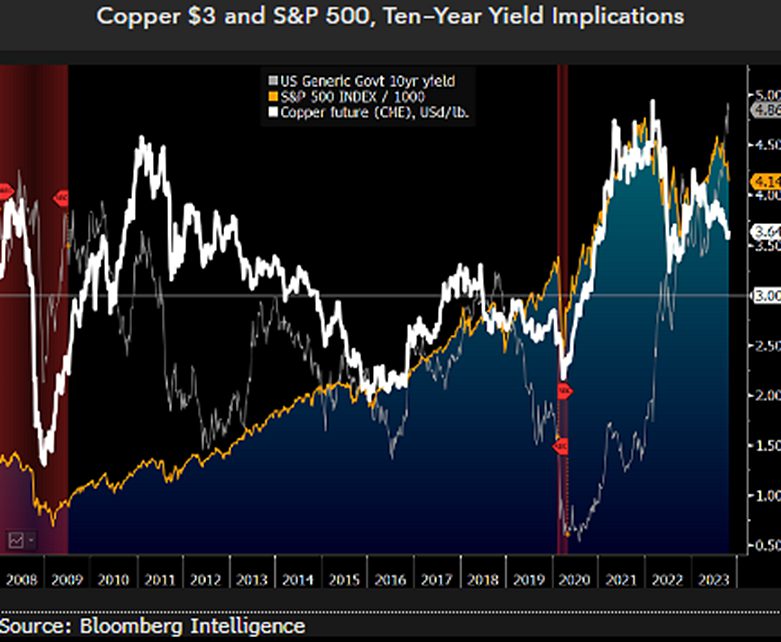

Senior commodity strategist Mike McGlone wrote that gold prices could skyrocket further and reach $3,000 next year in 2024. The macroeconomic conditions could push gold prices up and weaken the stock market, the Bloomberg commodity strategist forecasted.

Also Read: 3 Ways BRICS Could End U.S. Dollar Supremacy

McGlone published a report titled “Copper $3, Gold Toward $3,000: US Recession Could Be 2024 Path” this month predicting that a big upswing in gold prices is on the way. If gold hits $3,000 next year, it would be a return on investment of nearly 50% from its current price. That’s a huge leap for gold in less than a year if his prediction turns accurate.

The global adversity will help gold to spike in price as it is a safe haven and a hedge against inflation. The development “may portend a firming foundation for the metal,” McGlone summed it up.