FTX’s collapse in Q4 last year intensified the cryptocurrency market’s bearish woes. In the latter half of November 2022, Bitcoin dropped down to a low of $15,479. After that, the sluggish state extended for a few more weeks.

However, Bitcoin turned a bullish page in 2023. With just 27 days into the new year, BTC has already climbed back to its pre-FTX levels. In fact, since the beginning of this year, the market’s largest cryptocurrency asset has inclined by ~40% so far.

Also Read: Is a “Bigger Breakout” Looming for Bitcoin, Ethereum?

FTX Saga: A thing of the past for Bitcoin?

A few from the community believe that Bitcoin has already bottomed out and the November lows created last year were its cyclic bottom.

Also Read: Bitcoin: What Is $1 of BTC From 2009 Worth Today?

Charles Edwards, the founder of Capriole Investments feels that BTC has already closed and moved past the FTX chapter. He recently tweeted,

“Bitcoin has put the FTX fraud into the history books. It’s like it never happened. Many thought it was the end of our industry, but Bitcoin always comes back from the purging of bad actors stronger than ever. Nothing will stop the relentless adoption rate of this industry.“

Time to shout a big hooray?

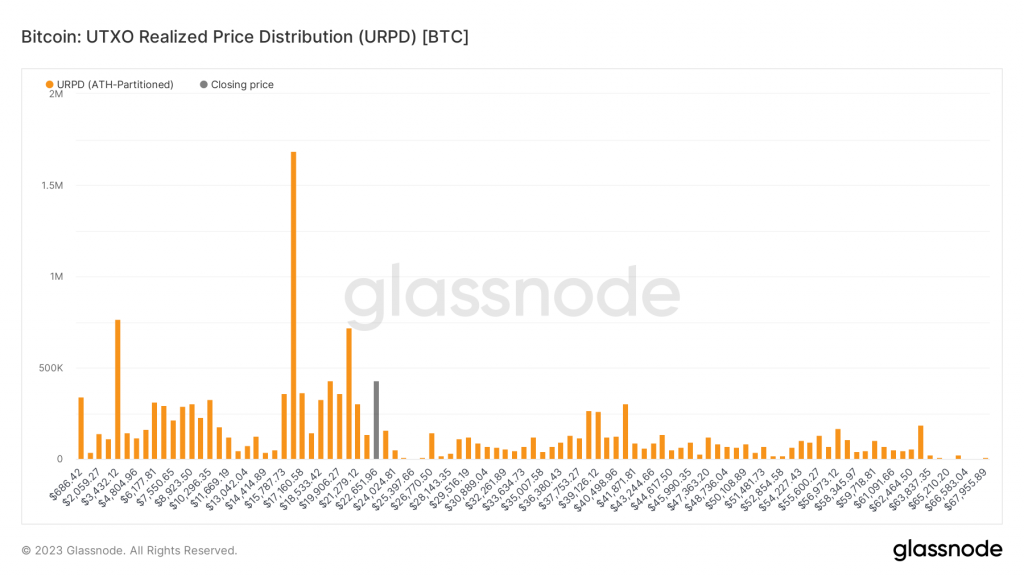

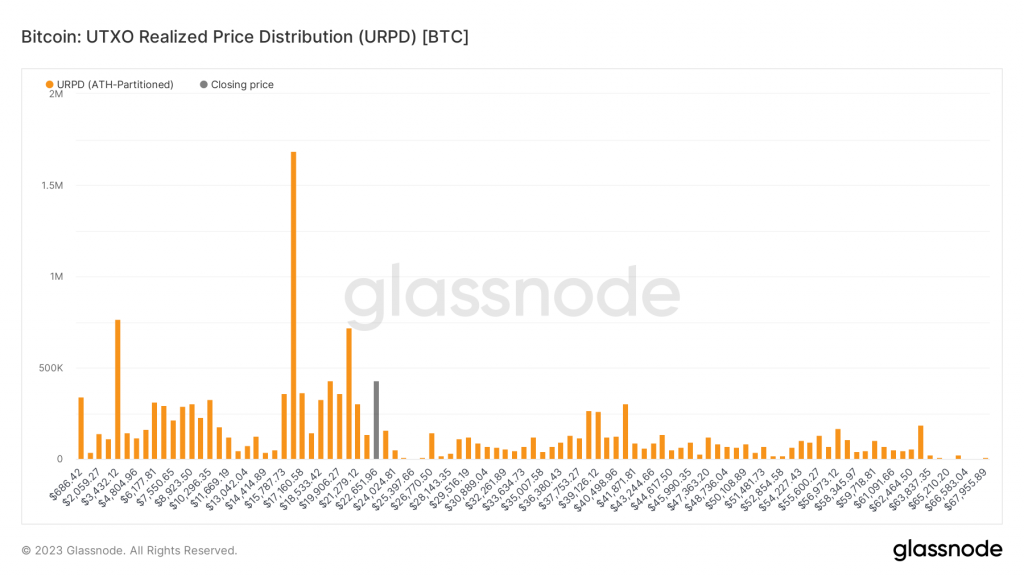

According to on-chain data, a significant amount of supply was moved when Bitcoin was trading around its lows. A recent tweet by Reflexivity Research’s Co-Founder Will Clemente revealed that a “whopping” 9% of supply was moved at $16.5k. According to Clemente, investors are not going to settle for less. Elaborating on the same, he tweeted,

“I doubt those that were buying down there amidst the FTX fear/panic are going to be looking to sell after just a 30-40% move.”

Also Read: Are Bitcoin Traders Turning Optimistic Right Now?

In fact, cryptocurrency asset trading firm QCP Capital also recently revealed how quickly the market sentiment has flipped from bearish to bullish. It called it a “microcosm” of the macro market behavior.

As analyzed in a recent article, options traders have started turning optimistic. Alongside a bunch of positives underlined by Watcher Guru, there’s another key takeaway. QCP Capital brought to light that for the first time since 2021, risk reversals traded in the positive territory last week.

Asserting on how it seems like the FTX saga never happened at all, QCP tweeted,

“Market conditions are drastically different from the bearishness we saw in Q4 2022. The options market in its current state makes it seem like FTX never happened at all!”

Nevertheless, caution needs to be exercised by participants because the macro events lined up for the next few days have the potential to “break the heart” of the bulls, according to QCP Capital.

Also Read: Bitcoin, ‘Bitzlato’ and the DOJ: What Just Happened?