It is a known fact that American billionaire entrepreneur Mark Cuban is an Ethereum maximalist. Time and again, he has voiced out his mega-bullish views concerning the asset, and more often than not, has been validated by others from the community.

Even though Ethereum’s fundamentals remain strong and its use-cases keep expanding, ETH has not been able to consistently perform well on the price front. Back in November last year, Ethereum went on to surpass the $4.8k price mark. However, for the most of this year, it has been trading under $3.5k.

Monday’s dip dented the token’s bullish prospects even further. After noting a 4% daily dip ETH was trading sub $3k, at $2911.57, at press time.

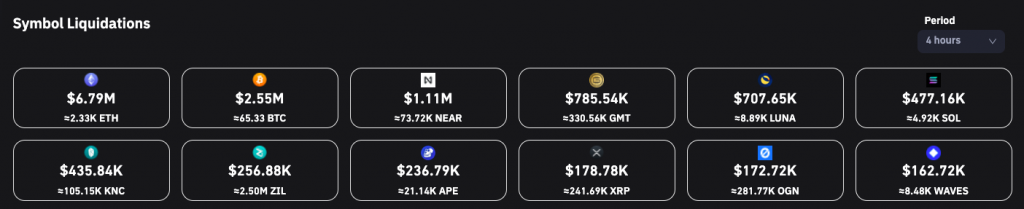

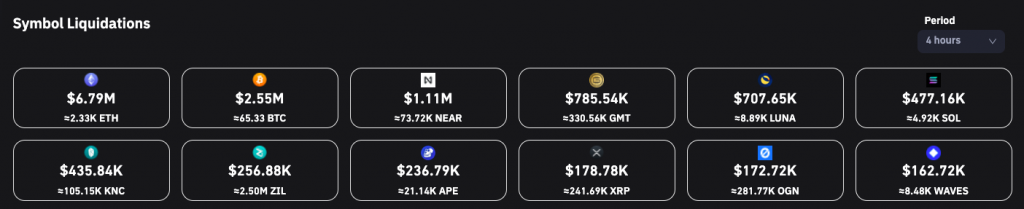

Consequentially, in the 4-hour window, Ethereum liquidations had surpassed that of all other major coins. Data from Coinglass brought to light the same.

While ETH worth $6.79 million was wiped off in the said period, the liquidations of assets like BTC and NEAR stood at $2.5 million and $1.1 million respectively. All other coins’ liquidated value reflected merely 6-digits.

Cuban’s Ethereum HODLings shrink alongside

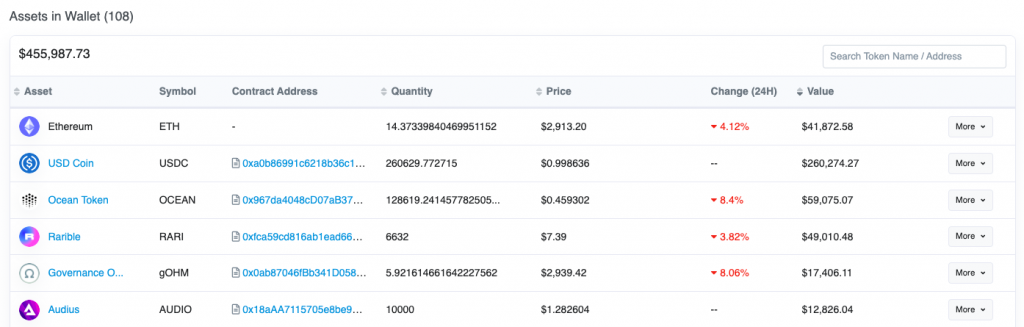

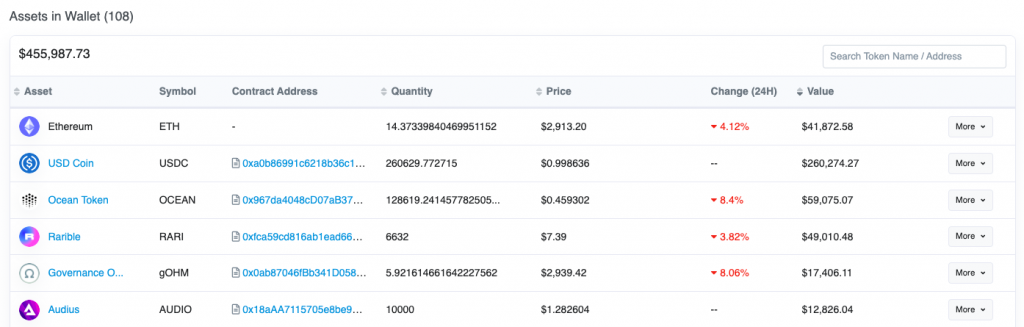

Despite the dip, ETH remains to be the top asset in Cuban’s wallet. The billionaire maxi possesses 14.37 ETH, cumulatively worth $41.87k. Cuban’s wallet became public when he revealed his NFT collection on Lazy, and people from the space have been tracking it ever since.

Interestingly, Circle’s USDC stablecoin has occupied the number two spot. At press time, the 260,629 USDC in Cuban’s Ethereum wallet represented more than 50% of the portfolio. As such, USDC was not present in his portfolio up until late last month.

Investors usually divert funds towards stables during times of uncertainty, for it shields the aggregate value of assets they HODL if the market ends up dipping. So, perhaps, Mark Cuban had anticipated the current dip and might re-divert his USDC funds with other top assets, like Ethereum, over the next few days. Thus, it’d be interesting to keep an eye on his wallet to see if does so.