Bitcoin [BTC] remains undefeated despite the advent of several new cryptocurrencies. However, in terms of building and use cases, Altcoins were seen outshining BTC. Ethereum, Solana, Cosmos, Polygon, and several other assets saw growth in terms of developer activity throughout the last couple of years. So much so that most of these networks have significantly more developers than Bitcoin.

Electric Capital’s recent research emphasizes how monthly active Web3 developers rose by 5.4 percent throughout the last 12 months. The cryptocurrency industry welcomed 23,300 developers in 2022 despite the tragic drop in the overall market. Moving beyond Bitcoin and Ethereum, 72% of monthly active developers were from other networks.

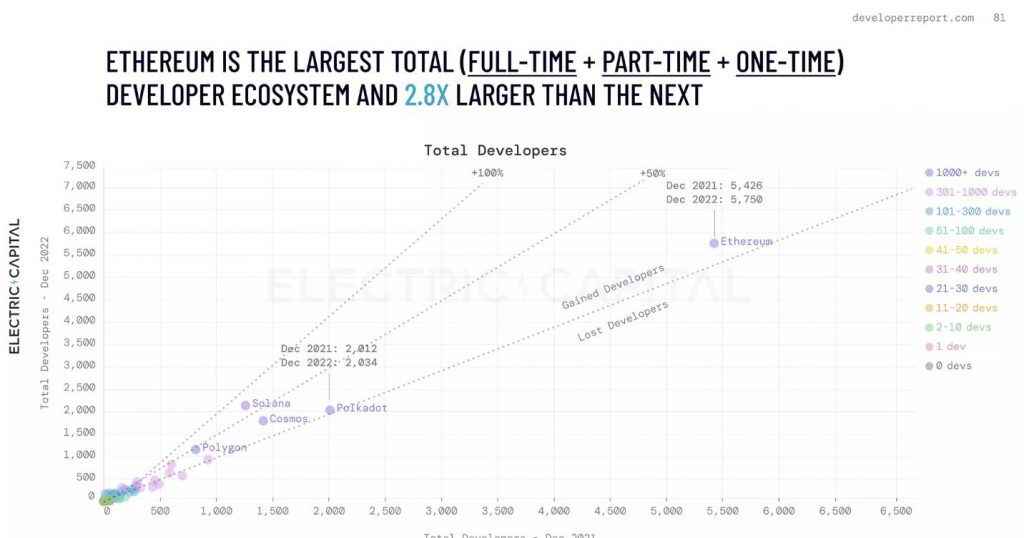

Bitcoin took a backseat while Ethereum had a notable number of developers. When compared to December 2021, Ethereum closed 2022 on a great note as its monthly active developers rose from 5,471 to 5,734. However, since its high in June 2022 of 6,860, active developers recorded a 16% drop.

Nevertheless, Ethereum was touted as the largest total developer ecosystem.

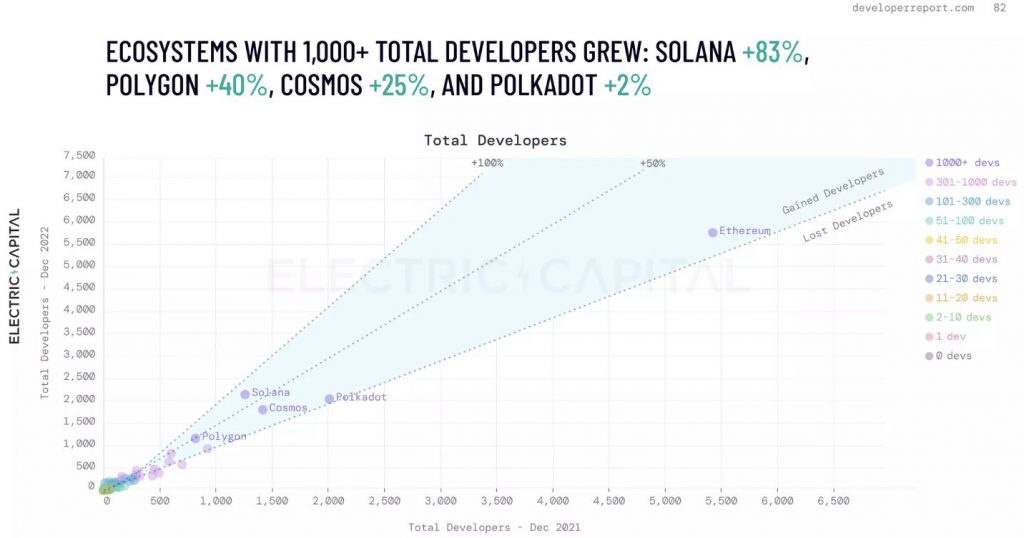

After Ethereum, Solana, Polygon, Cosmos, and Polkadot networks entailed more than 1,000 developers also recorded significant growth. It should be noted that all networks started out with just 200 developers in 2018.

