Crypto asset prices have been mundane so far in 2022. It’s been weeks since Bitcoin has remained stagnated around the $20k mark. All attempts to climb above the said level have been futile till now.

The market has additionally been characterized by low volatility of late. As illustrated below, this metric noted a free fall to its one-year low towards the end of last month. Despite noting a slight recovery, it continued to hover around its lows at press time.

As a result, the largest crypto asset is currently less volatile than equity indices like Nasdaq and the S&P 500.

Also Read: If MicroStrategy invested in Ethereum over Bitcoin, What would be its Valuation?

What to expect going forward?

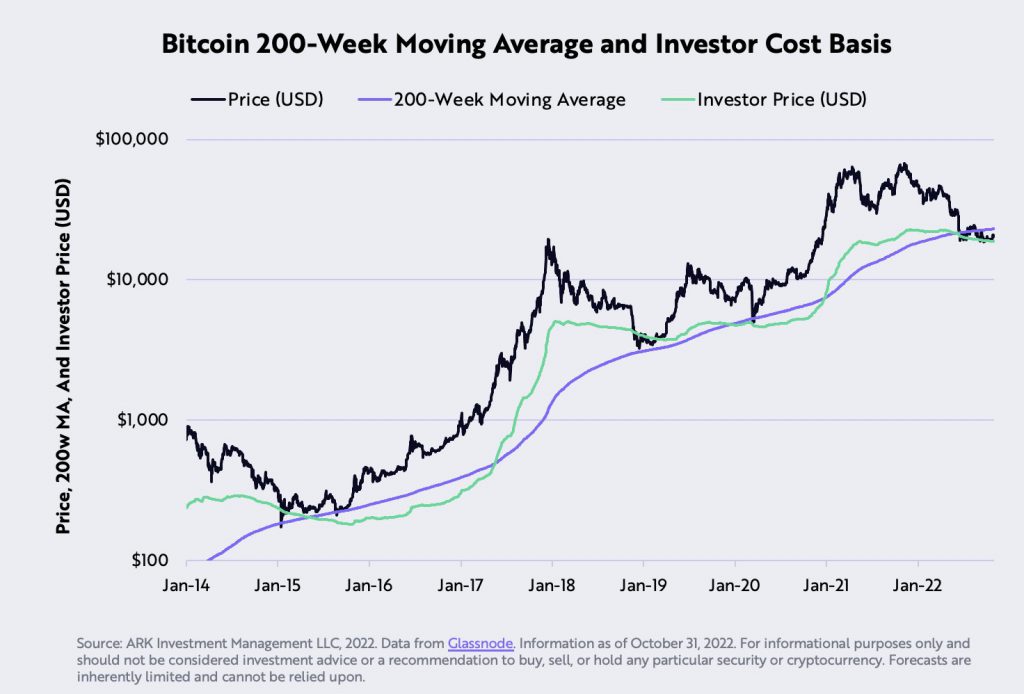

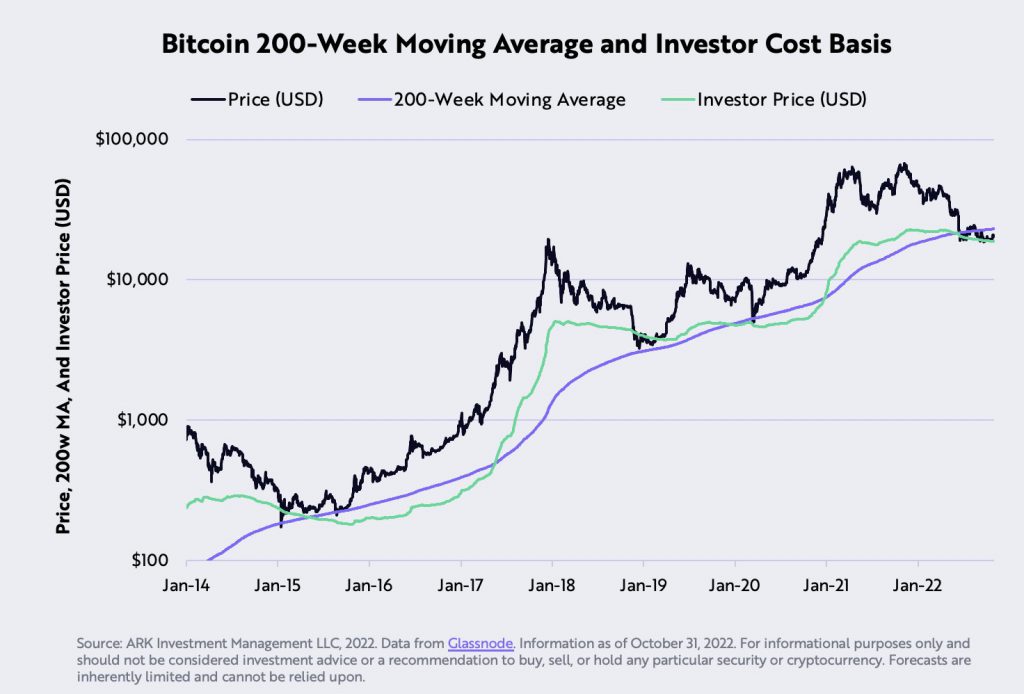

Yassine Elmandjra—Crypto Analyst at ARK Invest—took to Twitter to highlight the current state of affairs in the market. As highlighted below, Bitcoin continues to trade between support at its investor cost basis [$18,814] and resistance at its 200-week moving average [$23,460] for the third month in a row. Resultantly, the analyst opined,

