The BRICS alliance is advancing to shake up international affairs by effectively coordinating financial policies around their basic principles. The upcoming BRICS summit aims to confront the geopolitical landscape that is dominated by developed Western nations and their financial establishments. The bloc of five nations has accelerated the pace of de-dollarization intending to end the U.S. dollar’s superiority.

Also Read: What Happens if Europe Accepts BRICS Currency?

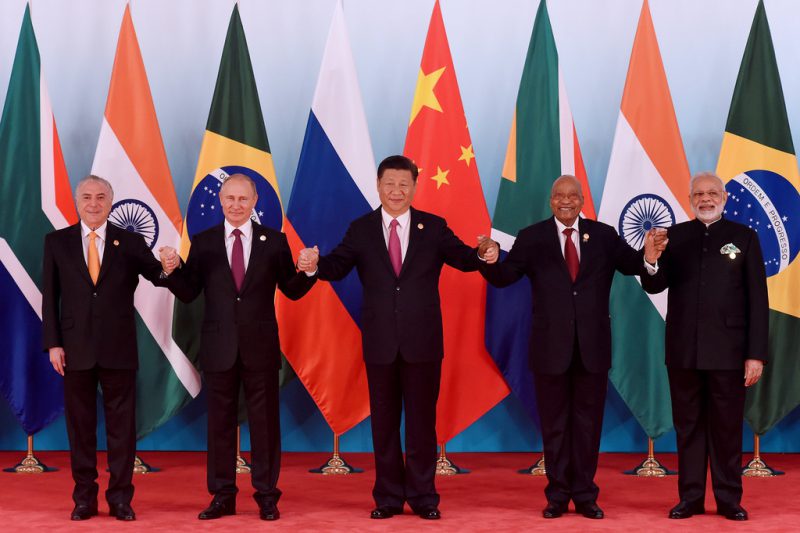

BRICS is an acronym for Brazil, Russia, India, China, and South Africa. Four out of the five member countries are openly critical of the usage of the U.S. dollar for cross-border transactions. India is the only country in the bloc that mostly maintains a neutral stand on the issue. However, India has pursued and convinced other countries to settle trade with the Indian Rupee and not the U.S. dollar.

This brings all five member nations to the same stage that is ready to challenge the U.S. dollar. The fate of the dollar will be tested when the BRICS alliance decides on the formation of a new currency. The soon-to-be-released currency could take shape in the next summit in August in South Africa.

Also Read: BRICS Bank That Was Built To Challenge U.S. Dollar Now Needs USD

BRICS Alliance Advancing To Eliminate the U.S. Dollar Financial System

BRICS has already convinced nearly 40 countries to ditch the U.S. dollar and accept the new currency for international trade. Around 21 countries, including the oil-rich Saudi Arabia and the United Arab Emirates, have expressed interest to join the alliance. If Saudi Arabia and the UAE gain approval into the bloc, it could alter the geopolitical landscape and shake up international affairs.

Global financial policies could be readdressed according to their ideas leading to a shift in power from the West to the East. The move could put the U.S. dollar under pressure as it would find no means to fund its deficit.

Also Read: BRICS: 30 Countries Participate to Ditch the U.S. Dollar as Global Reserve Currency

In conclusion, BRICS is on the verge of altering geopolitical, financial, and international affairs according to their ideas and policies. If the new BRICS currency gets accepted by the majority of countries, the U.S. dollar’s decline could begin.