Following Bitcoin’s impeccable rise in January, the community assumed that the king coin would persist in its bullish trend. With BTC hitting a high of $24,167.21, several were rooting for $25K. Sadly, this movement was disrupted as the asset dipped to a low of $21,539.39 over the weekend.

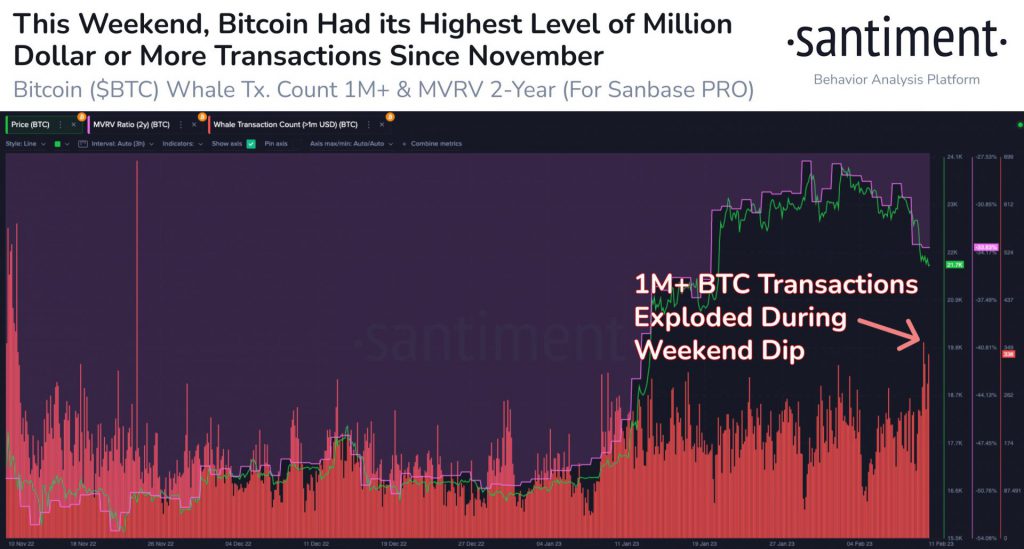

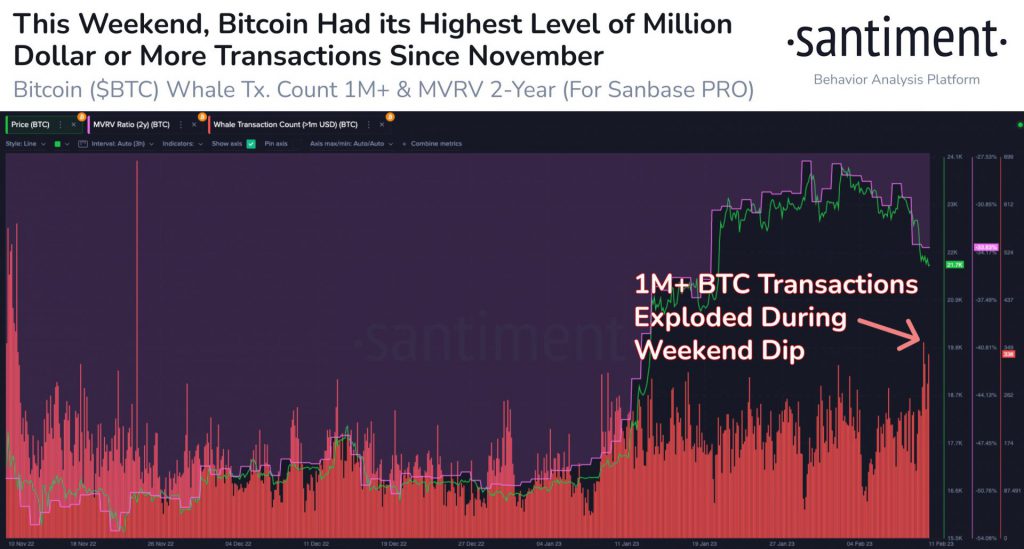

While the latest dip did bring about increased fear among investors, the whales were banking on the same. According to a recent report by Santiment, whales were active over the weekend. This was significant as it is the highest transaction rate that was seen in 3 months.

There a more than a million Bitcoin transactions over the weekend. However, it isn’t quite clear if these whales were buying or selling BTC.

But, as seen in the above chart, the MVRV is dropping. As MVRV declines, it shows that realized cap is growing faster than the market cap, further suggesting that there is less incentive to sell in the market. Therefore, the latest move by the whales is most likely inclined toward whales accumulating BTC.

At press time, Bitcoin witnessed a slight increase. The king coin was trading for $21,753.43 with a 0.37% daily drop.

Was this a mere corrective period or a death cross for Bitcoin?

As mentioned earlier, an array of predictions began surfacing. Several suggested that the king coin was undergoing correction. A few others were inclined towards the “death cross” narrative. Prominent analyst, Benjamin Cowen pointed out that Bitcoin was forming a bearish pattern.

A shorter-term moving average, like the 50-week, crosses below a longer-term moving average, like the 200-week, to form this pattern. It is deemed to be a negative indicator that denotes the possibility of a long downward movement or a trend reversal.

While this indicator has been pertinent, many pointed out that it doesn’t really define the direction of Bitcoin’s price.