Even though Bitcoin’s macro accumulation trend is on, institutions have merely been skirting around BTC. Most of their recent buys have not been noteworthy. As a result, Bitcoin has been consolidating in the $20k-$22k price bracket.

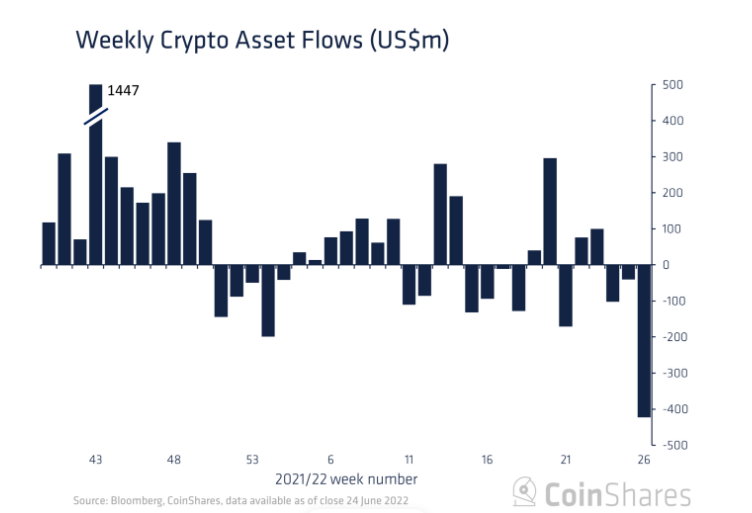

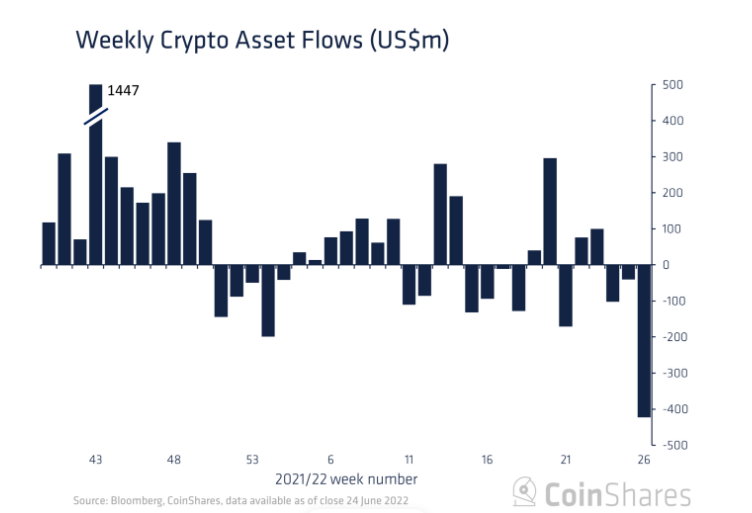

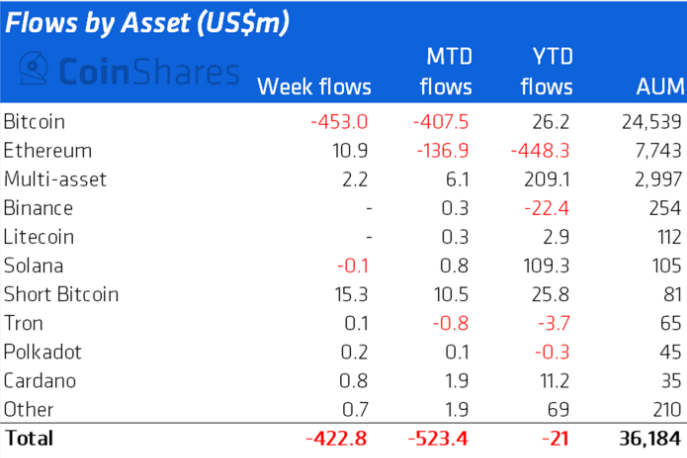

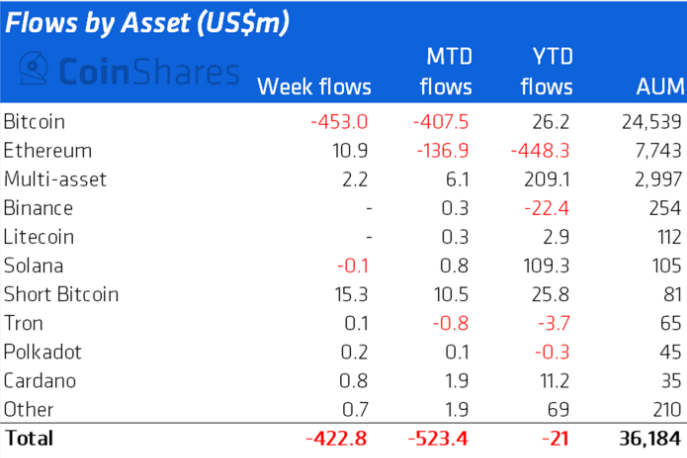

In fact, CoinShares’ latest weekly report brought to light that crypto digital investment products noted one of their most significant outflows, last week.

