The largest cryptocurrency with a market cap of $794 billion witnessed a decent week. Yes, we are talking about Bitcoin(if the context was not clear), with the king coin registered a 9.11% recovery. BTC’s last significant weekly green candle was observed back during the 4th week of January 2022. While the trend is far from being outrightly bullish, a key indicator was becoming active again. Tether was hugely influential for BTC”s bull run in 2021, and USDT may play another key role going forward.

In fact, the plot of stablecoins altogether cannot be ignored as Bitcoin continues to hold a position in the chart.

Tether addresses improve activity with Bitcoin reaching $42,000

According to Santiment, after Bitcoin reached $42k on 19th March, Tether or USDT addresses have responded with strong positive activity. Data suggested that Tether witnessed a couple of massive addresses activity periods, with more than 150k active addresses interacting in the USDT network. This is the largest spike in activity in 2022, and one of the largest moves since December 2020.

Now, without context, the increase in USDT activity does not mean a lot but based on past observation, it may carry weight. Stablecoins were not a part of BTC‘s rally in 2017 but they played a huge role in 2021. The supply of USDT and other stablecoins increased multi-fold during the 2021 bull-run and its overall importance improved. Investors were no longer dumping Bitcoin and other Alts for cash during a correction, but hedging it on stablecoins to weather volatility whenever required.

Now, keeping the above narrative in mind, it can be speculated these addresses might be coming back to life for another possible bullish rally. However, it is important to note that on the flip side, these addresses could be selling their positions for cash as well.

BTC being risk-on is an add-on?

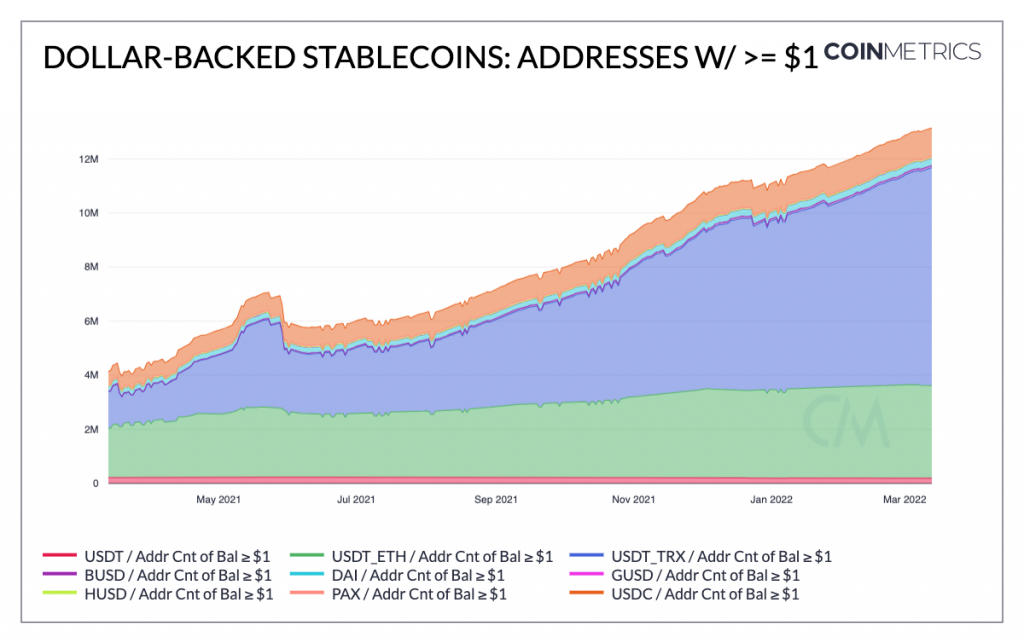

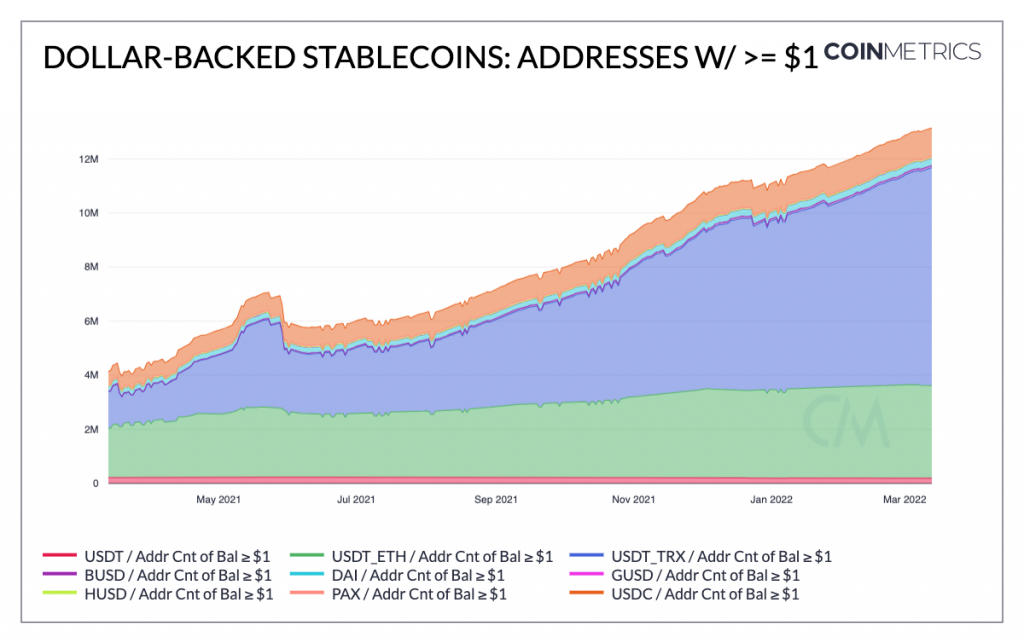

From the top-20 crypto assets in the market, 25% of it, is made of stablecoins. At the beginning of 2020, there was only one in the top 20. It is obvious that public blockchains are increasingly becoming more critical for on-circulation during a bearish market. Another strong reason to justify this idea is the fact that Bitcoin has been extremely risk-on during the last few months, rather than safe haven.

Hence, the adoption of US-dollar backed stablecoins such as USDT, USDC, and UST have increasingly accelerated in terms of the total number of addresses holding a minimum of $1. The total addresses have surpassed 12 million after being under 4 million during the beginning of 2021.

Over the coming months, stablecoins should play a vital role for Bitcoin and other assets, however, direction-wise, it is still anyone’s guess.