Avalanche outpaced its top competitors and rallied to a weekly high on Thursday following a 14% price increase. Apart from positive sentiment following the launch of a new trust fund, here are a few reasons which could have contributed to AVAX’s climb.

While most crypto’s climbed higher on Thursday following Bitcoin’s jab at $40K, Avalanche seemed to outpace its immediate competition. The altcoin touched a 1-week high at $69.5 and became the highest gainer among the top 15 tokens at press time.

The rise came in tandem with the launch of a new trust fund (Valkyrie Avalanche Trust) by Valkyrie Investments. The fund is expected to increase institutional exposure to the Avalanche network. The Nashville-based firm, which manages $1 billion in assets, said that the trust will also begin staking AVAX to generate additional returns within the fund.

Following the deal, Valkyrie CEO Steven McClurg said “AVAX is growing rapidly in terms of adoption, largely as a result of its blazing fast transaction speeds…By launching this trust, we are able to give qualified investors exposure to a protocol that they have been increasingly asking about as DeFi projects, NFT platforms, and many other projects”.

Network Health

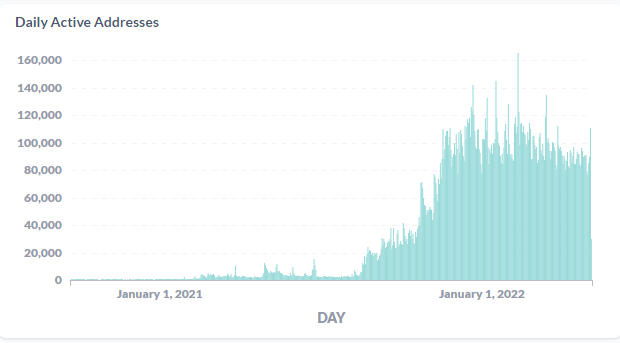

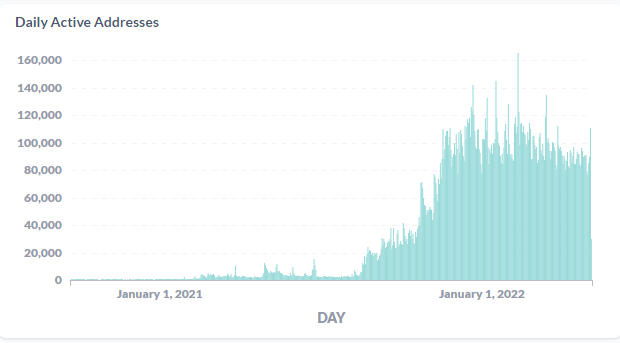

Looking beyond external developments, AVAX’s daily rise was also backed by a sudden spike in daily active addresses on 4 May, suggesting increased network activity. Daily active addresses on the mainnet averaged above 90,000 in April and even though the figure was lower than March levels, Avalanche was able to retain a bulk of investors despite last month’s negative price action.

Avalanche Daily Chart

Technical factors showed that Avalanche’s rise was not completely out of the blue but rather buttressed by important support around $55 which was tagged on 30 April. The price level has been a significant region for bullish traders, helping AVAX climb by 170% to an all-time high of $152 last year. More recently, the area helped with an 80% spike after sellers forced a massive correction in late January.

Forward Path

Despite its daily gain, the near-term outlook for Avalanche remained cautious. The price was trading at the conjuncture of its 20-SMA (red) and $68-resistance – an area that could lead to profit-taking. To establish a more bullish regime, AVAX would have to close above its daily 200-SMA (green) and $97-resistance.