Most alts, including Ethereum, saw inflows. Bitcoin was the only major coin that registered a significant amount of outflow. Per CoinShares,

“The outflows were solely focused on Bitcoin, which saw net outflows for the week totaling US$453m.“

Who let their Bitcoins out?

When geographically broken down, the outflows were almost solely from Canadian exchanges, and “one specific” provider.

Canada’s Purpose Bitcoin ETF noted massive outflows recently, summing up to 24,510 BTC on Friday. Notably, the fund’s Bitcoin under management has fallen by 24,545 BTC since when compared to the day before the dump, making it a 51% decline.

Also, these were the most severe redemptions registered in the short-lived BTC ETF history. The fund’s current Bitcoin under management is now at lows not seen since last October.

Chalking out the plausible reason, one of Arcane Research’s reports noted,

“The enormous outflows are likely caused by a forced seller in a huge liquidation.”

However, if ProShares’ outflows are stripped, CoinShares brought to light that Bitcoin would have seen aggregate inflows summing up to $70 million last week. The same clearly, per the data aggregator, brings to light the “highly polarised” sentiment amongst digital asset investors.

Are whales on a different page?

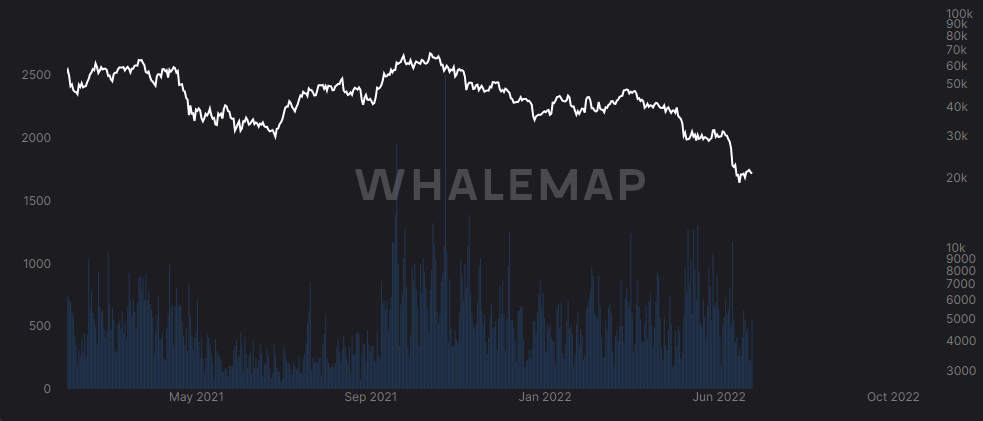

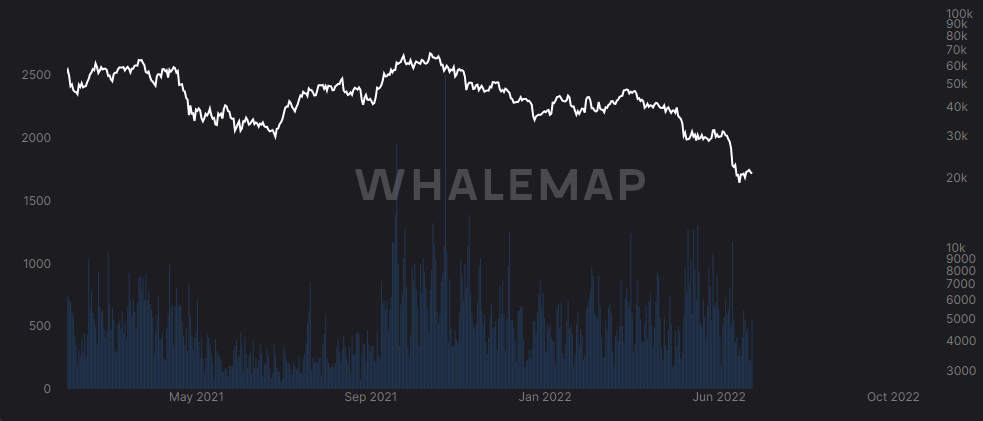

Alongside Purpose’s dump, it is interesting to note that large players, on the whole, have brought down their cumulative number of Bitcoin transactions.

Even though the transaction count metric is a double-edged sword, it can be noted from below that during most downtrend phases in the recent past, the count has decreased and vice versa. So, the current trend brings to light whales’ falling appetite and languish interest w.r.t. Bitcoin.

The forced selling of Purpose’s Bitcoin triggered the asset’s price to move down towards $17,600 this weekend, but the market was quick to absorb the selling pressure and bounce back above $20k. The same indicates that the ongoing macro accumulation trend has more weightage when compared to the recent institutional dumping and whale inactivity.