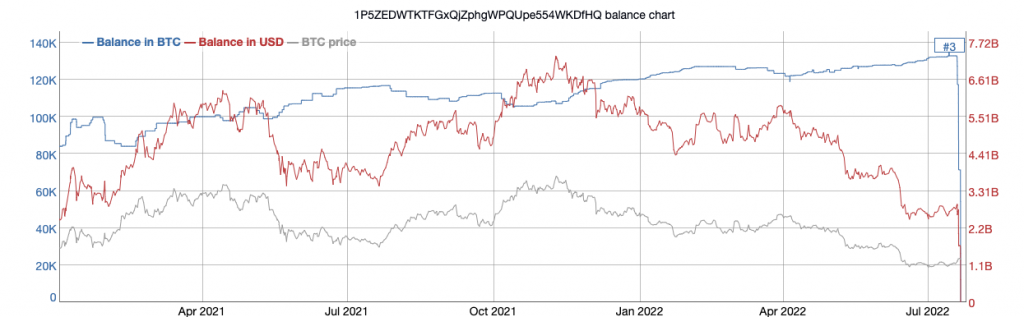

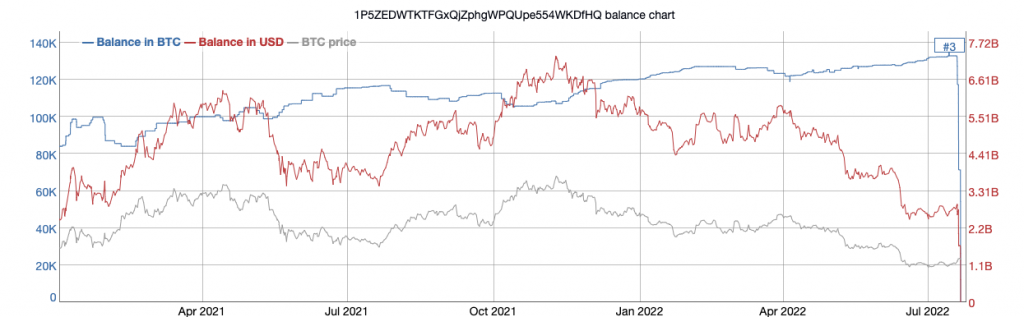

Of late, there have been speculations that the third largest Bitcoin whale has been dumping his HODLings. Retrospectively, people from the community have started vouching that BTC would likely react to the same and drop below $10k.

‘CryptoWhale,’ who has been quite accurate with his bearish predictions, noted that the current phase is “exit liquidity” for whales. Per on-chain data from BitInfoCharts, the whale dumped approximately 15500 BTC on 19 July. Back then, CryptoWhale had asserted,

“I expect much more to be sold off very soon.“

Rightly so, the selling spree did not stop. In a series of transactions spread across Wednesday and Thursday, the whale’s balance dived from 112,382.42 Bitcoin [worth $2,643,251,736] to 0.00999896 Bitcoin [worth merely $230].

The catch

On-chain data analytics platform CryptoQuant’s CEO Ki Young Ju took Twitter to contend that the wallet might either be a cold or custodian wallet “highly likely” owned by Gemini and pointed out that the transaction(s) are “just internal.” He also asserted,

“What’s obvious is that it’s not a user deposit to exchange hot wallets for selling $BTC. Not at all.“

Young Ju went on to highlight that the balance held by the OG wallet had been moved to another new cold wallet. He also stated that the last batch of $29k BTC transferred “might” be added back.

“This internal transfer seems to be finished soon. The rest of the BTC held by “1P5Z…” moved to “1LQo…” Now, this new cold wallet has 103k BTC, and 29k BTC might be added more from “1FzW…”“

Similar mislabelling has occurred and instilled FUD among market participants in the past. Last year, CryptoQuant highlighted how on-chain data providers misconceive one exchange wallet to be another’s.

What are Bitcoin whales collectively up to, though?

Well, whales did encash on the recent dip and amassed Bitcoin. Analytics platform Santiment highlighted the large whale transactions “primarily happened during the bottom” in July. However, with the price recovering and Bitcoin trading in the green, the volumes have gradually started normalizing.

Interestingly, a new whale managed to grab the spotlight in July, and per Santiment, it received more than 50.5k BTC in the second week. Also, during the beginning of this week, in a brief period, Bitcoin transactions worth >$1 million spiked to their highest value in over a month. This precisely means that whales remain fairly active despite the price fluctuations.

Read More – Bitcoin: Is a ‘genuine’ bottom formation finally underway?