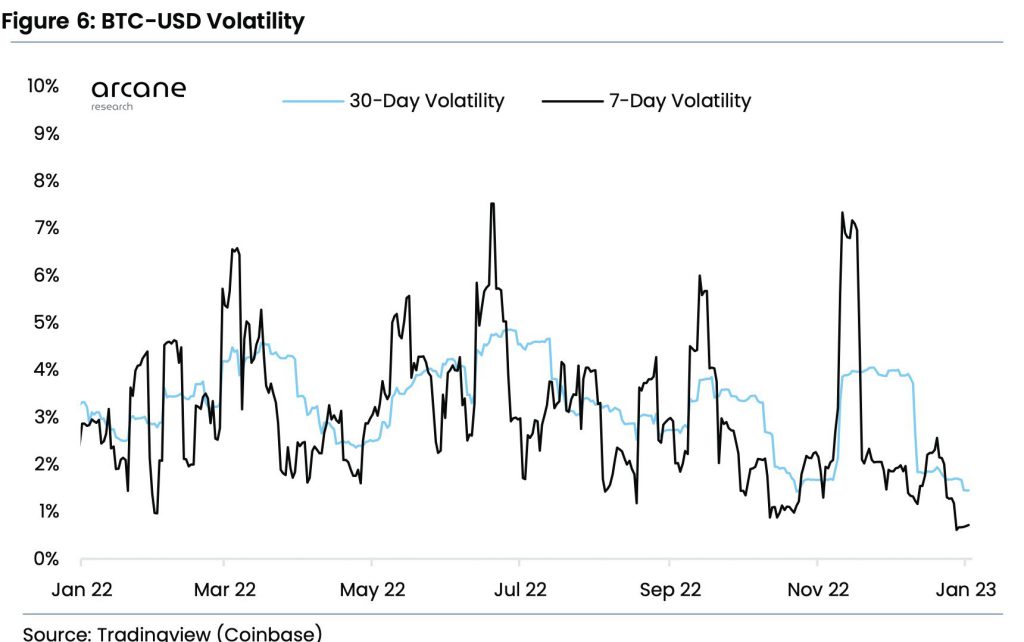

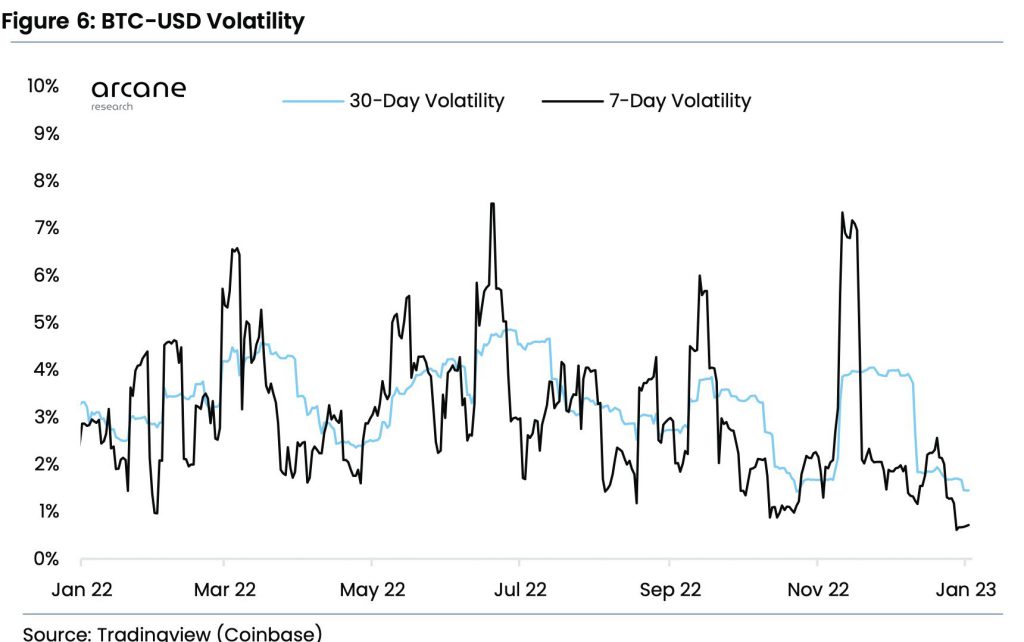

According to Arcane Research’s latest report, Bitcoin’s (BTC) volatility has fallen to “rare lows.” 7-day volatility has fallen to 0.7%, a level last observed in July 2020. Additionally, the 14-day volatility has fallen to 1.4%. This level of Bitcoin volatility was last seen before the fall of FTX in early November 2022. Additionally, since February 2019, the 30-day volatility has only been lower seven times, or for 0.5% of days.

Arcane notes that low volatility periods are rarely prolonged. Historically, volatility compression periods are followed by abrupt swings. This happens even in poor market conditions.

