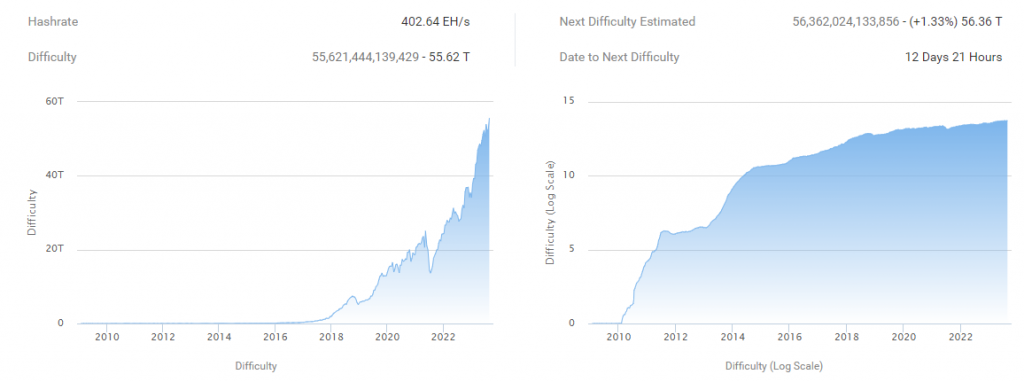

Bitcoin’s mining difficulty attained a new all-time high during the latest adjustment. The number rose by 6.17%, aiding the difficulty of attaining 56 trillion for the first time ever in Bitcoin’s history.

The rise in difficulty reflects the security of the network. However, it also adds pressure to miners’ margins and squeezes their profits. This is because mining amid increased difficulty requires more electric power, translating to increased expenses for miners. To add to the woes of miners, power prices in Bitcoin mining hub Texas registered a 6,000% surge last week.

Data from BTC.com pointed out that the latest 6.1% rise was one of the largest rises registered by Bitcoin’s difficulty in 2023. Last time, it rose by only 0.12%, while prior to that, it dropped by 2.94%.

The next fortnightly adjustment is all set to take place after 12 days and 21 hours. According to estimates, this metric will yet again register a rise. It is expected to claim 56.36 trillion rising by 1.33% from the current level.

Also Read: Bitcoin Must Surpass $98,000 for Miner’s Sustainability in 2024

The ‘Reliability’ Factor

Commenting on the current state of affairs, a community member posted on X [formerly Twitter],

“Bitcoin’s hashrate is a true testament to the network’s strength and security. As it continues to soar to new heights, it’s clear that the miners behind this revolutionary digital currency are working hard to ensure its stability and resilience.”

In another recent Quicktake post on CryptoQuant, pseudonymous analyst MAC_D pointed out that despite the difficulty miners are more active in Bitcoin mining at the moment. As a result, investors’ confidence in the security and reliability of the BTC network has refined. Even though the price of BTC has fallen, the analyst says that the asset is still undervalued. Consequentially, he indicates it can be a time to “actively” accumulate BTC.

Also Read: Europe: Crypto ETP Inflows Rise to ~$230 Million in June, July

At press time, the largest crypto asset was trading at $25,855, down 11.11% over the past week.