Bitcoin has a finite supply and the number is capped at 21 million. As of now, the largest crypto’s supply stands at 19.26 million.

Out of the coins currently in circulation, a substantial chunk has been permanently lost. Losing private keys or recovery phrases is one of the most common way by which users get stripped of their access to BTC. Retrospectively, they lose the ability to cash-out or spend them.

Supply of Bitcoin owners who’ve passed away also account for a part of the inaccessible coins. Additionally, intentional transfers to vanity addresses also contribute to the same.

As of the beginning of 2023, more than 1.45 million coins were already lost. At the current price, they’re worth approximately $26.4 billion. Even though unfortunate, it makes the remaining supply more valuable.

Also Read: Bitcoin Reclaims $18K: Is A Bull Run In Sight?

Bitcoin Dormancy On The Rise Too

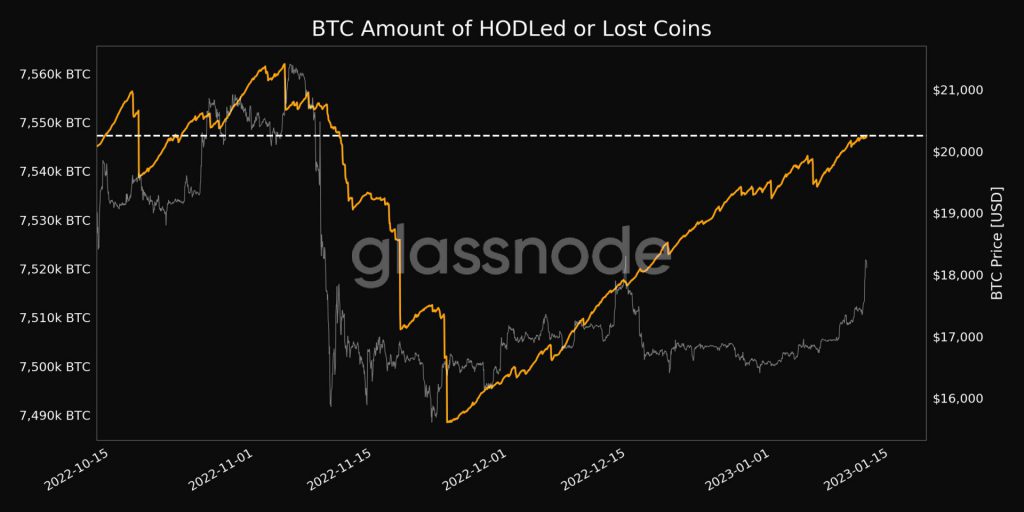

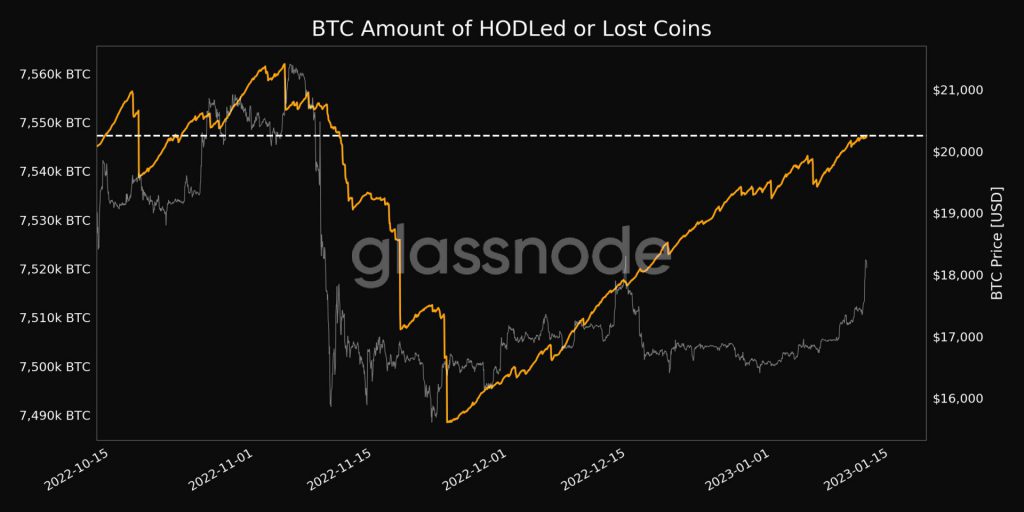

As far as the macro picture is concerned, lost BTCs are usually counted along with the coins held by investors. According to the latest data from Glassnode, the amount of held or lost coins reached a 1-month high of 7,547,295.716 BTC on Thursday.

