The BRICS alliance is indulging in massive sell-off by offloading billions worth of US treasuries and stocks. China is on a US Treasury dumping spree as it looks to halt the rise of the US dollar against the Yuan. The Chinese government is defending the weakened Yuan by offloading billions worth of US treasuries and stocks from its reserves.

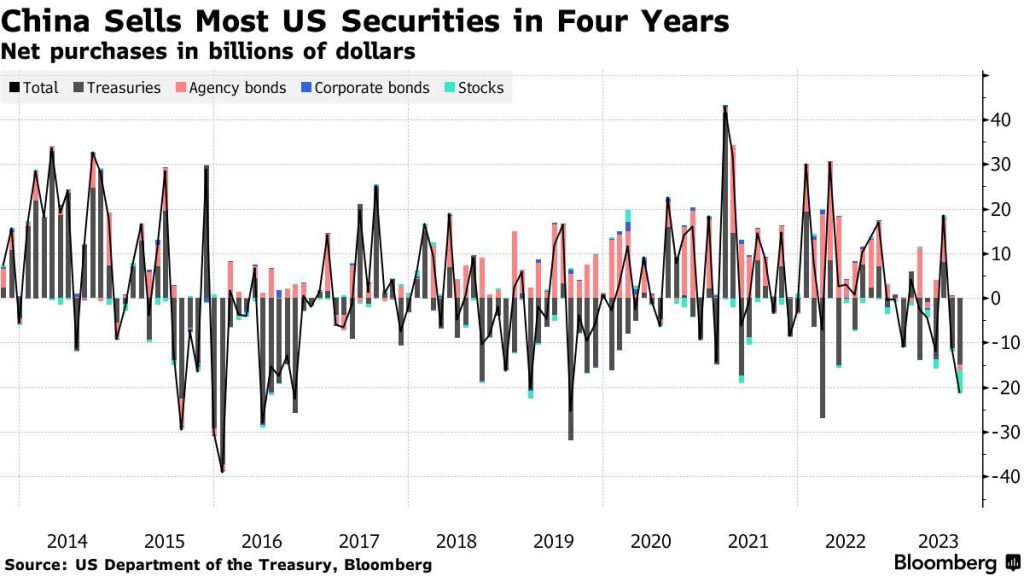

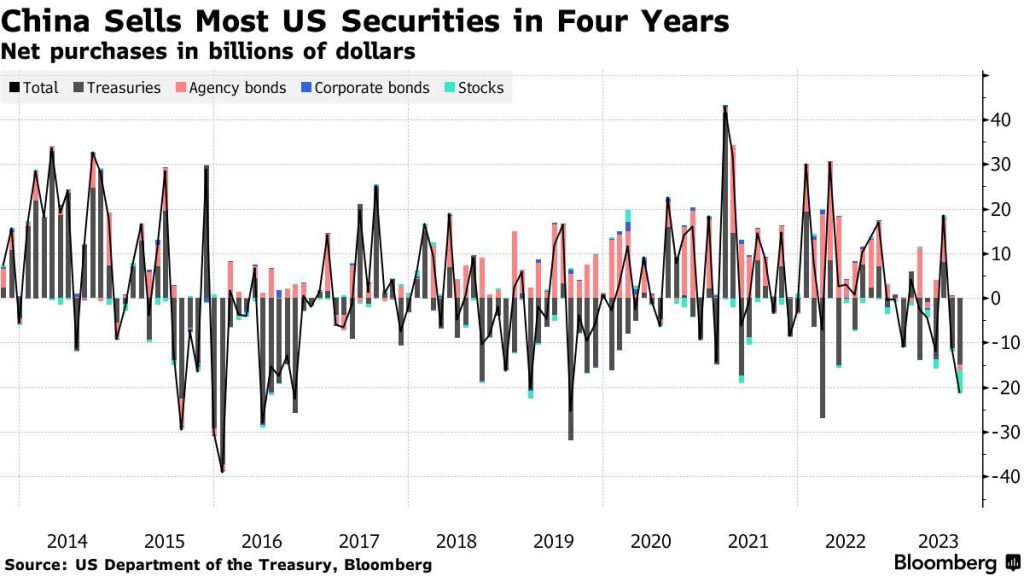

BRICS member China dumped $21.2 billion in US treasuries and stocks in August, according to latest data released by the US Treasury Department on Wednesday. This is the highest that the Chinese government sold US government bonds in four years.

Also Read: BRICS Is Now Richer Than G7 Countries

The sell-off comes at a time when the Chinese Yuan fell to its 10-month low against the US dollar. Reports state that the Communist government initiated state-run banks to intervene in the currency markets on behalf of the Central Bank. The bulk of the offload came from state-run banks as they dumped US treasuries and equities worth $21.2 billion.

Also Read: Experts Predict If BRICS Currency Can Dethrone the U.S. Dollar

The development prevents the Yuan from ending on a low against the US dollar in the foreign exchange markets. The rising US dollar is worrisome to developing countries as it adds a burden on the import and export sectors. Therefore, China and the BRICS bloc are dumping US treasuries and stocks in the markets to protect their respective local currencies.

BRICS Dumped $123 Billion in US Treasuries & Stocks in 2023

The BRICS alliance has sold government bonds, US treasuries, and stocks worth $123 billion in 2023 alone. India is also accused of market intervention by selling the US dollar to protect the Rupee from falling to new lows. Reports state that the Reserve Bank of India told a state-run bank to dump the US dollar to keep the Rupee from going down.

Also Read: BRICS: Payments in U.S. Dollar Decline By 25%

Japan is also accused of intervening in the currency markets to keep the Yen from ending at new lows against the US dollar. Despite BRICS initiating multiple attempts to stall the US dollar’s growth, the greenback outperformed all local currencies in October.