Amidst a host of de-dollarization efforts, and the rising prominence of the BRICS collective, could a BRICS currency threaten the US dollar’s global reserve status? Many economists suggest the greenback’s entrenchment as a protection, but growing national currency use and macroeconomic factors could tell a different story.

The Chinese yuan has been growing in prevalence amidst the BRICS alliance. Moreover, as negotiations on a BRICS currency are underway, a future where the dollar’s dominance is questioned is not out of the picture.

The Rise of the US Dollar

Understanding the BRICS currency’s potential threat to the US dollar requires first understanding how it became the global reserve currency. Specifically, after World War II, the United States went from a leading role to a global system. Subsequently, being rather unaffected by the war and boasting a plethora of gold reserves and other resources, the US stood tall.

However, prior to World War II, the US crafted a new world order known now as the Bretton Woods Agreement. Specifically, in Bretton Woods, New Hampshire, 44 countries gathered to develop a new world order. Moreover, those allied countries would de-peg from the gold standard to the US dollar instead.

Then, the US dollar was pegged to the US gold reserve, which would serve as a proxy. Subsequently, the central banks of those same countries would hold a fixed exchange rate against the dollar, which was redeemable for gold. thus setting in motion an international accumulation of the American currency, with countries regulating their own currencies with respect to the greenback.

USD Internationally

Another aspect of the Bretton Woods agreement was the eventual creation of the International Monetary Fund (IMF). That organization would provide loans to its member countries while creating an even wider reach for the greenback. Eventually, the dollar would gain unrivaled dominance; in 2022, the IMF noted that the dollar held more than 58% of the world’s total currency reserves.

Alternatively, the euro only holds 20.47%, while the Chinese renminbi holds a mere 2.69%. Ultimately, the US dollar held an unprecedented $6.47 trillion in Q4 out of $11.96 trillion of the total foreign exchange reserves. Subsequently, international trade occurs with the US dollar more often than not.

However, a lot of that changed with the sanctions imposed on Russia by the West. As a fallout from the invasion of Ukraine, the sanctions sought to separate the resources of Russia from the rest of the world. Conversely, the action showed that the US would not operate with the objectivity needed for the custody of the world’s finances.

