It wouldn’t be wrong to contend that miners are the heart and soul of the Bitcoin ecosystem. Mining, as such, is the process by which new Bitcoins enter into circulation. And miners usually mine the coins and send them to exchanges for market participants to purchase.

Miners usually cling onto the coins they mine for the long term. On the other hand, whenever they sell, the asset’s price tends to subject itself to downtrends.

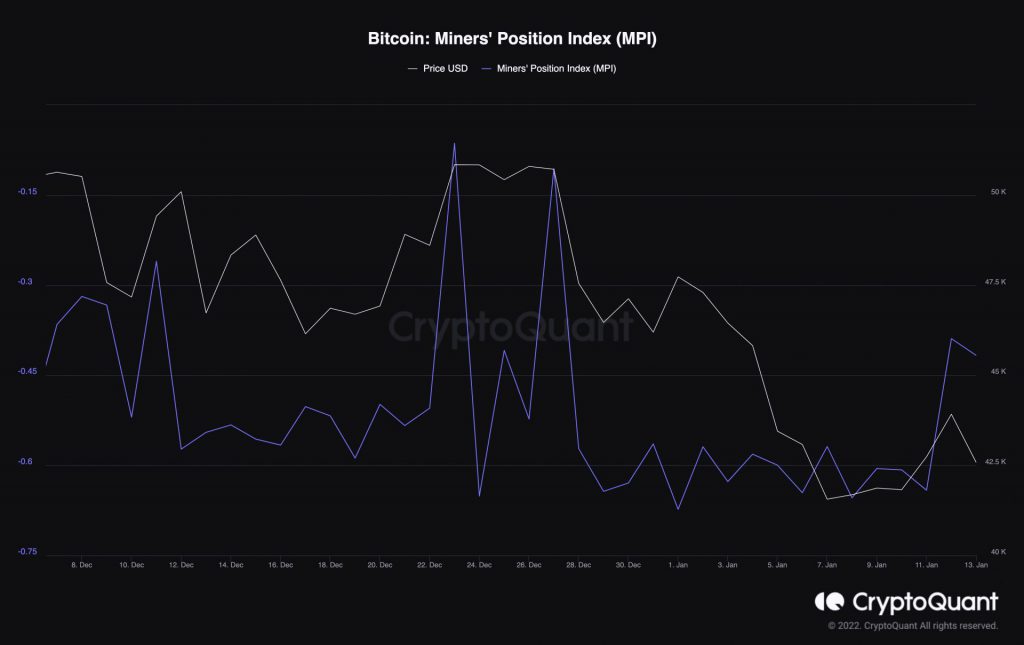

The miner position index, or the MPI, aids in gauging the broader miner trend. Simply put, this metric brings to light the ratio of the total miner outflow to its one-year moving average of total miner outflow.

Higher value shows that miners are sending more coins than usual. The same indicates possible selling. Parallelly, whenever this index depicts low values, it can be inferred that miners are holding onto their coins.

As of now, the said index value is hovering right below 0 [around -0.4, to be precise], and poses so selling threat.

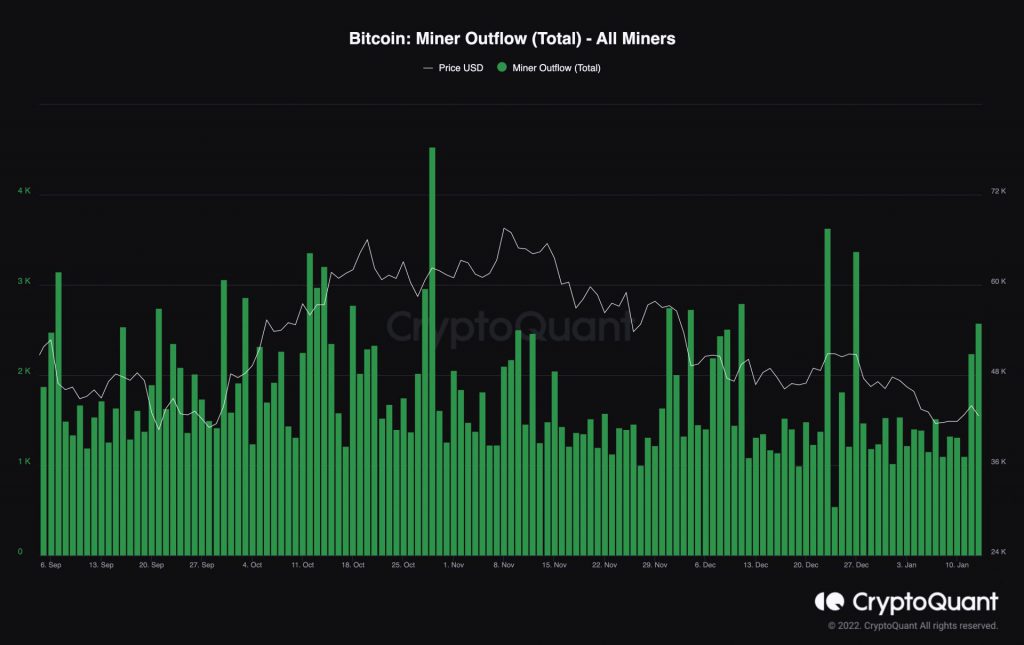

Since the MPI takes into account the one-year moving average into account, it slightly lags behind. Directly looking into the daily miner outflows would give us a better insight into what miners are currently up to.

As can be seen from the chart attached below, the outflow number has risen above 2k over the last couple of days. However, it should be borne in mind that the said rise is quite negligible when compared to the numbers observed in January and March last year [around 10k].

Thus, alongside the usual shuffling, it can be inferred that miners who are in need of urgent liquidity are the ones who are selling their coins, while the remaining continue to HODL in anticipation of a macro price rise.

The hash-rate oddity

BTC’s price has hardly been favorable to bulls since the past few months. In effect, the micro-landscape has transitioned to bearish.

Amidst the state of the current environment, Bitcoin’s hash rate just reached a new ATH of 183 Exahash a day back.

Here it should be noted that to mine, miners have to solve cryptographic equations and to do so, they require computational power. So, a higher hashrate means that more power is required and vice versa.

The hash rate did witness a massive dip around May last year, owing to China’s crypto crackdown. However now, as most rigs have returned back to operation, the hash rate landscape has changed and become even more secure because miners are flocking back into the space.

Usually, a high hash rate coincides with bull markets. As Bitcoin’s price climbed up north in the 18-month macro bull period spread across 2020 and 2021, the hashrate, by and large, remained high. So, with the numbers rising again and Bitcoin miners clasping onto their coins, is it time to expect a bull run again? Perhaps, only time can tell.