As the crypto winter deepens, Bitcoin (BTC) mining income and profitability have continued to fall in lockstep with the asset’s price. May has been one of the worst months in recent memory for BTC miners.

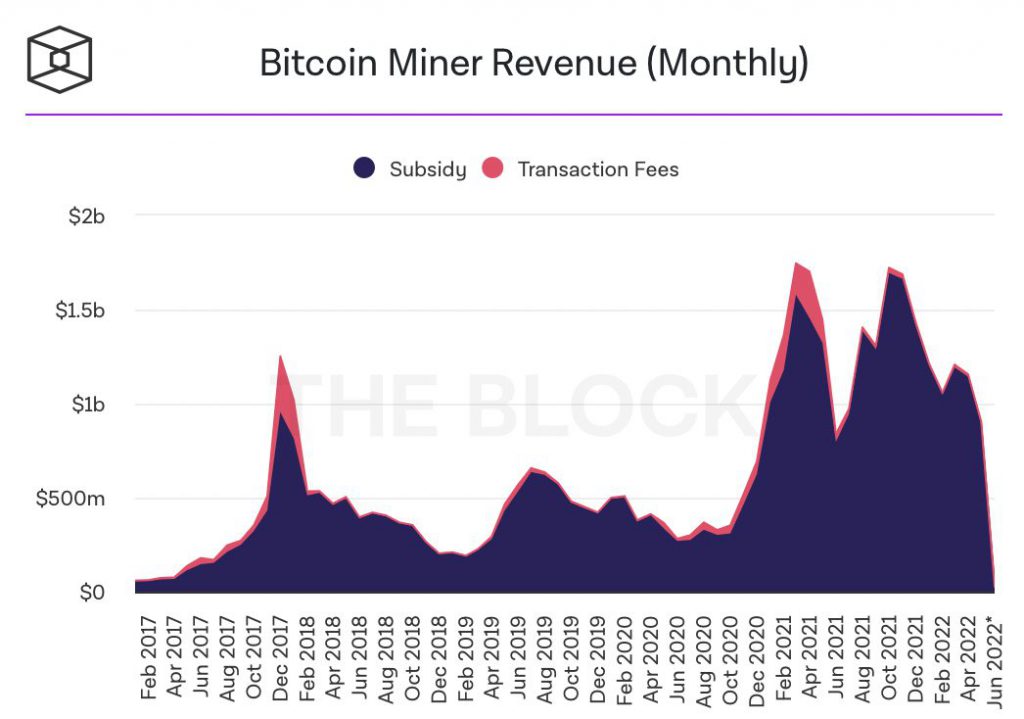

As per the data available on The Block, Bitcoin miners’ revenue dropped to $906 million, from April’s $1.16 billion.

