Thinking of investing in Cardano? The platform often enjoys price increases before a major network update but its technical charts suggest that an ongoing downtrend could last longer. It might be more profitable to let the correction play out before parking funds in the smart contract operator.

Cardano is just a little over two months away from Vasil hard fork in June, which founder Charles Hoskinson says “is the biggest update in long time”. The hard fork is expected to sizably improve Cardano’s network performance and bring in more decentralized finance (DeFi) apps, smart contracts, and decentralized exchanges.

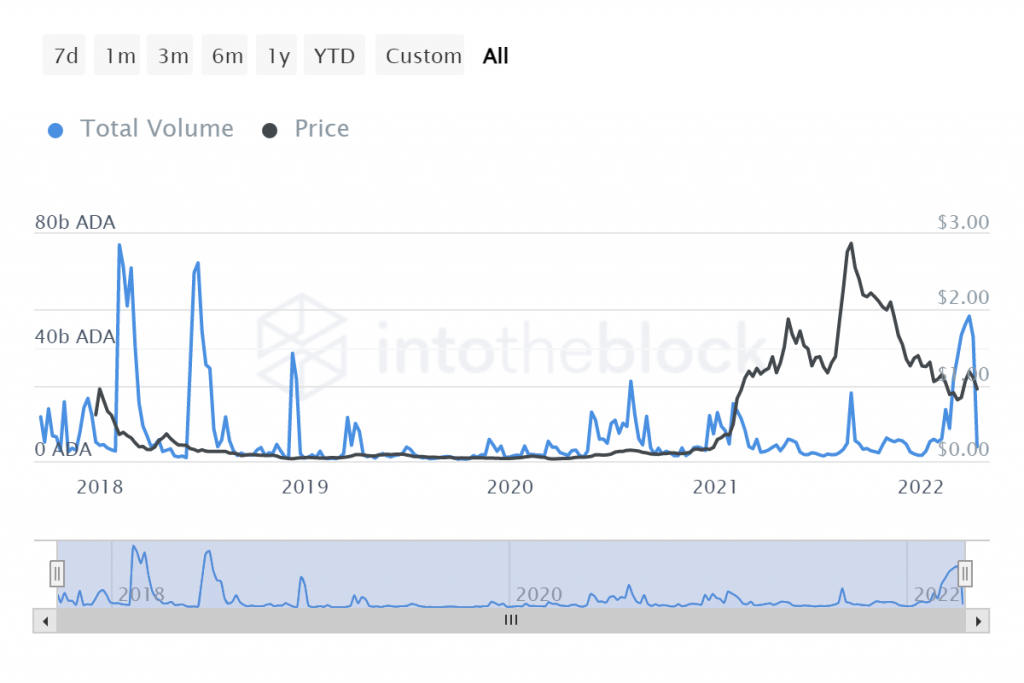

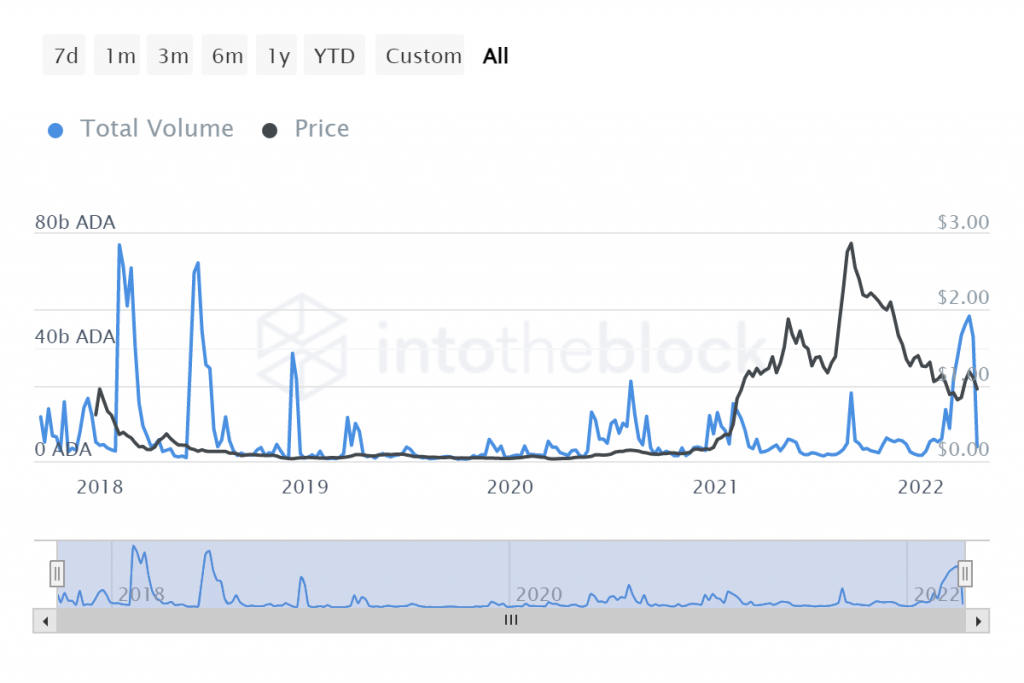

Notably, Cardano’s price generally picks up on the chart as investor sentiment turns bullish before the planned updates. Such was the case with Cardano’s Shelly hard fork in July 2020 and Mary hard fork in March 2021.

However, Cardano’s current position on the chart presented a rather dire situation. The price was trading at a near 1-month low after slipping below an important support level at $0.92. Technical indicators RSI and MACD were both bearish on ADA and did not show signs of any immediate reversal.

Meanwhile, value transferred over on the Cardano network was also suggestive of low trading activity. Cardano’s transaction volume, which aggregates on-chain transactions has declined constantly throughout April and was currently at a near a 1-month low.

Cardano Support Levels

With an uptrend looking unlikely over the short term, Cardano could slip by another 11% before tagging its next support zone. However, support levels of $0.815-$0.75 could bring about a much-needed change in ADA’s price. The area had proven to a be reliable defense after triggering a 60% upswing in late March.

Given the current market dynamics, a wait-and-watch approach would be a safer bet for Cardano at the moment. Investors can wait for the present correction to run its course and start longing only once a favorable trade emerges between $0.817-and $0.75 support.