Timing the market gets tricky at times. While one set of people go all-in and place dicey Bitcoin bets, others—with a low-risk appetite—opt for strategies like DCA to play safe.

Well-experienced market participants usually rely on price strategies to determine trends and place their orders. That gives them an additional edge over the others. In this article, we will discuss 2 such patterns that would aid you to tread through uncertain market phases.

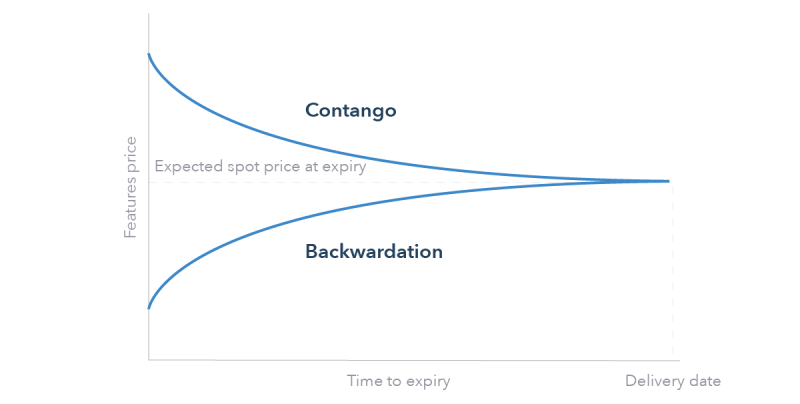

Contango and Backwardation

These price patterns usually shape up when the spot price and the futures price of Bitcoin are different.

Contango is essentially a situation where the futures price of Bitcoin is higher than the spot price. Backwardation, on the other hand, is totally the opposite of Contango. It, basically, is a pricing situation where the futures price of Bitcoin is lower than the spot price.

How to make use of these patterns?

The Contango pattern, more often than not, indicates a bullish market. Contango is considered to be an optimistic sign because it indicates that the market expects the price of Bitcoin to elevate in the future, and as such, participants are willing to pay a premium for it now. Congruently, backwardation is associated with a bearish market.

So, keeping track of the spot-futures price difference, investors can time their entry points accordingly. Similarly, traders can also benefit from price convergence, for they are presented with arbitrage opportunities.

Hyperbitcoinization – still a distant dream?

Now, one common narrative that maxis have been advocating is that the above phenomenon would eventually lead to hyperbitcoinization. Per them, as Bitcoin’s supply keeps reducing, its demand would rise. Market participants buying the asset en masse out of FOMO would push up BTC’s price. The rising price, in return, would attract leverage buyers. These traders, via their trades, would pull up the contango spread.

USD arbitrageurs would want to encash on the risk-free returns as well. To hold a candle to the spread, they’d buy Bitcoin and sell futures. Buying Bitcoin would trigger the price to elevate higher. The same would increase the contango spread and end up attracting more arbitrageurs. Investors would be re-tempted to buy Bitcoin to HODL and the cycle would continue.

Even though the end result of the same might seem to be hyperbitcoinization, it shouldn’t be forgotten that the path won’t be that straightforward. High spot price phases would ultimately imply a backward market. Sentiment flips would happen all along the way, making hyperbitconization merely a theoretical concept for now.