Cardano’s price has remained troubled by broader market fluctuations since April, declining by a further 21% over the past week. While some analysts have called to buy the ADA dip, the charts and network activity suggest that investors might have to wait slightly longer for a better buy opportunity.

Cardano’s price has been constantly declining since 4 April, losing out to support levels of $1.17, $1.04, and $1.00. Yesterday’s broader market sell-off rubbed more salt to Cardano’s wounds, with ADA recording its highest daily loss in nearly 3 months.

Such drastic corrections are awaited by a multitude of traders who target potential bottoms to ‘buy the dip’. However, a quick technical analysis showed that ADA recovery might just stem from a more reliable support level than its press-time price.

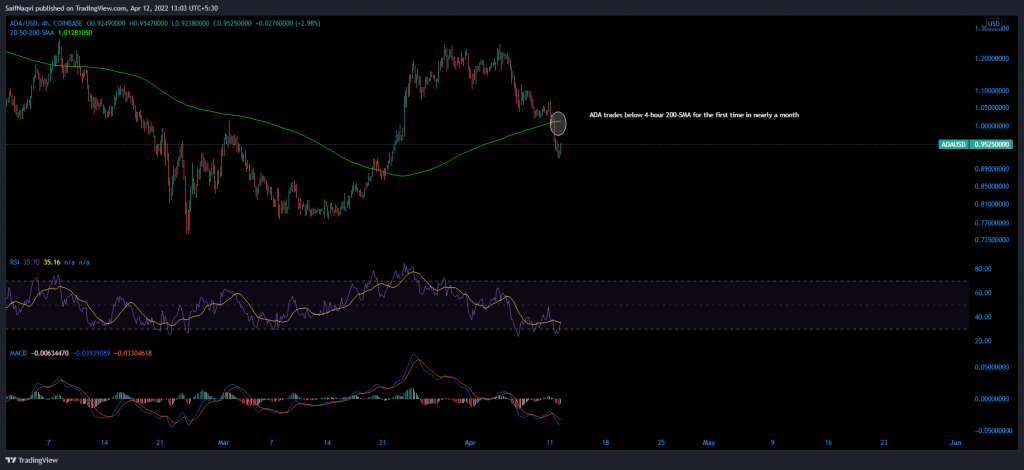

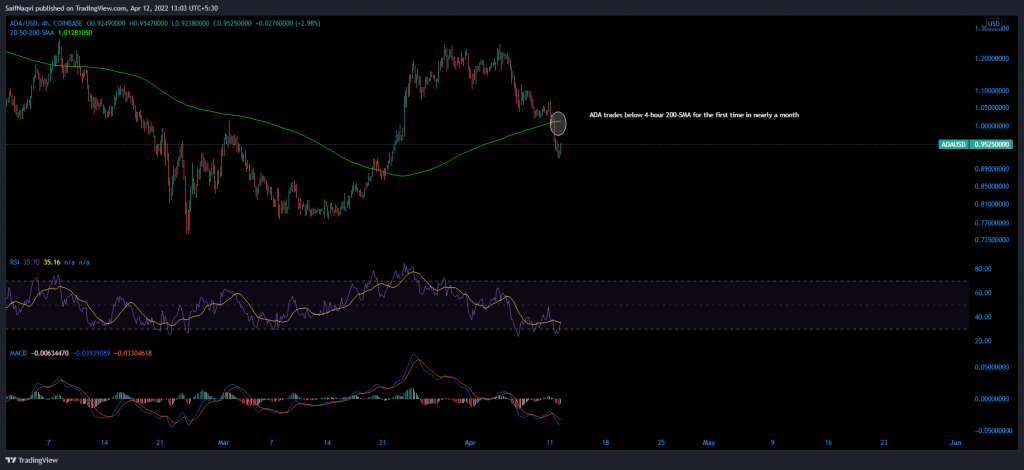

Cardano 4-hour – Still bearish

Firstly, Cardano was in a clear bearish bias on the 4-hour chart. The candles were trading below their 200-SMA (green) and the indicators aligned more favorably for sellers than buyers.

Secondly, on a macro level, Cardano has been suffering from low network activity over the recent weeks. Its Total Value Locked (TVL) has nearly halved since 28 March while daily active addresses have slipped by 67% over the past week.

The state of its market does not leave ADA in a healthy position as it trades as $0.92 support. While a Bitcoin pump could trigger some gains for ADA, it’s unlikely that bulls would be able to press the issue after taking into account the abovementioned macro factors.

Instead, market participants could rake in more rewards after ADA tags its demand zone of $0.77-$0.74 which was a ‘stronger bottom’ to buy the dip. The area had triggered a month-long uptrend between early March-early April, helping ADA record a near 60% increase in value. Technically speaking, such zones carry higher chances of leading a bullish reversal.

Furthermore, waiting for another downtrend could even give Cardano some room for its network to get back into shape for a more organic price pump.

Conclusion

Cardano’s chart and network activity suggest that a more dependable buy the dip moment would be available at $0.77-$0.74 and not at ADA’s press-time level. New investors are recommended to wait for another leg downwards before placing long bets in the market.