Also Read – Bitcoin: ‘Tension’ To Likely Build Up By End Of January, Why?

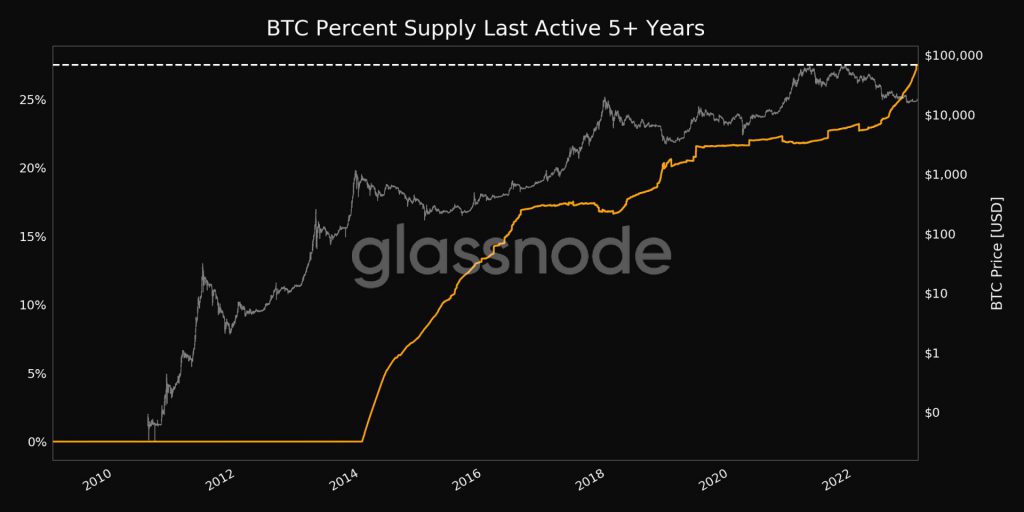

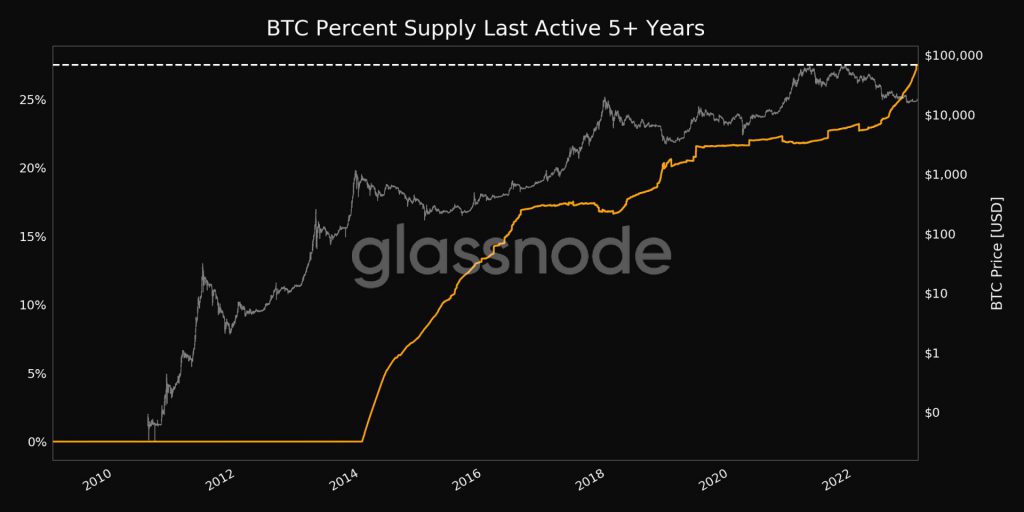

The aggregate dormant supply, alongside, seems to be on the rise. Like shown below, the supply last active 5+ years back has just attained an all time high of 27.513%. The higher the dormancy the better, for it signifies that “diamond hands” are dutifully holding their Bitcoin stashes without being tempted to book profits.

On the price front, Bitcoin has been faring pretty well since the beginning of this week. Thanks to the 8% weekly incline and 4% daily incline, the market’s largest crypto asset was trading at $18.2k at press time.

Also Read: Will Bitcoin face a ‘bull-trap’ post-December CPI Numbers?