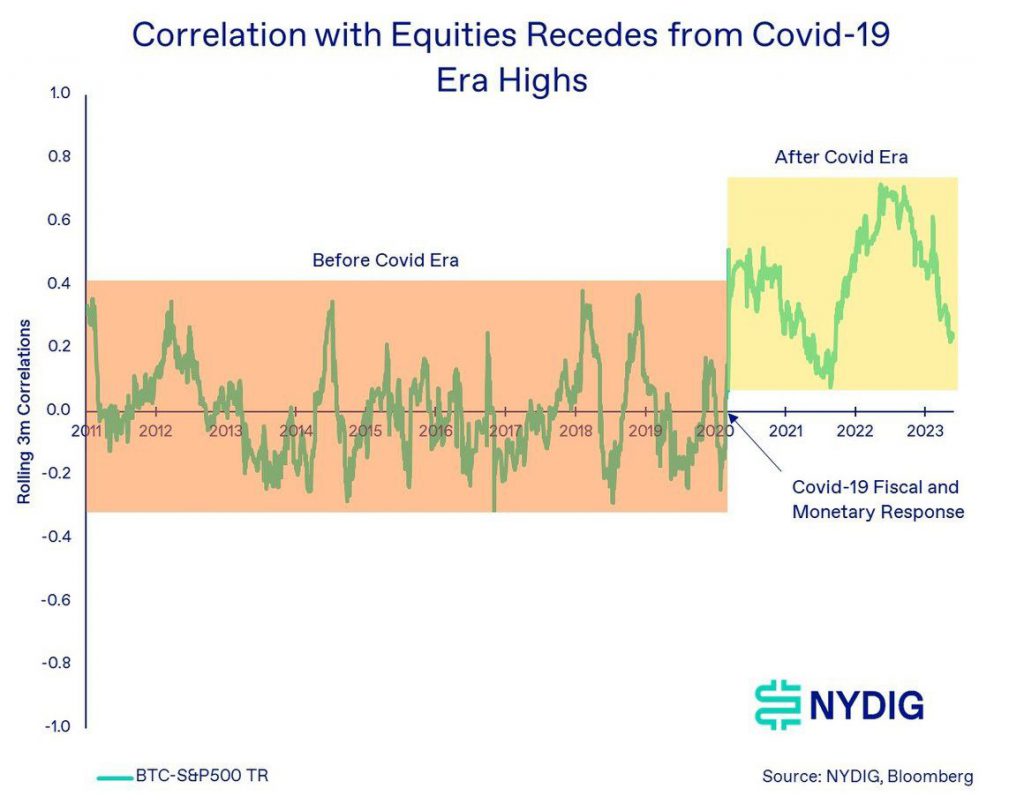

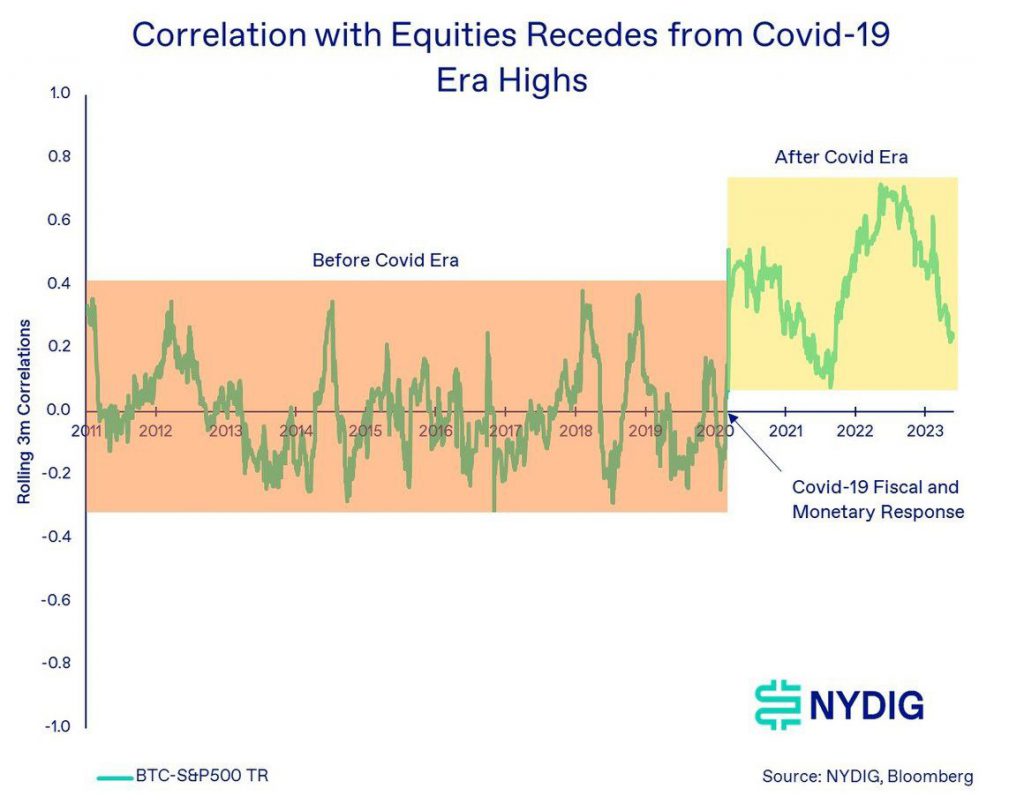

A recent research report by NYDIG brought to light that Bitcoin’s correlation with the equity market has been significantly declining from its Covid era peak. As depicted below, Bitcoin was not strongly dependent on equities or other major asset classes during the pre-pandemic era. Nevertheless, as central banks and regulators worldwide responded with monetary and fiscal stimuli during the pandemic, the correlation started rising.

Also Read: Ethereum Registers ‘Largest’ Outflow Since the Merge: $35.6 Million Withdrawn

The current correlation is almost at par with mid-2021 low levels. With indices like the S&P 500 trading in the green, the drop might seem like a spoilsport. However, that might not essentially be the case.

Bitcoin’s YTD returns are over 55.5%. Now, that’s higher than ETH [44.9%] and Altcoins [6.65%]. In fact, top stocks like Apple, Google, and Microsoft have also risen by 39% to 47% so far this year. As far as the aggregate performance is concerned, stock indices’ numbers are not all that flashy either. The S&P 500, for instance, has risen by only 14.2% in the same YTD timeframe, while the Nasdaq is up by 30.68%, giving BTC the edge in terms of absolute returns.

Bitcoin dominance rises

