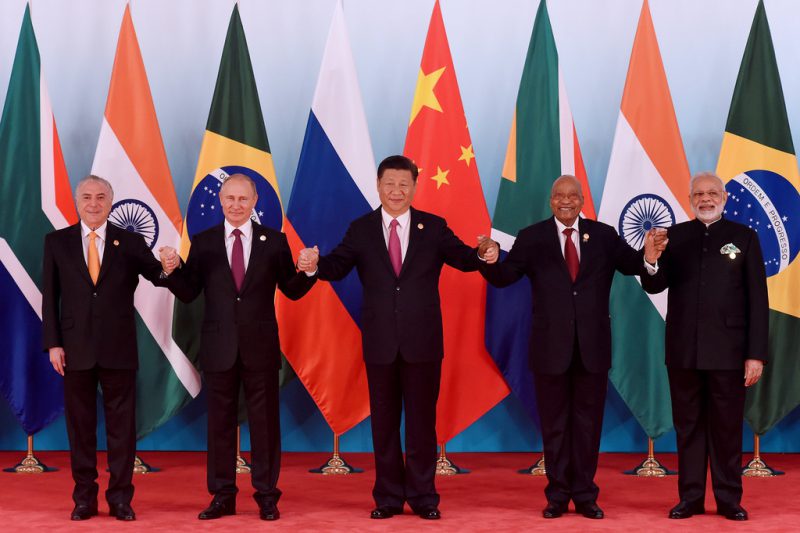

BRICS countries are on a gold-accumulating spree that could spell doom for the U.S. dollar. For the uninitiated, the World Gold Council published a report highlighting that China purchased 102 tonnes of gold in 2023. On the other hand, Russia purchased 31.1 tonnes of the precious metal, while India accumulated 2.8 tonnes to its gold reserves. Though the development looks small at the global level, it could be a tipping point for the U.S. dollar.

The alliance of nations buying large amounts of gold is worrisome for the future of the dollar. China, Russia, and India are advancing to eliminate the dollar-backed financial system at rapid speed. The only safe investment that could back their native currency or a new currency is gold.

Also Read: BRICS Countries Buying Large Amounts of Gold To Topple the U.S. Dollar

BRICS Gold Accumulating Spree Worrisome: Here’s Why

- BRICS nations buying massive amounts of gold caused the precious metals price to increase over the last three months. Gold has spiked nearly 20% in one year. Another round of large purchases could weaken the dollar as historically, gold and the dollar have an inverse relationship. When the price of gold goes up, the dollar tends to slide shedding its value.

- If BRICS’ new currency is backed by gold, it could assure the other country of safe international trade. The dollar is in debt and trading in the USD keeps other nations at risk of a potential fallout. If a recession hits America and the BRICS currency is backed by gold, other countries could remain unaffected. Therefore, gold could spell doom for the U.S. dollar in the long run.

- When other nations use a gold-backed currency, the demand for the U.S. dollar reduces on the global stage. The development could see a shift from Western-dominated economies to developing economies sitting in the driver’s seat. America’s ability to finance its current account deficit would take a beating.

Also Read: BRICS: U.S. Dollar Fading as Supply & Demand Dips

The CEO of U.S. Global Investors Frank Holmes, said that the pattern of BRICS nations buying gold is worrisome.

“If you look back at the list of net buyers (gold). You’ll notice that three are members of the BRICS countries (Russia, India, and, China). I point this out because, as I’ve been sharing with you for a couple of weeks now, we may be seeing the emergence of a multipolar world, with a U.S.-centric world on one side and a China-centric world on the other,” he said.