Ark Invest’s Coinbase shares purchase spree has been going on in full swing. Cathie Wood’s investment management firm reportedly bought $2.5 million worth of shares on Thursday, making its third purchase of this week.

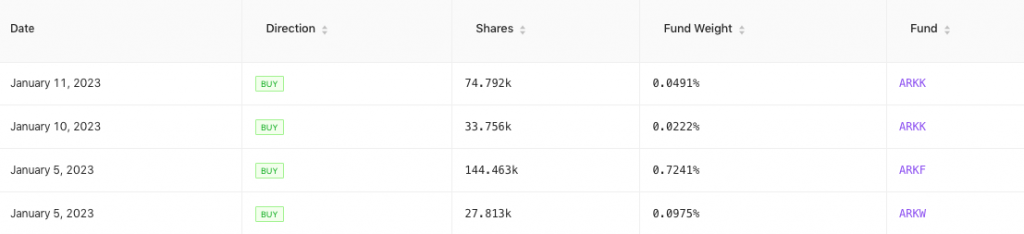

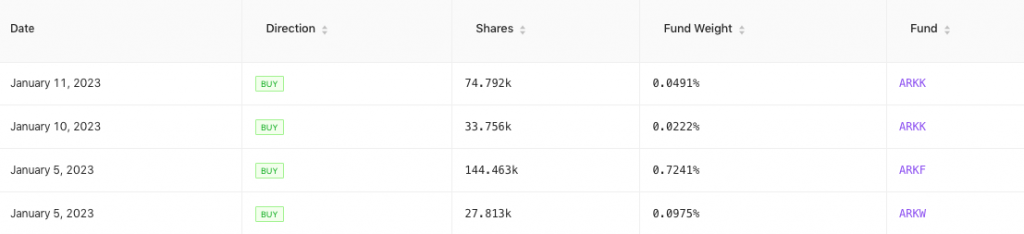

As reported earlier, ARK bought 33,756 shares on January 10 and 74,792 shares on January 11. Based on the last close price of $47.55, the aggregate value of all these purchases, including the latest one, comes up to $7.35 million.

Before this week, Ark Invest bought another 172.27k shares on January 5 for its ARKF and ARKW funds.

Also Read: ARK makes second purchase of Coinbase shares in a week

COIN’s price has noted a steady 41.22% incline over the past 5 trading days. When compared to its Friday lows of $31.59, the share price has already escalated to $47.55.

However, the latest uptick registered has hardly made any difference on the macro frame. When compared to where it was trading a year back, COIN is currently $180.68, or 79.17% down.

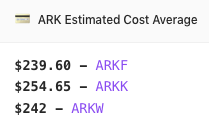

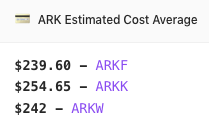

At the moment, Ark holds around 8.716 million COIN shares in its ARKK, ARKW, and ARKF funds. They together account for 3.21% of the firm’s total investments. The firms’ aggregate purchase price currently hovers in the $239.6 to $254.6 bracket.

Also Read: Coinbase Exchange Re-Demands User Information In Ongoing Lawsuit

Other Coinbase Related Devs

Earlier this week, Coinbase announced that it was firing a fifth of its workforce to remain afloat amid the turbulent market conditions. Around 950 employees were impacted by the decision.

Prior to this, around 60 employees were asked to leave the company in November 2022, while in June, the exchange fired 18% of its workforce. These layoffs also stemmed from the prolonged bear market conditions that stunted the company’s growth.

However, experts are reportedly “encouraged” by the job cuts. Wedbush analyst Dan Ives said that the cuts are “an important first step, but not necessarily the end.” He further opined that there could still be more cuts, but asserted that the latest move showed that the management was “focused on cash preservation.”

Additionally, Coinbase CEO Brian Armstrong is also quite optimistic. In a letter to employees that was made public by the platform, the executive noted that a competitor falling will ultimately help the exchange greatly.