In a recent statement, Arthur Hayes, the Chief Investment Officer at the family office Maelstrom and former CEO of BitMEX, shared his belief that Bitcoin Exchange-Traded Funds (ETFs) have the potential to draw substantial capital from traditional financial markets. As a notable figure from the early days of Bitcoin trading, Hayes underscored the significance of market inefficiencies and Bitcoin’s uncorrelated behavior compared to traditional assets in driving significant inflows into the cryptocurrency sphere.

Exploring New Trading Opportunities

According to Hayes, the approval of spot Bitcoin ETFs could usher in fresh trading prospects by enabling traders to exploit price differentials between U.S. benchmarks and global markets. Stressing the global nature of the Bitcoin market, where price discovery predominantly occurs on platforms like Binance based in Abu Dhabi, Hayes emphasized that the introduction of spot ETFs could create predictable and enduring arbitrage opportunities. This, in turn, could attract billions of dollars within a relatively short period on less liquid exchanges.

Hayes envisions the emergence of spot ETF products in major Asian markets, such as Hong Kong, catering to the “China southbound flow.” He anticipates that highly regulated bourses and native crypto exchanges in these markets may introduce market inefficiencies, providing traders with additional opportunities for profit through arbitrage.

Also Read: Spot Bitcoin ETFs Attract $400 Million In Net Positive Inflow

ETF-Based Financing and Addressing Market Imbalances

Looking beyond trading opportunities, Hayes anticipates a burgeoning sector in ETF-based financing as Bitcoin trading becomes more commonplace. He suggests that banks might establish desks offering fiat loans against Bitcoin ETF holdings, allowing them to pocket the spread and influence Bitcoin interest rates, potentially leading to market imbalances.

Bitcoin Institutional Inflows: Contrasting Approvals

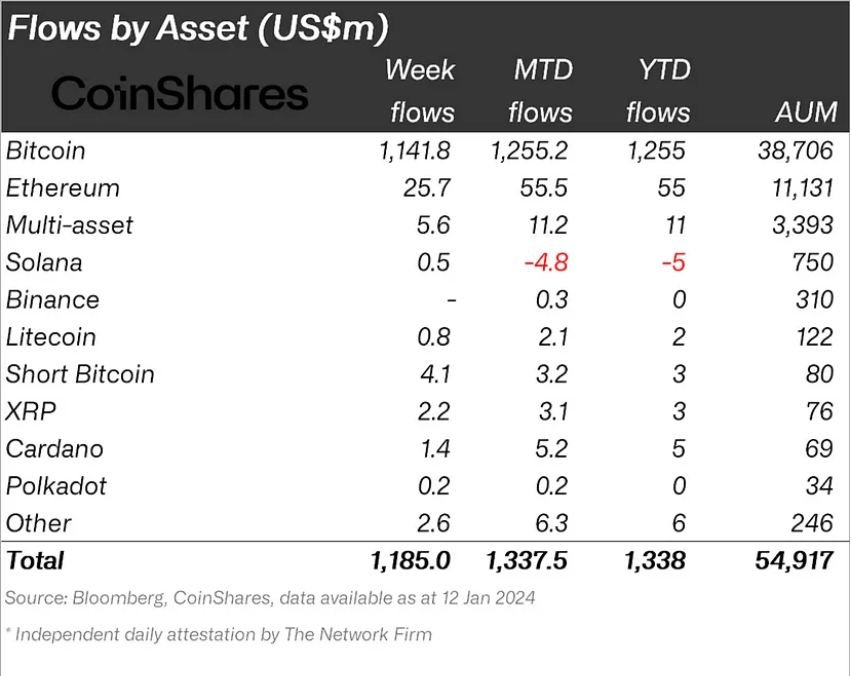

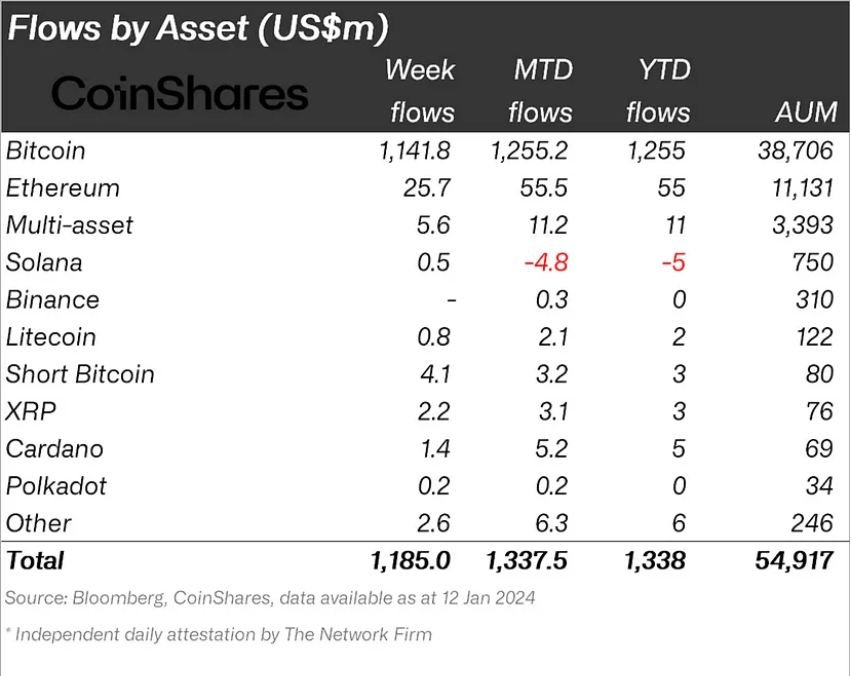

Reflecting on the recent approval of spot Bitcoin ETFs, Hayes observed that the inflows into BTC alone amounted to $1.14 billion. While this figure garnered attention, it fell short of the benchmark set by Futures Bitcoin ETFs approved in 2021. The Futures-based ETFs attracted a total inflow of $1.50 billion at launch, representing a 31.5% higher figure than the recent spot ETF approval.

Despite the specific cryptocurrency not surpassing previous records, the total Exchange Traded Product (ETP) trading volume did reach a record high, hitting $17.50 billion in the past week. This figure significantly exceeded the average weekly trading volume in 2022, which stood at $2.00 billion. The ETP trading volume constituted about 90% of the daily trading volume on trusted exchanges, marking a substantial increase compared to the typical range of 2% to 10%.

Also Read: South Korea: Samsung & Mirae Asset Halt Bitcoin ETFs Amid Alert

Arthur Hayes’ perspectives on the potential of Bitcoin ETFs to attract significant capital from traditional financial markets underscore the evolving dynamics of cryptocurrency investment. With the approval and adoption of spot Bitcoin ETFs, the market may witness increased trading opportunities and financial innovation. The convergence of traditional finance and the cryptocurrency space presents a dynamic landscape that has the potential to reshape how institutional and retail investors engage with digital assets in the years to come.