Amidst the talk of the BRICS nations development of an alternate currency, US Treasury Secretary Janet Yellen has stated that the sanctions on countries like Russia could hurt the US dollar. Moreover, international trade has been adamant in its pursuit of an alternative standard currency to the greenback.

The BRICS nations have been outspoken in pursuing a new international trade currency. Conversely, Yellen told CNN that economic sanctions on countries like Russia would only add to the threat of the US dollar’s prominence.

Yellen Talks US Dollar’s Fading Dominance

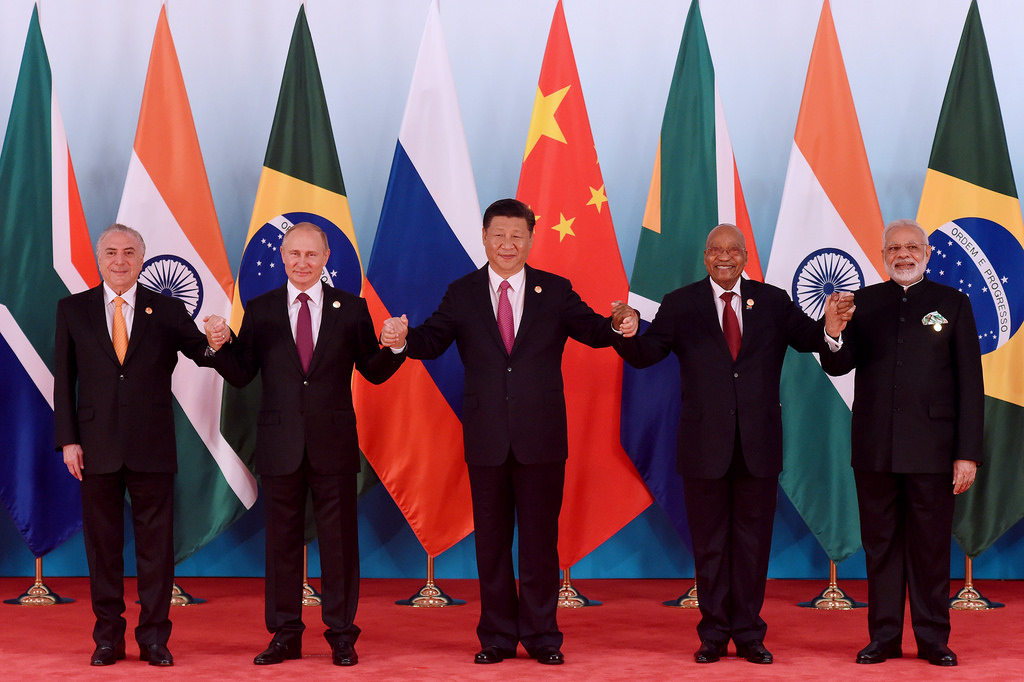

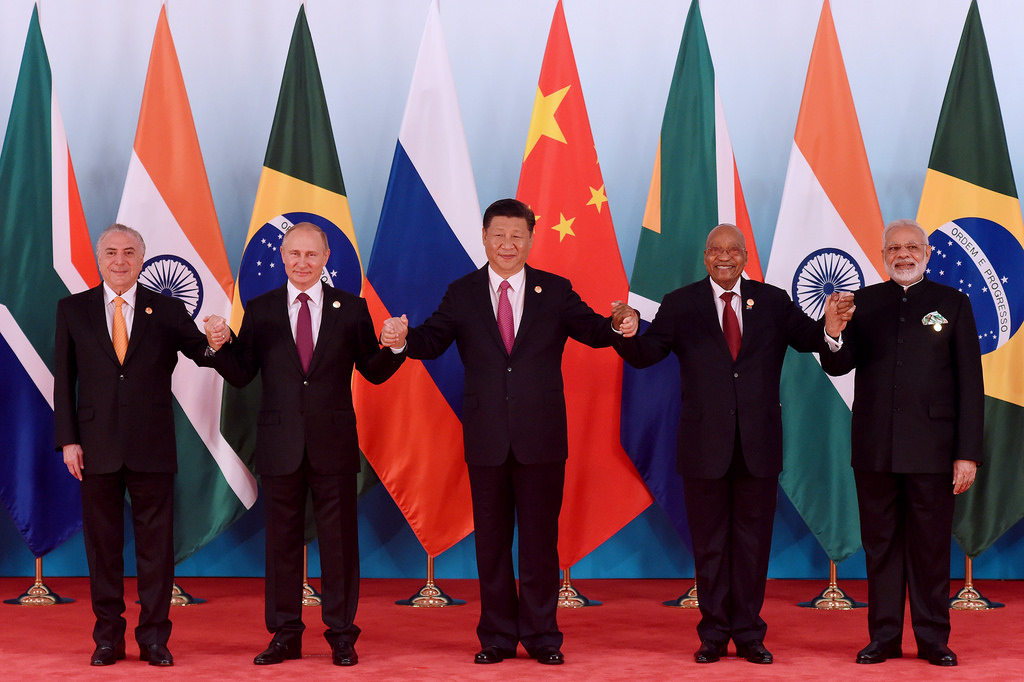

The BRICS nations—composed of Brazil, Russia, India, China, and South Africa—have undoubtedly grown in their importance globally. Undoubtedly observed in the recent collectives surpassing the G7 nations in GDP (PPP). Moreover, they have been outspoken in their pursuit of creating an alternative currency to eliminate the dominance of American currency.

Now, amidst the plans made by the BRICS nations, Treasury Secretary Janet Yellen has spoken on sanctions ultimately hurting the dominance of the US dollar. Specifically, Yellen spoke to CNN to discuss those sanctions and the adverse effect they could have on the greenback’s international relevance.

“There is a risk when we use financial sanctions that are linked to the role of the dollar that, over time, it could undermine the hegemony of the dollar,” Yellen stated in an interview. Conversely, she noted that the US uses the dollar as a tool “judiciously” in the same interview.

“It is a very effective tool. Of course, it does create a desire on the part of China, of Russia, of Iran to find an alternative,” Yellen remarked. Still, the growing voice against the US dollar’s dominance is not limited to those three.

Specifically, last week saw Brazil President Luiz Inacio Lula da Silva call for countries to develop their own currencies for international trade. As a result, decreasing reliance on the US dollar