“Given the tight range, an expansion in volatility should be expected soon.“

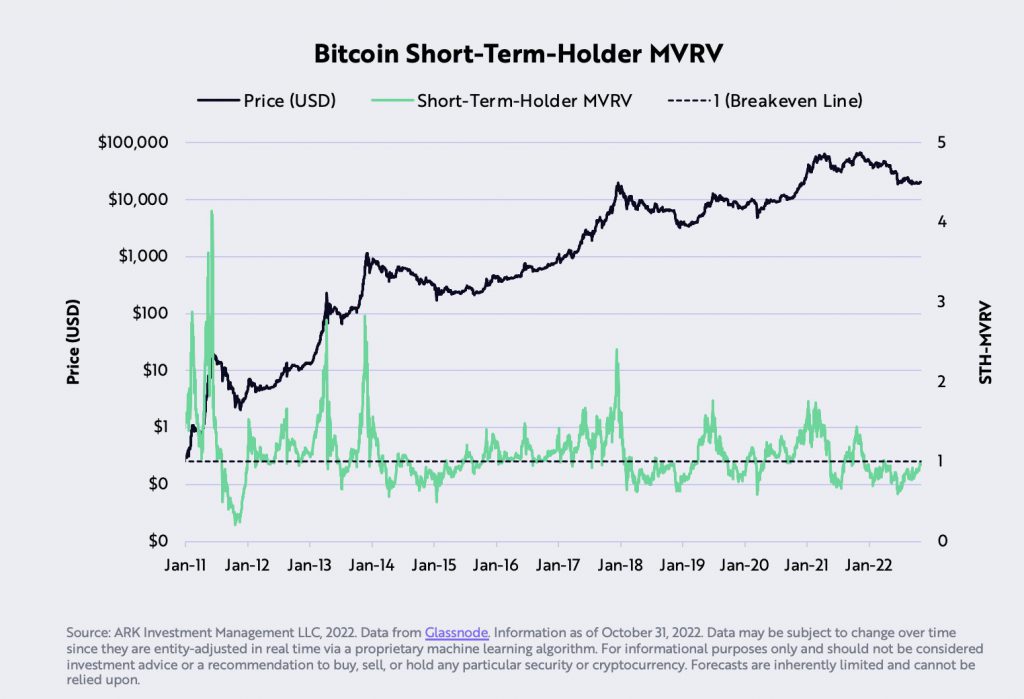

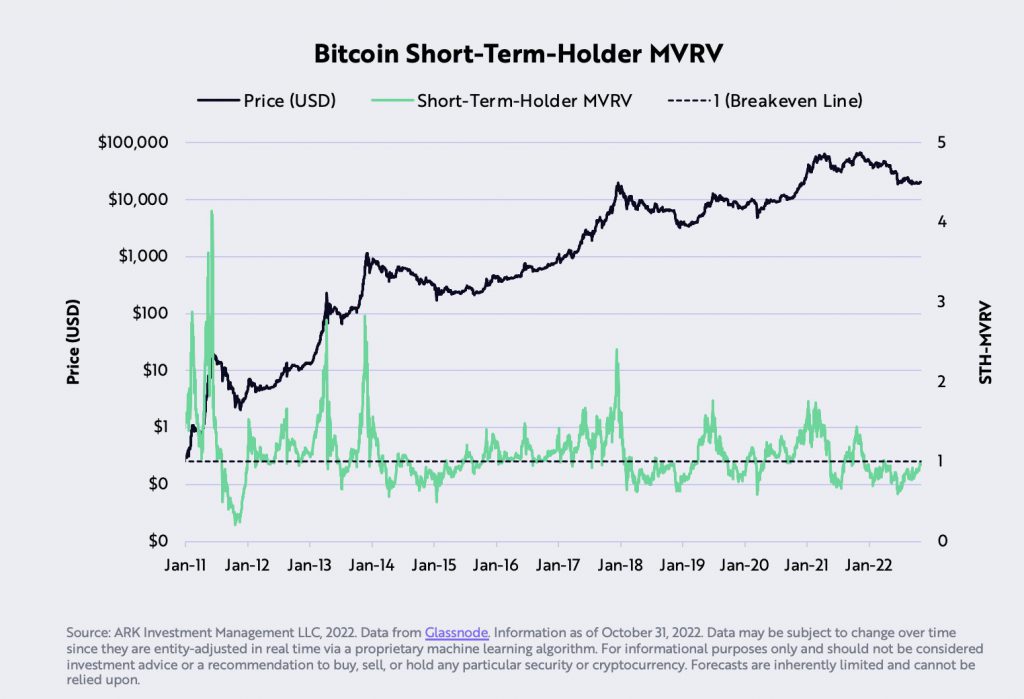

Currently, near 1, the short-term MVRV is at a crucial threshold for bulls to show dominance overbears. However, it should be noted the said set of HODLers are trading around breakeven [dotted line] at the moment, likely signaling a point of resistance.

At the moment, there’s no buying momentum to aid Bitcoin climb higher. Per data from CryptoQuant, the aggregate exchange flows have been negative for 5 out of the past 6 days. At press time on Monday, over 6132 BTC was already sent back, indicating the dominance of bears over bulls.

On the daily, Bitcoin was trading slightly above its 100 MA [blue]. Nevertheless, if the current weak momentum and resistance from ST HODLers persist, then, it’d be difficult for BTC to sustain above the same. In such a scenario, the largest crypto asset would continue consolidating around $20k.

However, if there’s a volatility injection and if Bitcoin ends up treading on the uptrend path, then, a gradual inclination toward $23.8k can be expected.

Also Read: This level is a ‘Good Springboard’ for Bitcoin in November