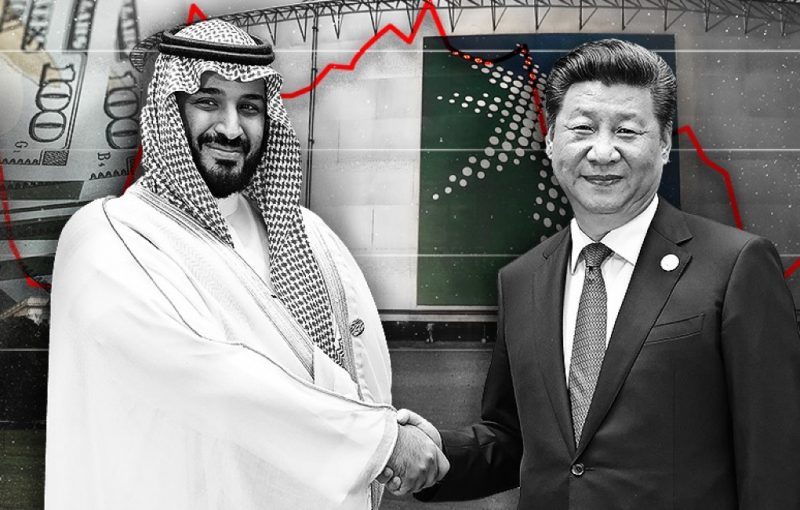

The US dollar is put under pressure as BRICS members China and Saudi Arabia are advancing in the de-dollarization motives. BRICS countries China and Saudi Arabia signed a trade agreement worth $7 billion on Monday kick-starting the prime de-dollarization process.

China and Saudi Arabia’s deal is a currency swap that favors their local currencies the Chinese Yuan and the Riyal. The trade agreement is valid for three years and both the countries will settle trade in local currencies up to 50 billion Chinese Yuan or 26 billion Saudi Riyals.

Also Read: BRICS: India Unhappy After Russia Begins to Cement Ties With Pakistan

BRICS: US Dollar Losing Steam in the China & Saudi Arabia Currency Swap Deal

Who is the biggest loser in the trade agreement between China and Saudi Arabia? The answer is clear, it’s the US dollar. The USD will play no role in cross-border transactions for payment settlements up to $7 billion between the BRICS nations. Therefore, China’s Central Bank will maintain a reserve of the Saudi riyal, and the Saudi Central Bank will keep the Chinese Yuan.

Also Read: Gold Price Prediction: Rejection at $2,000 Opens the Door for a Dip

When a cross-border transaction needs to be initiated, the Central Banks will use native currencies and not the US dollar. The move gives a boost to the Chinese Yuan and the Saudi Riyal as the US dollar is kept away from settlements. Ending reliance on the US dollar from BRICS countries is a win-win situation for both China and Saudi Arabia.

Read here to know how many sectors in the US will be affected if BRICS stops using the dollar for global trade. The development will have lasting implications for the US economy and also lead to inflation in the homeland.

Also Read: Argentina Has No Interest in BRICS, Says President’s Top Aide

China remains successful in its quest to convince developing countries to cut ties with the US dollar. If the trend continues in 2024, many more developing countries could follow suit and use local currencies for trade.