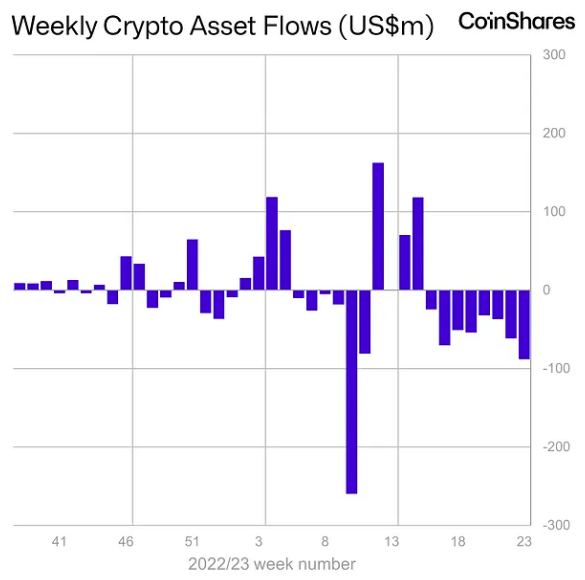

A myriad of negative developments has triggered capital outflow, instead of inflow in the crypto ecosystem. Owing to the recent lawsuits thrusted by the SEC, the community sentiment continues to remain dented. Leaving aside retail, even institutions have been exercising caution.

Over the past week, crypto and other related digital asset investment products registered outflows summing up to $88 million. Consequentially, the negative flows streak has been renewed, and the outflows over the past eight weeks have risen to $417 million. According to CoinShares’ latest weekly report, the uncertainty related to the interest rate hikes has played a key role in moulding institutional behavior. Specifically, the report noted,

“We believe that this is monetary policy related, with currently no clear end in sight to interest rate rises, leaving investors cautious.“

Also Read: Crypto: North Korean ‘Digital Thieves’ Steal $3 Billion in Heists

On the individual front, Bitcoin noted the largest outflow. Just over the past week, $51.6 million was suctioned out of the ecosystem. Altcoins, on the other hand, saw “mixed fortunes.” Litecoin, XRP and Solana noted minor inflows, while MATIC noted an outflow. The report pointed out,

“Interestingly, on aggregate, altcoins have seen inflows year-to-date (except Tron), in stark contrast to Bitcoin and Ethereum.“

Also Read: Solana, Cardano, MATIC Targeted by SEC, Down 31%

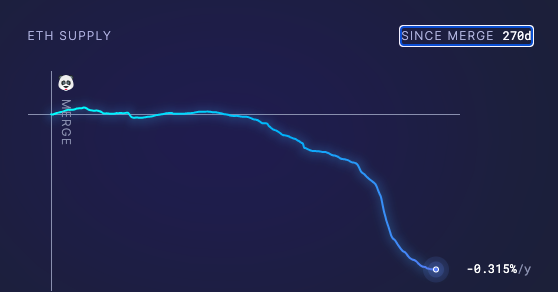

Ether noted the largest outflow since Merge

Ethereum, the leader of the Altcoin pack, ended up noting a significant outflow. Over the past week, institutions pulled out $35.6 million from Ether-related investment products. In fact, the latest number marks “the largest single week of outflows since the Merge in September last year.” Well, on the one hand, this does put some amount of bearish pressure on the price of the asset. However, there are other positive things that can be looked upon at this stage.

Ethereum has been on the ‘deflationary’ track over the past few months. In fact, at this stage, it is the most deflationary it has ever been since the Merge. Moreover, the supply growth per year is currently at -0.315% per year. Eventually, this could rub off positively on the price of the asset.

Also Read: Ethereum: 23 Million ETH Staked So Far, ‘Flippening’ Soon?