BRICS sees Europe as a competitor but also a potential investor that can open up avenues for the new currency. Europe is the gateway for BRICS to capture the Western markets and usher in a new financial era. If Europe accepts the soon-to-be-released BRICS currency, it could make the U.S. dollar lose its global reserve status. The supply and demand mechanics will fail to keep the U.S. dollar alive sending it on a path of decline.

Also Read: BRICS to End America’s Dominance?

South Africa’s BRICS ambassador Anil Sooklal confirmed early this month that European countries have expressed interest to join the alliance. The ambassador did not specify a country but hinted that a segment of the European Union could accept BRICS currency.

In recent months, the Eastern European country Belarus was the first to show interest in BRICS after President Alexander Lukashenko suggested plans to create a new economic union with zero restrictions. Read here to know more details about why Belarus is interested to enter the BRICS bloc.

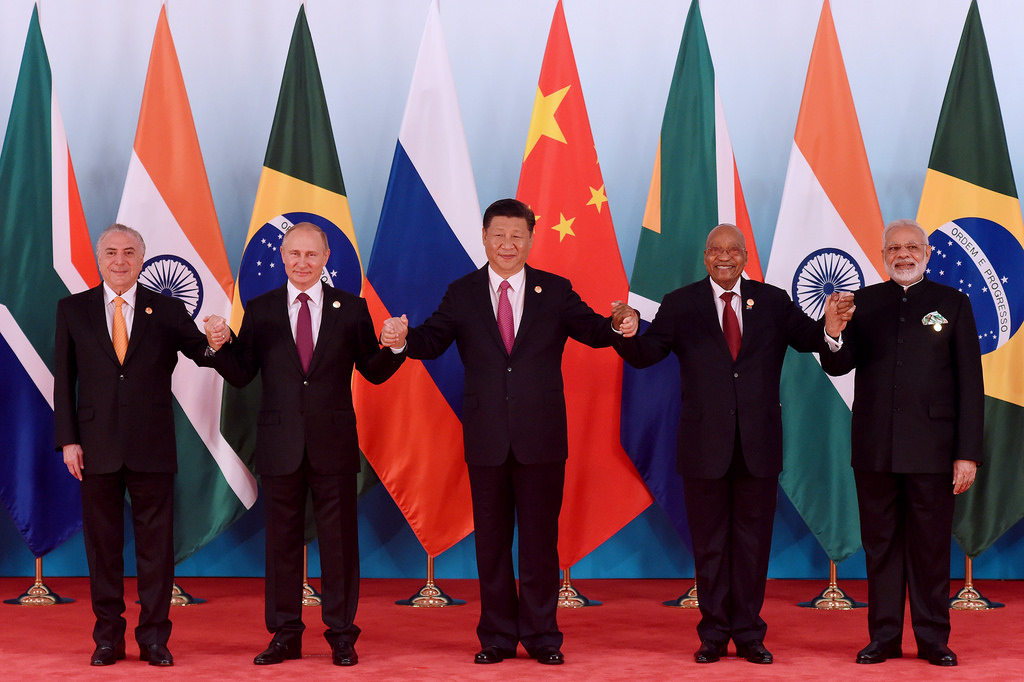

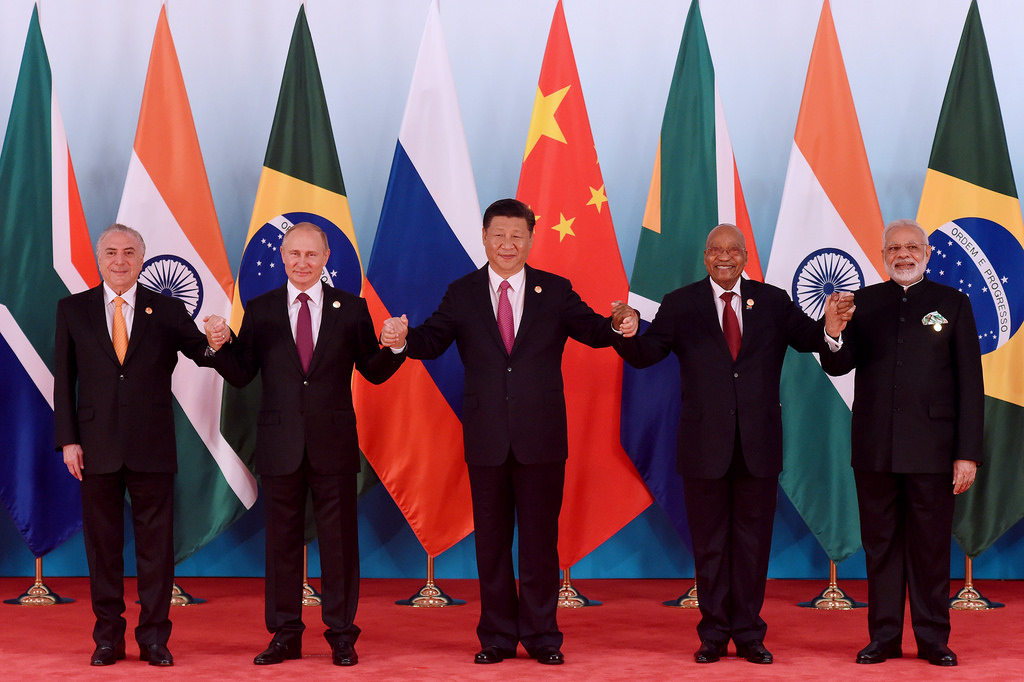

BRICS and Europe: The Gateway For The New World Order

In a recent Valdai Discussion Club Report, economists suggested that the BRICS bloc could strategize a common framework for Europe. All five BRICS countries have close ties to Europe and initiate billions of transactions through goods and services. If the BRICS alliance convinces European nations to pay through the new currency, it could make the tender stronger on a global scale.

Also Read: Saudi Arabia To Challenge U.S. Dollar’s Supremacy by Funding BRICS Alliance

“All BRICS countries are linked with Europe by a host of political and economic contacts and interests. They see the EU not only as a potential competitor and investor. All BRICS countries have their own unique experience of relations with European states and the EU as an institution,” the report read.

The economists added, “(We) believe this experience may soon allow them to consider how they might elaborate a common BRICS framework for a collective EU strategy”.