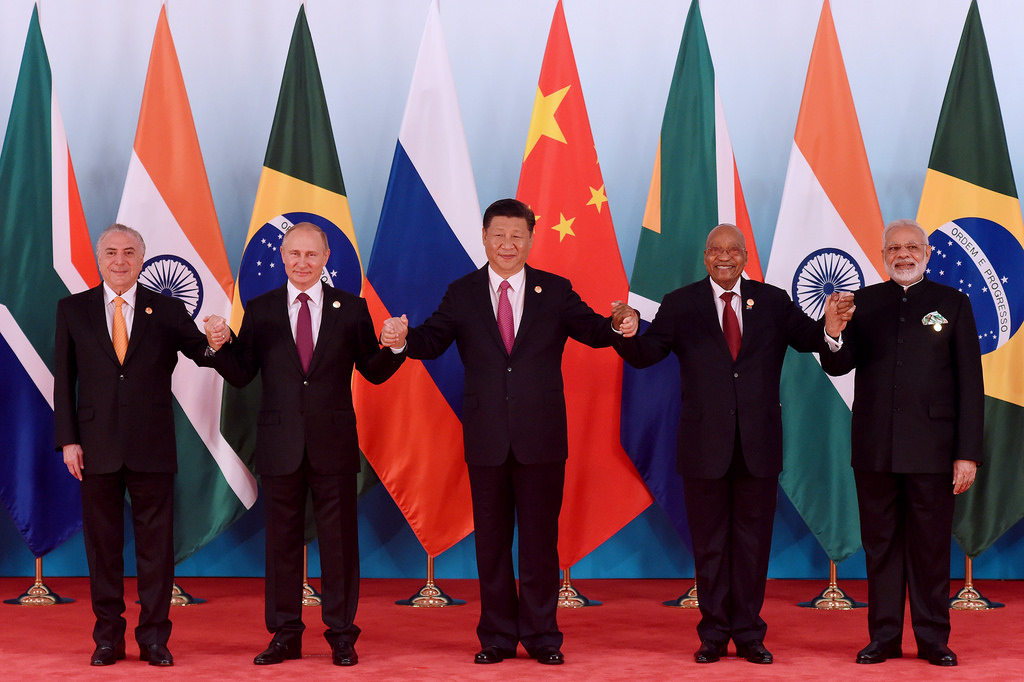

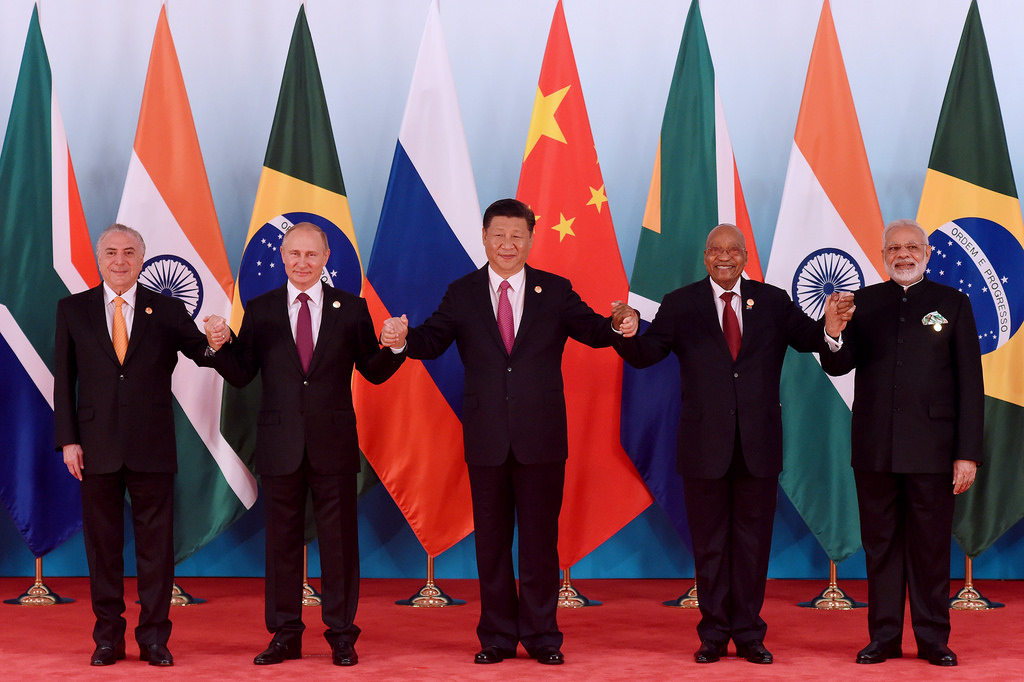

Subsequently, this development would lead to the prominent growth of the BRICS nations. Currently comprised of Brazil, Russia, India, China, and South Africa, the nations have found momentum against the US actions. Thus, the prospect of a different global reserve currency began to form.

BRICS Currency as Global Reserve?

Kristalina Georgieva, the IMF’s managing director, made clear their view on the US dollar’s status as a reserve currency. Specifically, by stating there is no alternative while assuring she, “does not see it coming any time soon.”

Conversely, the rise of BRICS presents an interesting point of observation. Reports ahead of the annual BRICS summit taking place this summer have stated that more than 19 countries are seeking membership in the bloc. Nevertheless, the expansion of the collection to 24 countries would garner more than 47% of the world’s population and 37% of the world’s GDP.

Additionally, the BRICS nations are major oil producers, which would lead to the dethroning of the petrodollar. Currently, the five nations are vital contributors to the world’s oil production. Moreover, Saudi Arabia has already shifted its international oil settlements, recently utilizing the Chinese yuan. A step that is critical for the eventual establishment of a BRICS currency.

Moreover, Argentina announced that it would settle international deals using the Chinese yuan as well. Signaling a similar turn away from the greenback. Subsequently setting in motion a global de-dollarization trend that feels difficult, if not impossible, to reverse at this point.

What may be more concerning is that Argentina’s switch from the dollar to the yuan was rooted more in triple-digit inflation and a dollar reserve shortage. However, the Chinese yuan is still pegged to the US dollar. Conversely, showcasing both the macroeconomic factors of the dollar’s fall and its necessity in the global economy.

A BRICS currency is a threat to the US dollar’s global reserve status, but the path toward that future remains incredibly difficult. Ultimately, a dethroning of the greenback could take place, but likely not for some time.