As most tokens from the market continued their downward trajectory on Tuesday, Axie Infinity seemed to be treading on a different path. This gaming token had already managed to wipe off its losses over the past day.

Barring Near and Monero, Axie Infinity was the only token in the top 45 that flashed a green reading on its daily timeframe. After inclining by 0.19%, AXS was seen trading at $47.7 at the time of press.

Axie Infinity is cut from a different cloth

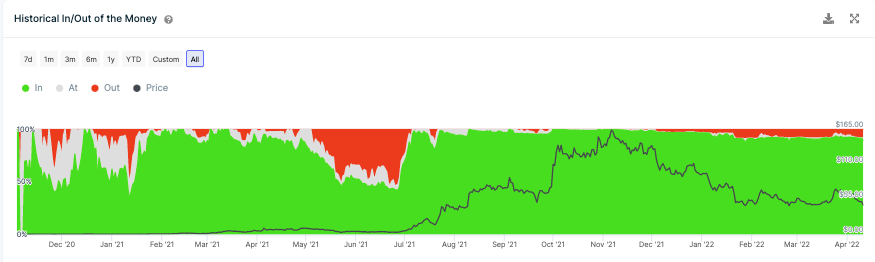

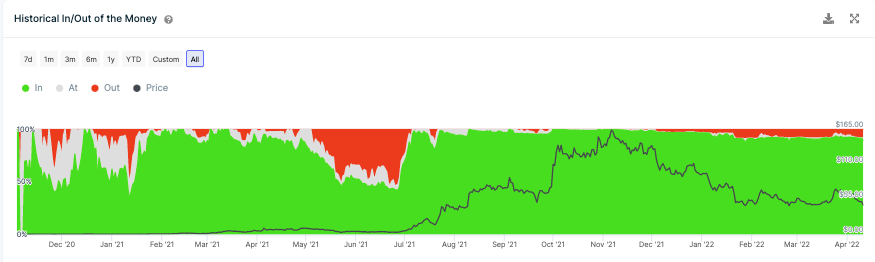

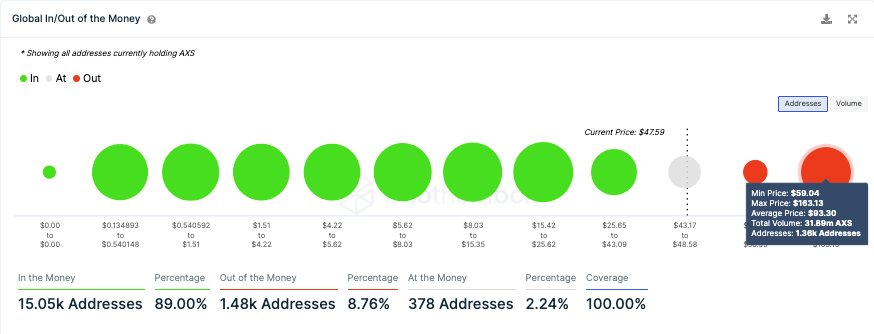

At the moment, Axie Infinity is nearly 70% down from its $166 ATH registered in November. Despite that, close to 90% of the investors are in profit. Such has been the scenario since the beginning of this year.

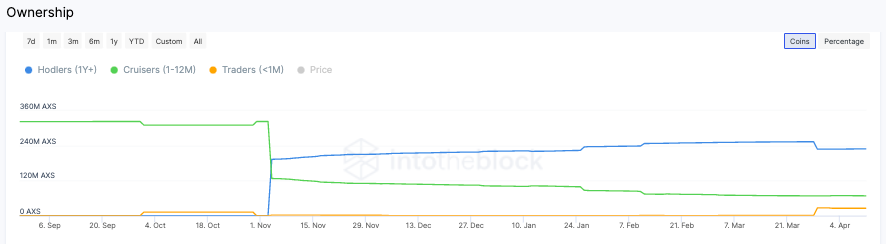

Here it is crucial to note that Axir Infinity noted a change in ownership dynamics at the end of last year. Mid-term HODLers [cruisers] shrunk in number, while long-term participants [HODLers] witnessed a parallel hike.

Now, when both the aforementioned data sets are viewed in conjunction, it can be deciphered that the Axie Infinity market is typically characterized by strong hands [long-term HODLers] who’ve bought their tokens during previous dips. As a result, close to 9/10th of them are in gains.

There is room to glide up

As expected, there is no strong resistance level in and around Axie Infinity’s price. The next major resistance cluster extends from $59 to $163. In this wide price range, over 1.36k addresses have cumulatively purchased approximately 32 million tokens.

So, from the current price, a glide up to $59 would translate to a 24% hike. As such, in a market mainly comprised of HODLers, the selling pressure usually remains low and fosters growth.

Having said that, the state of the broader market to has to be kept in mind. Despite Axie being able to briefly recover and decouple itself over the past day, it continues to share quite a high correlation [0.88] with Bitcoin. So, as soon as the broader bearishness is shrugged off, Axie would likely be among the first tokens to recover and register a leg up.