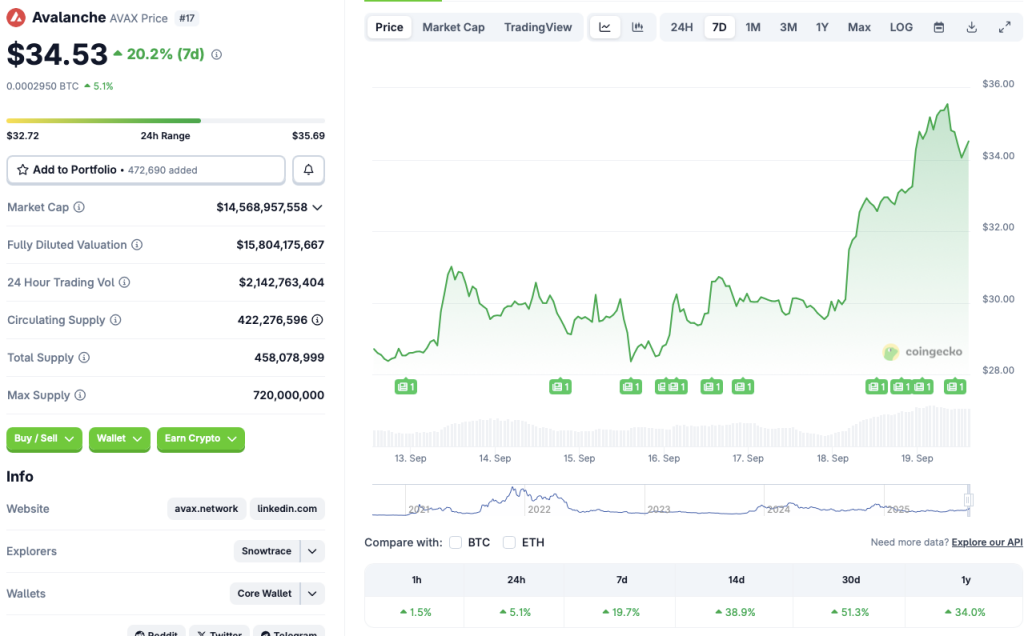

The cryptocurrency market seems to be slacking, despite an interest rate cut from the Federal Reserve. Bitcoin (BTC) is facing substantial resistance at the $117,000 price point, and most other assets are trading in the red zone today. However, Avalanche (AVAX) seems to be defying the market trend, registering rallies across all time frames. According to CoinGecko data, AVAX has risen 5.1% in the last 24 hours, 19.7% in the weekly charts, 38.9% in the 14-day charts, and 51.3% over the previous month. Let’s discuss why AVAX is rallying and if the rally will continue.

What’s Behind Avalanche’s Rally and Will it Sustain?

There are a few reasons why Avalanche (AVAX) may be defying the currency market trend. Firstly, the rally could be due to Bitwise submitting an S1 filing to the SEC for an Avalanche ETF. Crypto-based ETFs have seen substantial inflows over the last few months. Bitcoin (BTC) and Ethereum (ETH) have both hit new all-time highs, fuelled by ETF purchases.

Another reason for Avalanche’s upswing could be the announcement of the creation of two treasuries that aim to raise $1 billion to purchase AVAX tokens. Corporate treasuries have also played a major role in the current market cycle. The ETF and treasury announcement may have boosted investor sentiment.

Also Read: Cryptocurrency ETFs In Q4: Avalanche, Bonk, to Make Debuts?

Thirdly, the rally could be due to the Federal Reserve announcing a 25 basis point interest rate cut. Rate cuts usually lead to investors taking on more risks. Avalanche (AVAX) may have benefited from the rate cut announcement.

According to CoinCodex, Avalanche (AVAX) will continue to rally over the coming weeks. The platform anticipates the asset to climb to $41.48 before facing a correction. Hitting $41.48 from current price levels will entail a rally of about 20.13%.