Amid the correlation dip, it is essential to note that Bitcoin’s dominance in the market has been rising. For context, Bitcoin dominance is the ratio of the market capitalization of BTC to that of the rest of the crypto market. A rising figure usually indicates that the asset is adding value to its market cap at a faster pace and vice versa. In simpler words, an elevated dominance just points towards an increased say of Bitcoin in the overall state of the crypto market. In November last year, BTC.D was hovering around 39%. However now, it is up to almost 50%. In fact, it is currently at par with levels last registered in May 2021.

Also Read: Binance.US Market Depth Drops 78% in Just a Week

In fact, industry experts have mentioned Bitcoin’s say in the market to continue rising. MicroStrategy executive Michael Saylor said in a recent Bloomberg interview that BTC’s dominance will nearly double and rise to 80%. Other coins being deemed as securities by regulators is a boon for the king coin, per the Bitcoin maximalist. He added,

“The entire industry is kind of destined to be rationalized down to Bitcoin and a half a dozen to a dozen other proof-of-work tokens.”

Furthermore, Saylor expects Bitcoin’s price to increase tenfold, and then again tenfold from the current levels. At press time, BTC was trading at $25,880, after noting an almost negligible 0.8% deviation over the past day.

Also Read: Solana, Cardano, MATIC Targeted by SEC, Down 31%