The above data shows how a majority of the developers are bent toward emerging projects rather than Bitcoin.

Will this help emerging cryptocurrencies take over Bitcoin in terms of adoption?

Cryptocurrency adoption is moving on from its nascent stage. The demand for advanced use cases and ease of usage is on the rise. A high number of developers in a network denotes the possibility of enhanced innovation as well as use cases. Bitcoin has often been viewed as a store of value asset. As seen in the above charts, its activity also seems quite dull compared to the rest of the market.

Therefore, the chances of assets like Ethereum, Solana, Polygon, and others arising as the future of fintech are high.

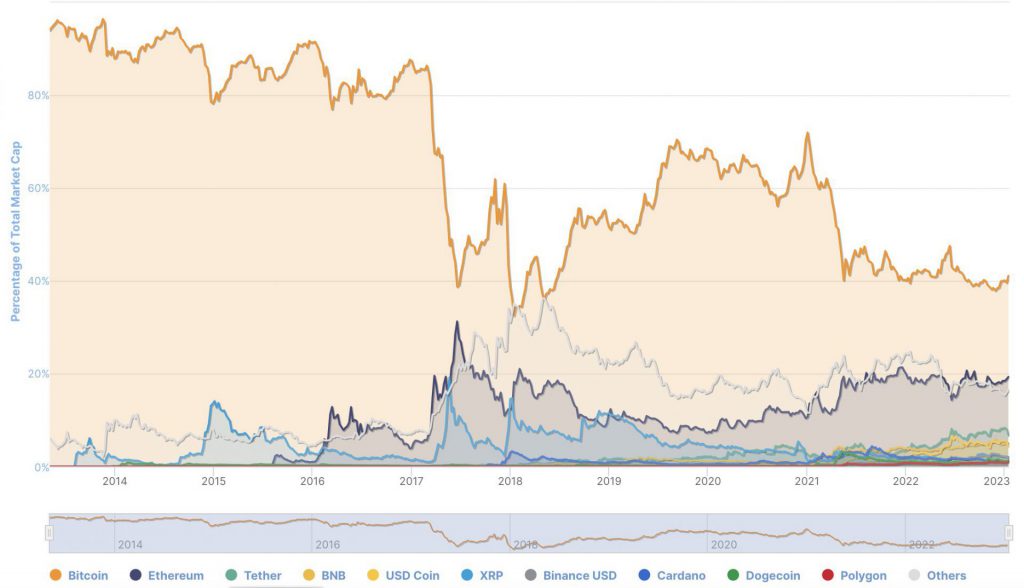

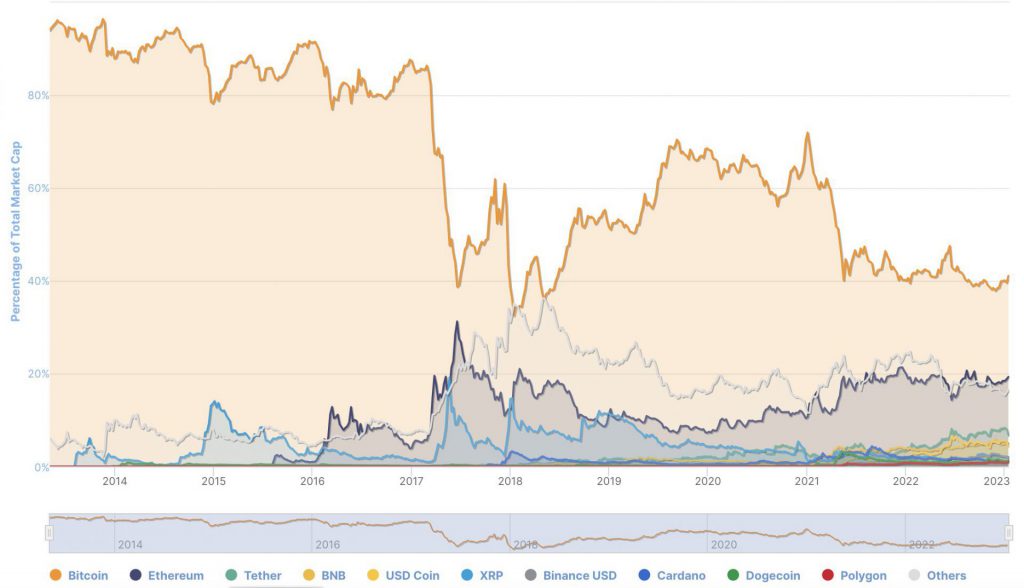

In addition to this, Bitcoin’s dominance is also falling.

Currently, Bitcoin’s dominance stands at 41.3 percent.