The US Federal Reserve published a blog article, titled “Buying eggs with Bitcoins – a look at currency-related price volatility”. the article was aimed at demonstrating Bitcoin’s (BTC) volatility versus the US dollar while purchasing eggs. However, the crypto community was quick to point to the larger picture which shows the low inflation rate of the original cryptocurrency as compared to the US Dollar.

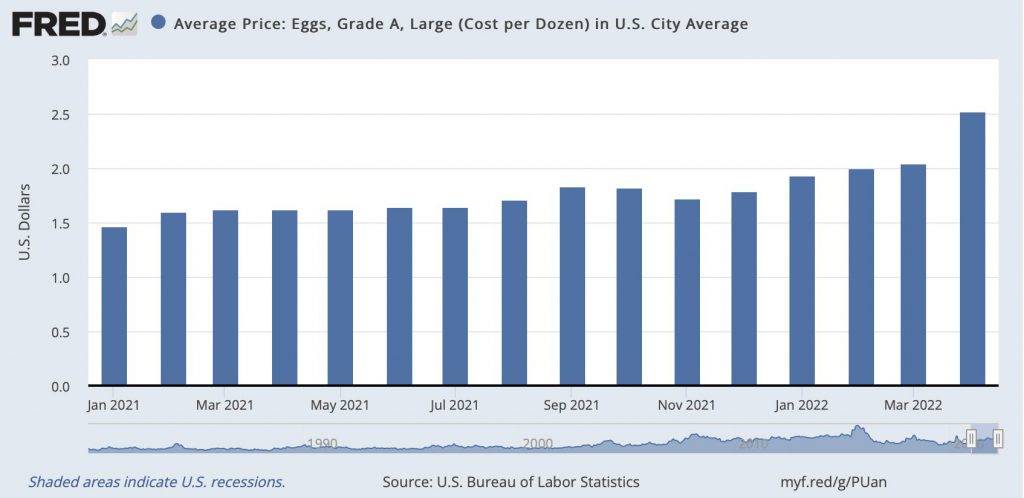

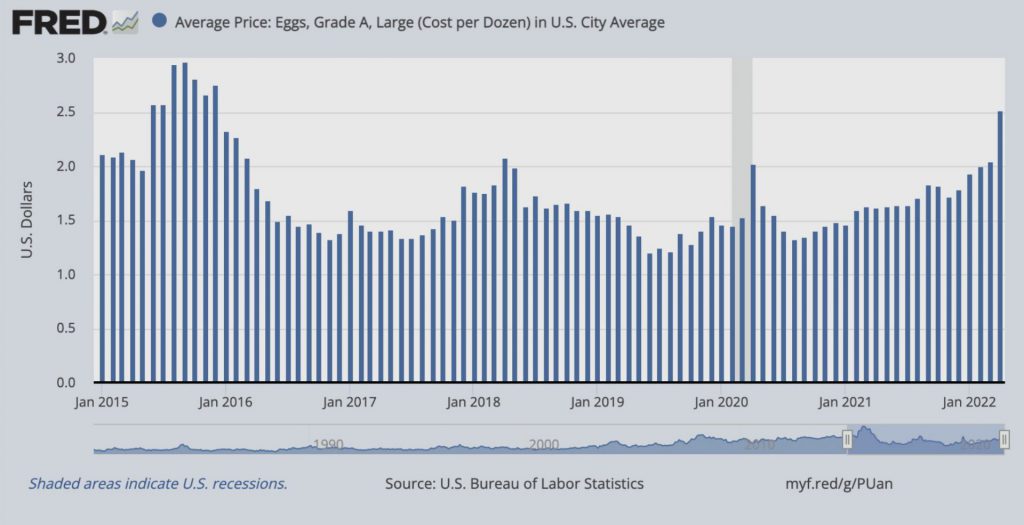

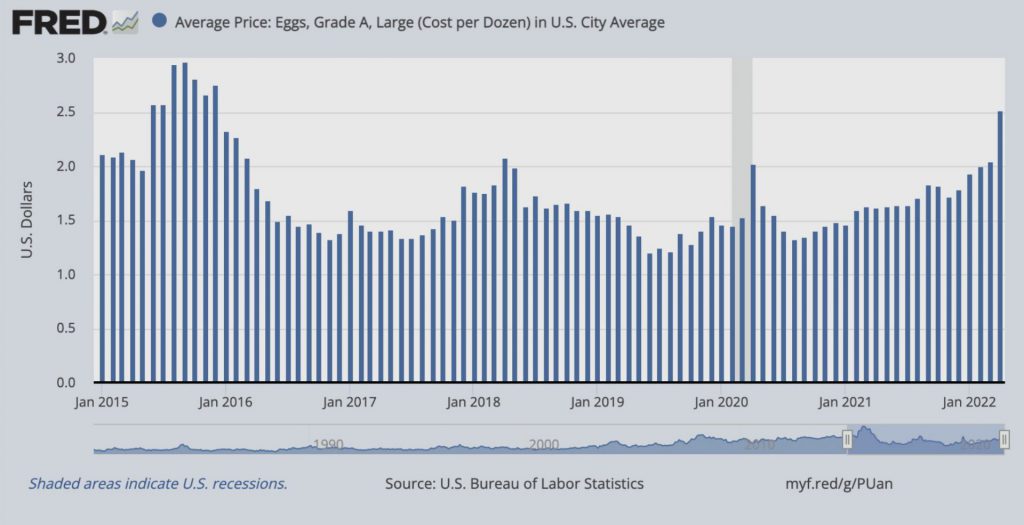

The blog first shows a graph depicting the historical price of eggs in US dollars for every month since January 2021, with prices ranging from $1.47 to $2.52 during the 14 months.