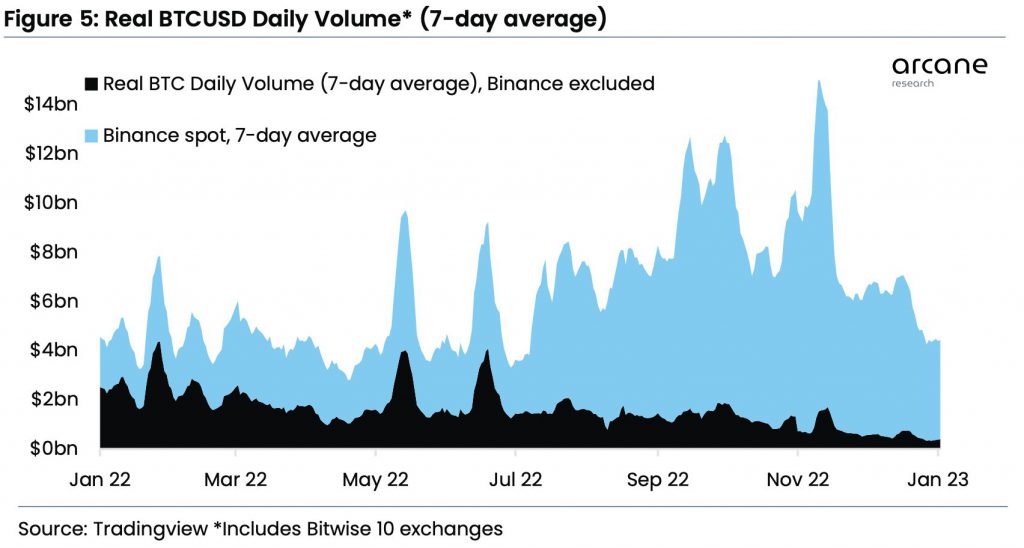

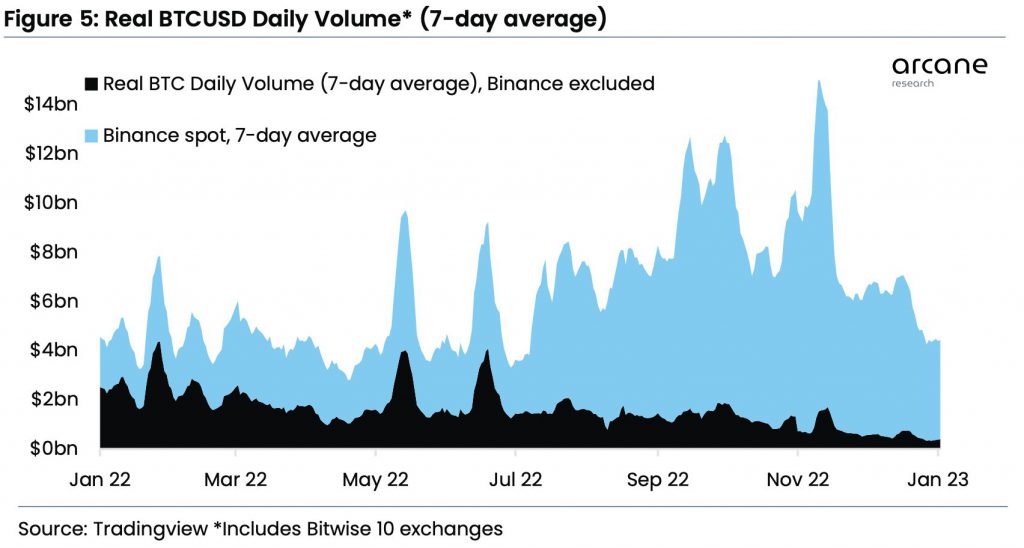

Bitcoin’s (BTC) low volatility is coupled with low spot volumes. Moreover, the futures market is also flattening. Volumes are at historic lows not seen since last summer when Binance eliminated trading fees on its Bitcoin pairs. Furthermore, trade volumes outside of Binance are likewise low.

The report notes a similar decline in trading volumes with decreased trading volumes in the spot market. A reduction in trade volume indicates a significant drop in market activity, which may be partially due to the holiday season.

Bitcoin stagnant, but Liquid Staking Derivatives surge

The arcane report notes that while Bitcoin is stagnant, liquid-staking Ethereum (ETH) derivatives are gaining momentum. This is most likely due to the upcoming Shanghai upgrade in March.

Top liquidity-staking platforms’ governance tokens are on the rise in the charts. Lido DAO (LDO) has rallied 24.5% in the last seven days. Meanwhile, Rocket Pool (RPL) is up by 9.6% in seven days. And StakeWise (SWISE) is up by a whopping 60.8% in the last seven days.

The Shanghai upgrade will allow investors to unlock their staked ETH for the first time. The move could result in the mass selling of ETH. Nonetheless, there is also the possibility of investors continuing to stake their ETH for steady returns.

At press time, Bitcoin (BTC) was trading at $16,852.13, up by 1% in the last 24 hours.