According to Arcane Research, the Bitcoin (BTC) and U.S. equities correlation has fallen to levels last seen in December 2021. According to the study, BTC’s 30-day correlation to Nasdaq stands at 0.29. The correlation decline is likely due to the recent rally in the cryptocurrency markets, possibly reacting to a positive CPI (Consumer Price Index) reading. The falling correlation suggests that American markets are becoming less relevant to cryptocurrencies. Moreover, this kind of development is typically regarded as favorable.

Although Bitcoin’s (BTC) correlation to U.S. equities is declining, Arcane notes that there are events that drive up the correlation. For example, upon the CPI data announcement, equities and BTC moved in tandem. However, the hand-in-hand movement did not last long.

Arcane also notes that Altcoins are outperforming Bitcoin (BTC) over a 30-day horizon. This is likely due to Altcoins falling harder after the FTX collapse in November.

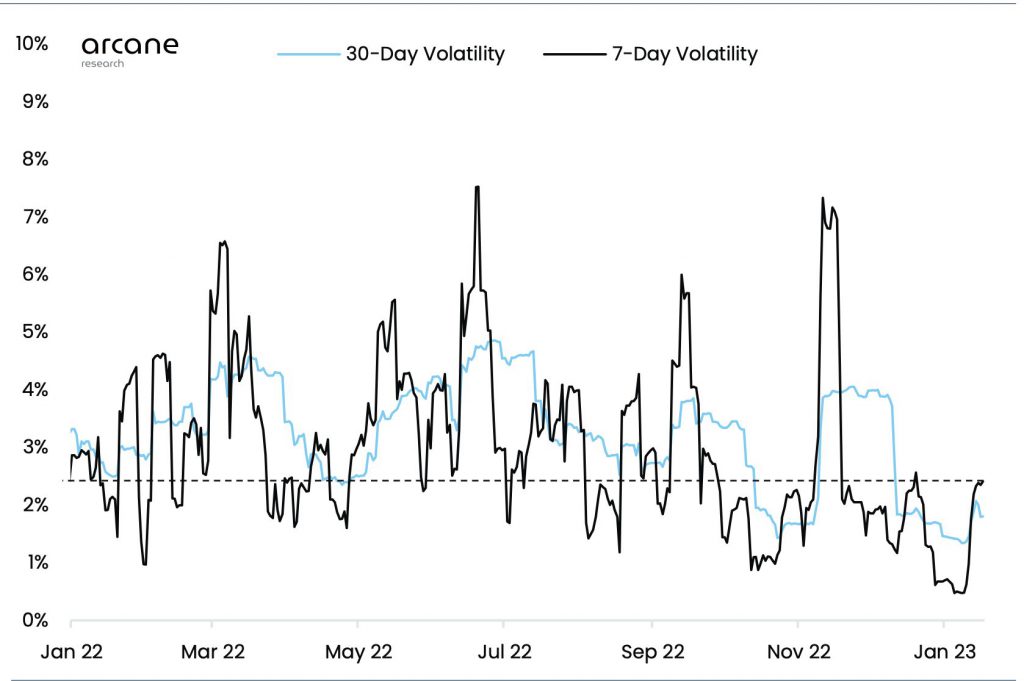

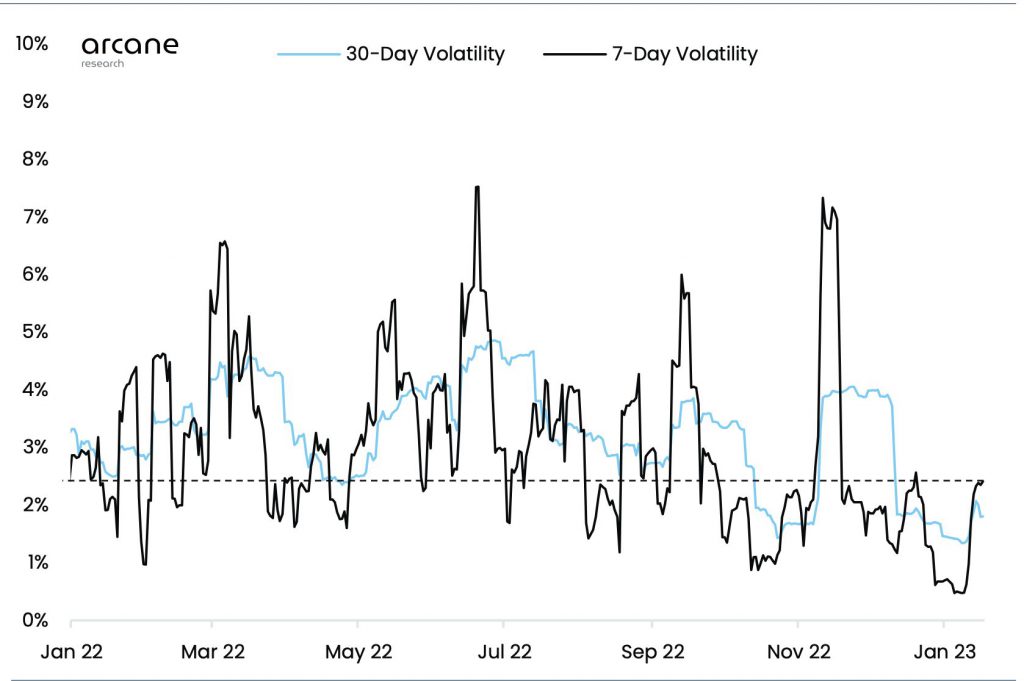

Bitcoin volatility rises, but steady growth

The preceding weekend saw one of the most remarkable rises for cryptocurrencies in a year. The global cryptocurrency market cap reached $1 trillion, a figure not seen since November 2022. Major currencies overcame key resistance levels and extended their rallies.

The little upward trend in BTC intensified last week, increasing the 7-day volatility from the previous week’s low of 0.4% to 2.4%. BTC’s 7-day volatility is not at all unusual and is still less than the 3.1% average 7-day volatility for the year 2022.

However, Bitcoin has seen steady growth thus far in 2023. From Jan 8 to Jan 14, BTC had seven consecutive days of gains, and 13 of the first 16 trading days of 2023 ended in a bullish region.

At press time, BTC was trading at $20,768.00, down by 2.2% in the last 24 hours. Additionally, the original cryptocurrency is 69.9% down from its all-time high of $69,044.77, attained in November 2021.