Amid all the talk of the developing BRICS currency, the Chinese Yuan’s record usage signals a continued global shift. Specifically, it was reported that the Chinese yuan had reached record numbers in global central bank swap lines in Q1 of 2023. Subsequently showing changing tides regarding the Yuan’s international standing.

Currency swap lines are agreements taking place between two central banks. Specifically, they agree to swap currencies in order to increase their respective capital holdings. Then, the two central banks promise to exchange it again while paying an interest rate. For China, it signifies a growing desire to accumulate the yuan for international trade purposes.

Chinese Yuan Shows Record Usage Globally

While the development of the BRICS currency has been at the forefront of international discourse, the Chinese Yuan has seen record usage, signaling a continued global shift. Specifically, the People’s Bank of China (PBOC) reported the outstanding balance of foreign currency swaps at the end of March was 109 billion yuan. That figure represents a 20 billion yuan increase compared to the end of 2022.

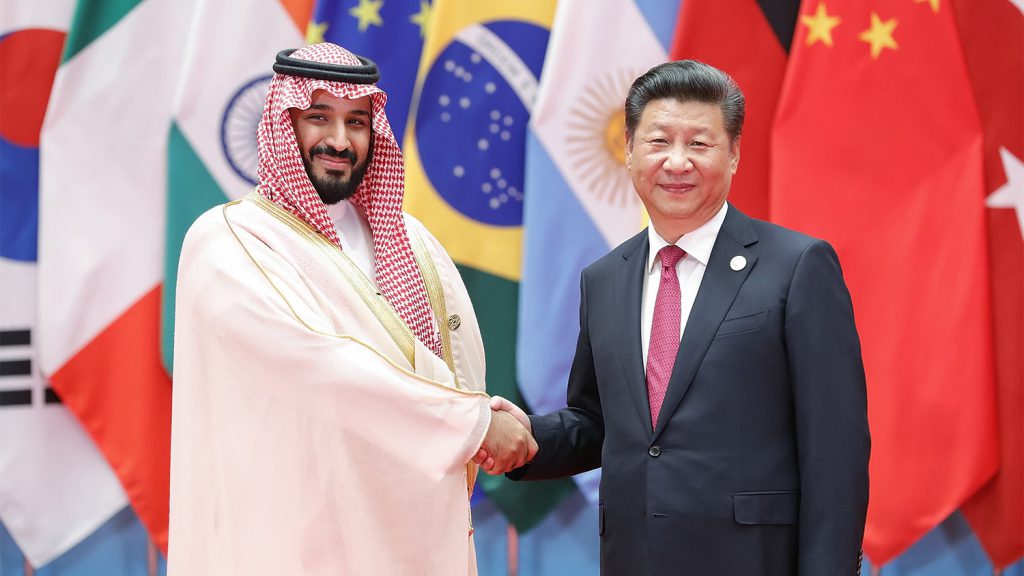

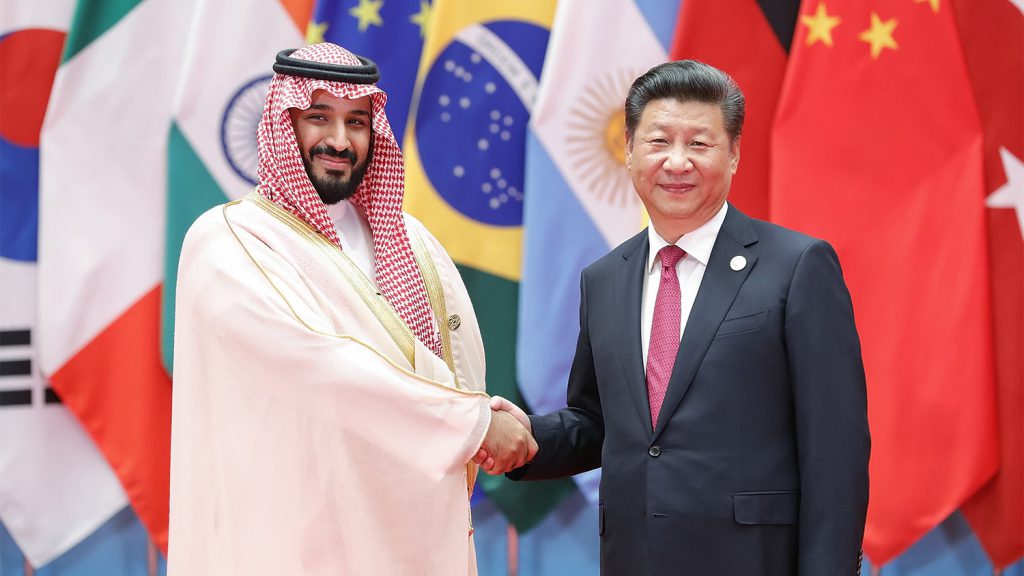

Although the PBOC did not specify the nations that have swapped current, the development is important. Specifically, amidst the de-dollarization efforts taken by BRICS, and its hopes of replacing the US dollar as a global reserve currency.

Nations have increasingly adopted the Chinese Yuan for the purpose of international settlements. Both Argentina and Brazil have sought to begin settling their trades in the Chinese currency. Thus, proving that the BRICS efforts have taken hold on a global level.

The 2023 annual BRICS summit is taking place in August, where a currency for international trade is set to be discussed. Moreover, developments like these combat many who observe the difficulty of the US dollar’s replacement.

Showing that countries are continuing their embrace of the yuan will open the door for a BRICS-implemented currency to eventually replace it. Alternatively, BRICS had reportedly aimed to increase the use of national currencies before an alternative was developed. For China, this process has already begun.