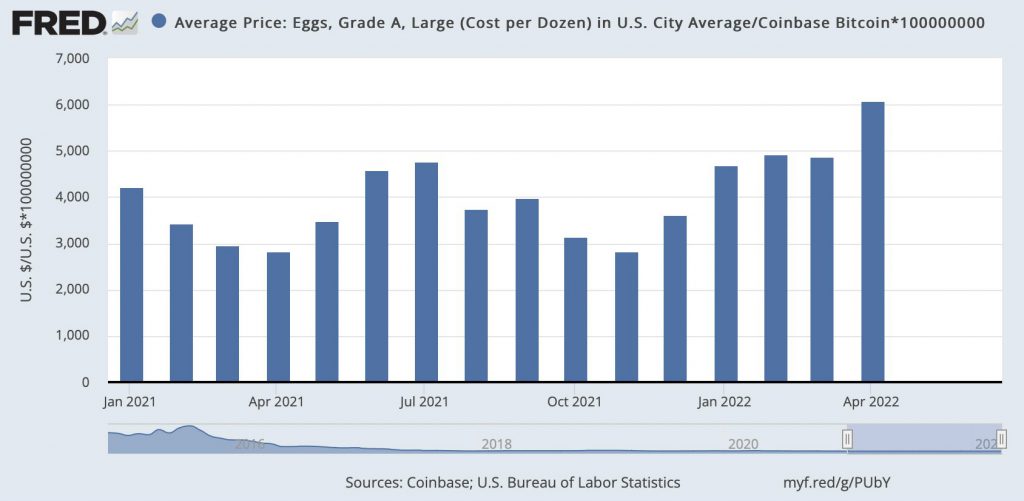

It then shows a graph of how Bitcoin has performed over the same period, adding that the price has changed far more than the price of the US dollar.

The research did not specify whether the trend was caused by a rise in egg prices, a decrease in the value of the dollar, or both.

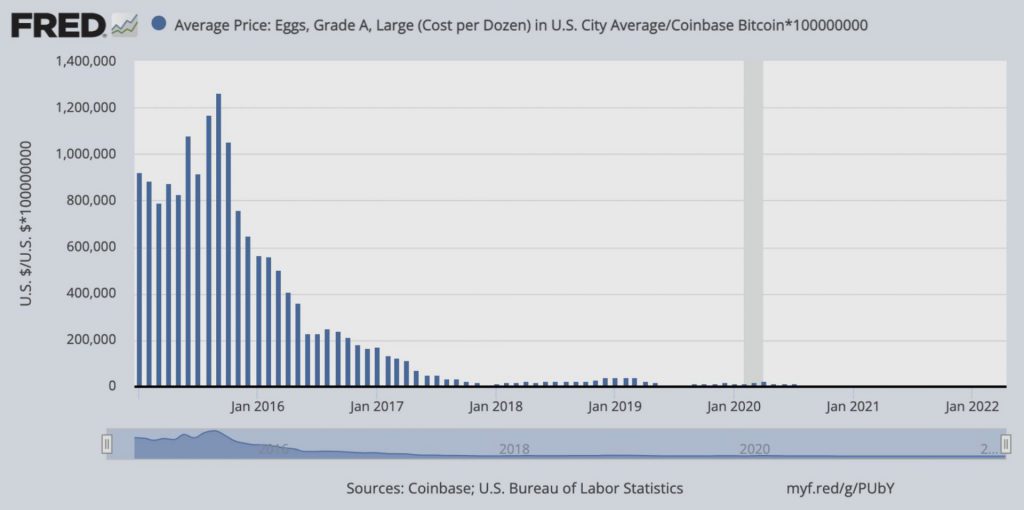

But for their research, the team decided to use Satoshi’s instead of Bitcoin (1 satoshi = 0.00000001 BTC) as the price of one BTC was a lot more when compared to a dozen eggs.

Although it appears that this is an attempt to take a shot at bitcoin, a deeper examination of the data reveals that the general inflation rate of eggs over time is lower in sats (44.3%) than it is in dollars (71.9% ).

The crypto community was quick to respond. Many thought that a more accurate picture of Bitcoin’s deflationary tendencies over longer periods, as compared to the US dollar, would be more accurate.

Other Twitter users viewed the Fed’s recognition of Bitcoin as a unit of account as a net positive for the original cryptocurrency.

According to the inflation calculator, the US dollar has lost 26% of its value since 2009, when Bitcoin first came into being and has been monitoring an average inflation rate of 2.32% each year since then.

One BTC, on the other hand, started at $0.00 in 2009 and is currently worth $29,547.02 at press time.