The color of the crypto market has undoubtedly left the community in fear. Bitcoin’s [BTC] plummet has got some panic selling while others were buying the dip. As this took the front stage, the mining industry witnessed a massive spike. From hash rate to mining difficulty, everything peaked as BTC nosedived.

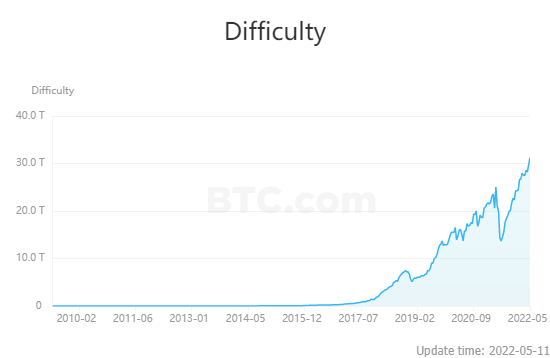

Bitcoin’s mining difficulty seemed to be witnessing an uptrend. The king coin’s mining difficulty is adjusted or changed after every 2,016 blocks. This occurs about every two weeks. Towards the end of April 2022, the mining difficulty peaked at a high of 29.79 trillion. Proving to be on an upward trajectory, the mining difficulty further recorded a new all-time high of 31.25 trillion. This reading was acquired at a block height of 735,840.

The aforementioned difficulty level would be adjusted after 13 days.

Just as its name, the Bitcoin mining difficulty factor estimates the nature of how challenging it would be for a miner to process a transaction on the blockchain. The mining difficulty is usually correlated to the hash rate. Bitcoin’s mining difficulty would mirror a surge in the hash rate.

As a result, the latest surge in the difficulty could be linked to the currently soaring hash rate of Bitcoin. At present, Bitcoin’s hash rate is at 227.128 E. This is reportedly lower compared to 251.8112 E it recorded back at the beginning of May.

Bitcoin mining comes with promising rewards. Therefore, an array of them veered into the mining market this year. The increase in hash rate is proof of the same. With more mining power being inducted into the network the hash rate and the difficulty surge.

Is Bitcoin cozying up with the bear?

With a 20 percent drop over the last couple of days, Bitcoin was soaked in red. The king coin was seen failing to attest significant support at $31k as it kept veering back to $30k. Just a while ago, the altcoin plummeted to a low of $30,320. However now, BTC witnessed a slight bump which pushed the asset to $31,603.

Additionally, the market cap of Bitcoin had also dropped to $500 billion from $1 trillion.