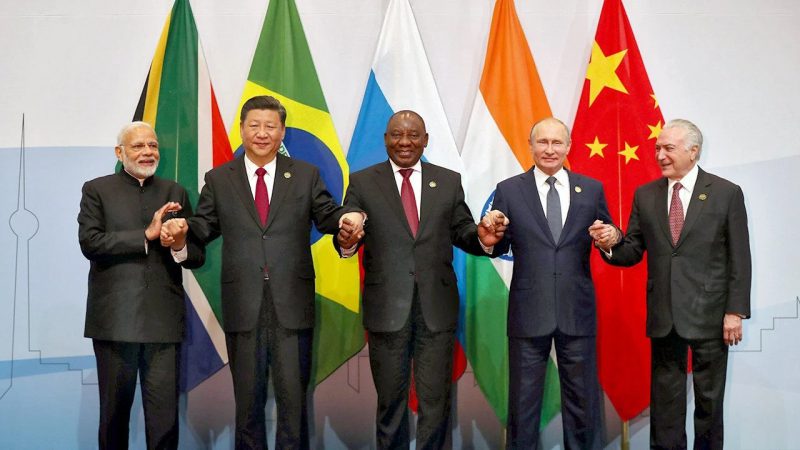

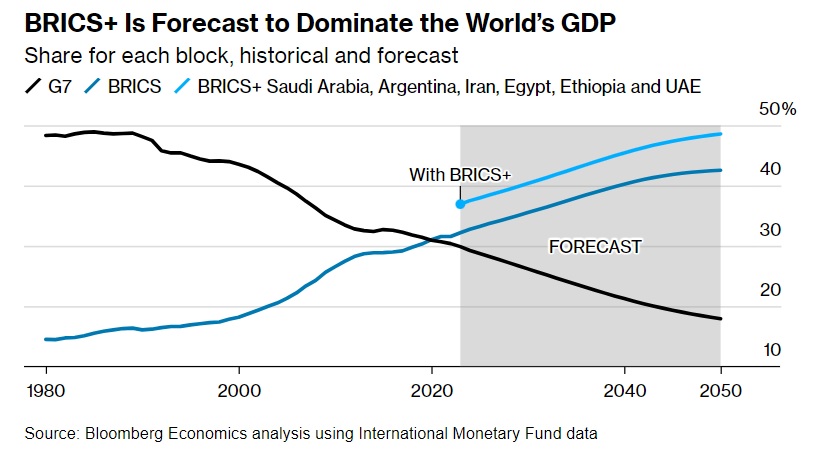

BRICS will expand to BRICS+ as Saudi Arabia, the UAE, Argentina, Egypt, Iran, and Ethiopia join the alliance. The combined GDP of the 11 nations climbs above $33 trillion and goes ahead by $8 trillion from the US. The GDP of the US currently stands at $25.5 trillion in 2023. BRICS+ currently controls nearly 30% of the world’s economy and could rise further if many more countries join the bloc.

This puts the US and other developed nations at risk, as developing countries are growing stronger than the West. The new alliance could re-negotiate trade agreements and tilt the playing field in their direction for better financial prospects.

Also Read: BRICS Expansion Will Significantly Speed-up De-Dollarization

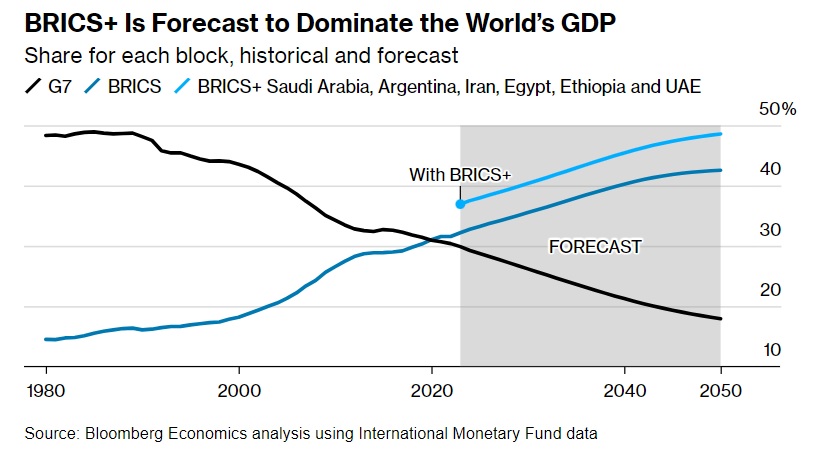

BRICS+ Projected To Control 50% Of the World’s GDP

Bloomberg has forecast that BRICS+ could control close to 50% of the world’s economy by 2050. According to the forecast, BRICS+ GDP could reach approximately 48% of the world’s GDP by 2050. The economic projection and analysis were taken using the International Monetary Fund data. However, the data used to measure the upcoming growth only took into consideration the 11 member countries.

Also Read: BRICS to Officially Abandon US Dollar

If BRICS+ expands further from 11 countries and beyond, their GDP could take the lion’s share of the global economy. There is a high chance that the alliance will induct many more countries into the bloc. 20 other nations’ applications are pending at the moment.

Also Read: BRICS: The Mighty Dollar Faces ‘Do or Die’ Situation

Therefore, the next two decades play an important role that could reshape the world’s political and financial landscape. Developing Eastern countries could have more clout and wield more power than the US and other Western allies.

The move will be the undoing of the traditional financial sector, paving the way for a new world order. The US and Europe could be alienated, eventually making the dollar, euro, and pound lose their status in the markets.