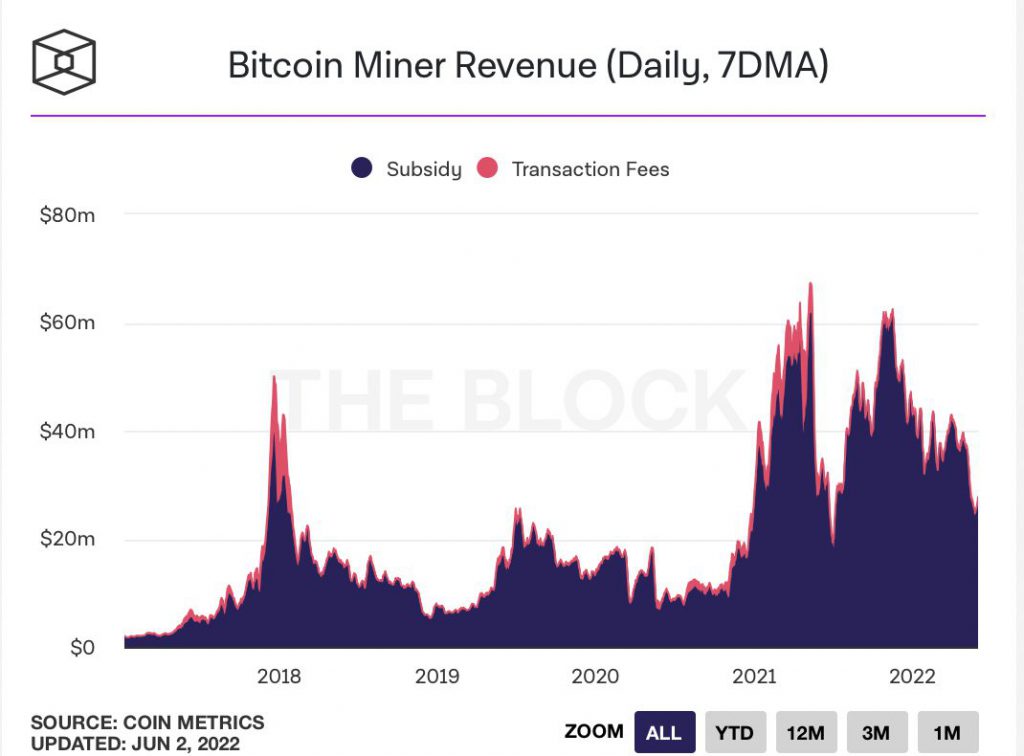

Daily revenue of BTC miners was $37.94 million on May 1st, according to statistics from The Block, but by the end of the month, it had dropped to $26.79 million. On May 25, daily mining income fell to an eleven-month low of $24.71 million. Daily mining income peaked in April 2021 at about $80 million but has since dropped about 66.5% to current levels.

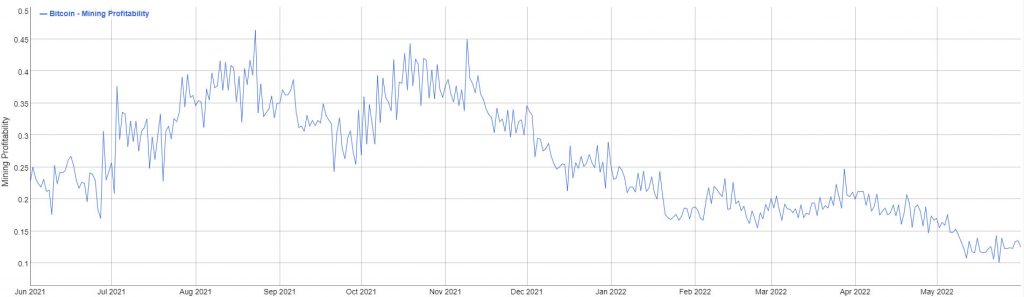

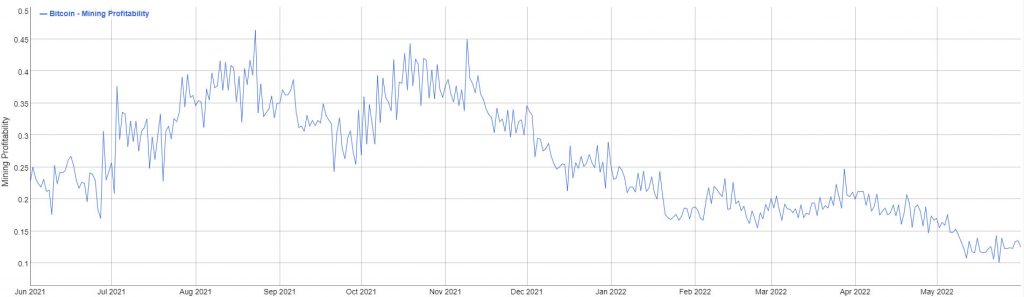

According to Bitinfocharts, mining profitability, which is measured in daily dollars per terahash per second, has reached its lowest point since October 2020. Mining profitability for 1 THash/s is presently 0.112 USD per day, according to the crypto metrics source.

Furthermore, the measure has been down by 56% since the start of the year and is down by more than 75% from its 2021 highs of 0.450 USD/day per TH/s.

However, according to Bitinfocharts, Bitcoin network hash rates remain strong, with the current daily average at 211.82 Exahashes per second.

