A few hours back, the House of Representatives passed the debt ceiling bill, green-flagging the U.S. to borrow more money. Despite receiving fair opposition, the bill passed the House with a 314-117 vote, suspending the $31.4 trillion upper cap. Now, the U.S. Senate must vote on the bill later this week, before President Joe Biden signs the measure into law. Meanwhile, it is projected that the government will hit its borrowing limit on June 5.

JUST IN: 🇺🇸 US House passes debt ceiling bill.

— Watcher.Guru (@WatcherGuru) June 1, 2023

After the vote, President Joe Biden tweeted,

“Tonight, the House took a critical step forward to prevent a first-ever default and protect our country’s hard-earned and historic economic recovery… I urge the Senate to pass it as quickly as possible so that I can sign it into law, and our country can continue building the strongest economy in the world.”

Ripple effects of the debt ceiling chapter

Even though the House passed the bill, several from the community remain displeased. According to Blackrock CEO, Laurence Fink, the recent “drama” pertaining to the debt ceiling has eroded global trust in the U.S. dollar. He emphasized that over the long run, this needs to be rectified and rebuilt. Furthermore, Fink said that the prolonged debate around this legislation, the risk of a U.S. default, and possible credit rating downgrades were all “destabilizing” factors for the dollar, the world’s leading reserve currency. He added,

“I believe we’ll have a resolution, … but let’s be clear, the United States is jeopardizing its reserve currency status.”

Now, with the dollar in jeopardy, other finite-supply assets like Bitcoin are being looked upon by investors. However, the path is not all that clear. Citizens who want to play safe and steer away from risky assets like crypto could essentially end up diverting funds to buy government bonds. In such a scenario, volumes will likely continue dropping and the space might end up facing another liquidity crunch. This, in turn, could rub off negatively on asset prices. Nevertheless, optimism still looms. Josh Gilbert, a market analyst with eToro, recently contended,

“The debt ceiling deal once again highlights Bitcoin’s utility because it’s essentially a break away from the traditional financial system. Given its finite supply, it’s free from the issues that the U.S. government is facing right now.”

Bitcoin still Struggling?

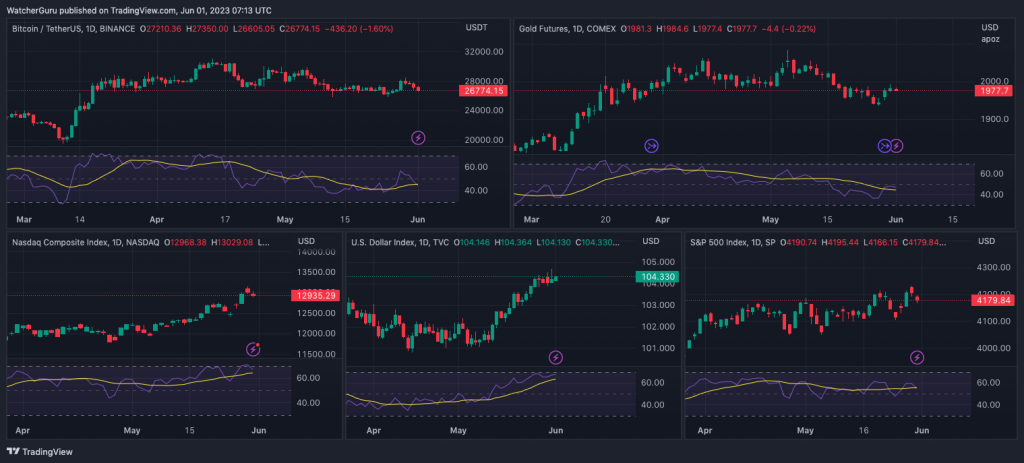

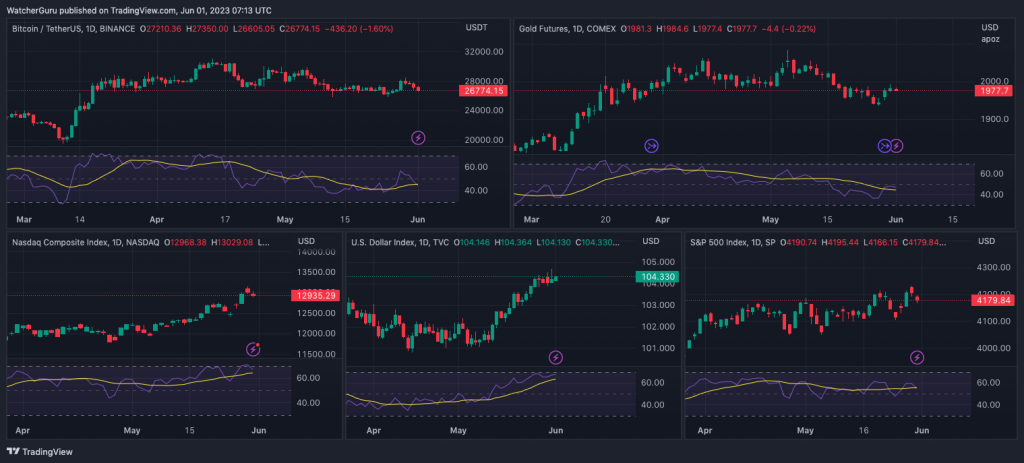

Bitcoin’s reaction, however, hasn’t been positive. On the daily, it was down by 1.6% and was trading at $26.7k. In fact. Right from Gold Futures, to the Nasdaq Index, and the S&P 500 Index, all other major indices and assets had also shed value over the past day. However, the Dollar Index alone was trading borderline in green at press time.

That being said, it is worth recalling that crypto asset prices initiated an uptick Saturday evening after House Republicans came to a tentative deal with the White House to raise the ceiling and avoid a default. In fact, Bitcoin roared even louder the next day. Thus, with the debt ceiling finale not over, asset price reactions can be expected to flip anytime.

Also Read: Dollar Index Inches to 103: Bitcoin, Gold Weaken