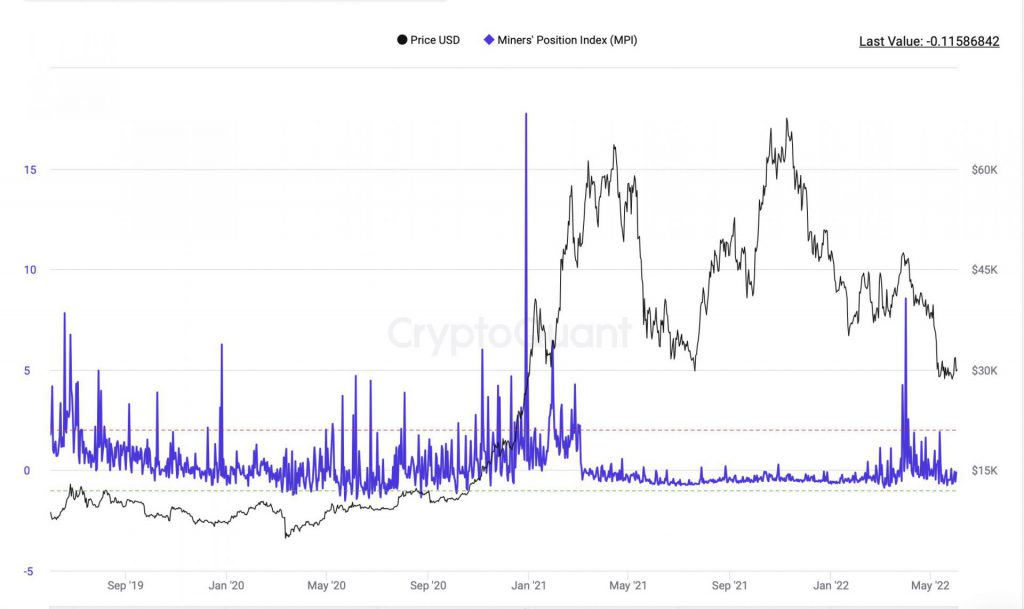

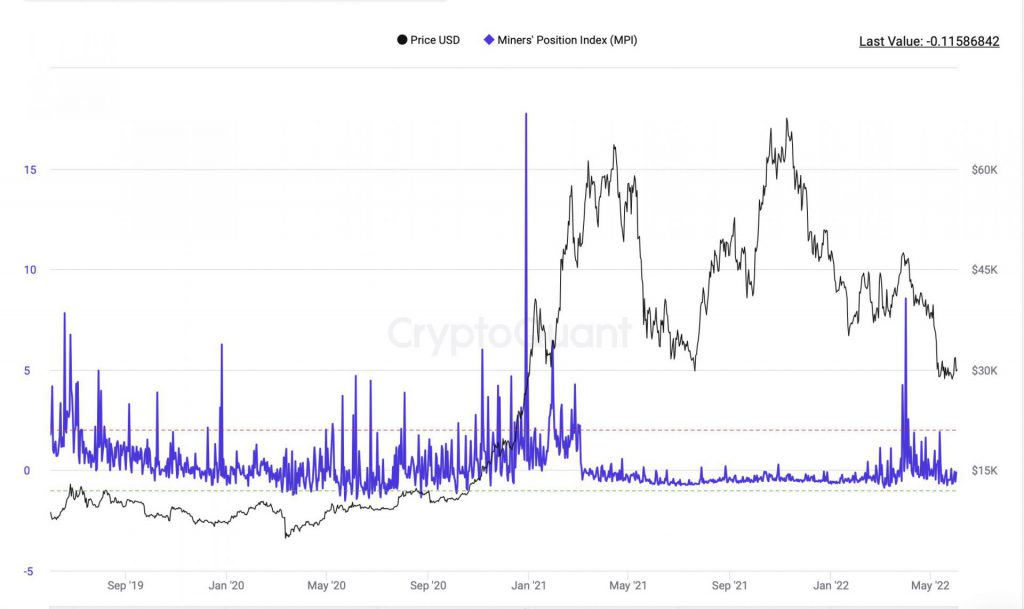

Additionally, the Bitcoin miners position index (MPI) stood at -0.1158 at press time, indicating that miners are avoiding selling their BTC.

Moreover, the data from Cryptoquant shows the miner reserve saw a slight incline towards the end of May, currently at $1.86 million. This is close to the levels seen in February of this year. Miners are most probably not seeing much profit in selling their BTC at the moment.

At press time Bitcoin (BTC) was trading at $29,781.76, down by 5.5% in the last 24 hours.