For the first time since July 2022, Cathie Wood’s company sold its Coinbase holdings towards the end of March 2023. In fact, that was also the time when several insiders including the Chief Executive Officer, Chief Legal Officer, Chief Accounting Officer, and Chief People Officer disposed of their individual COIN holdings.

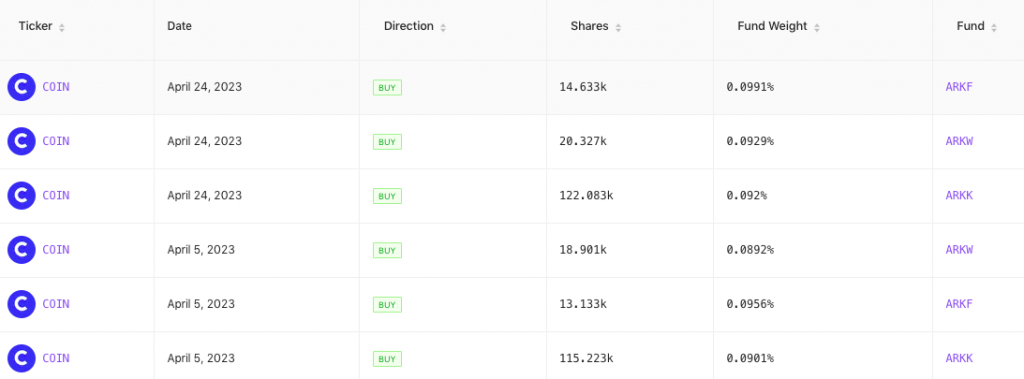

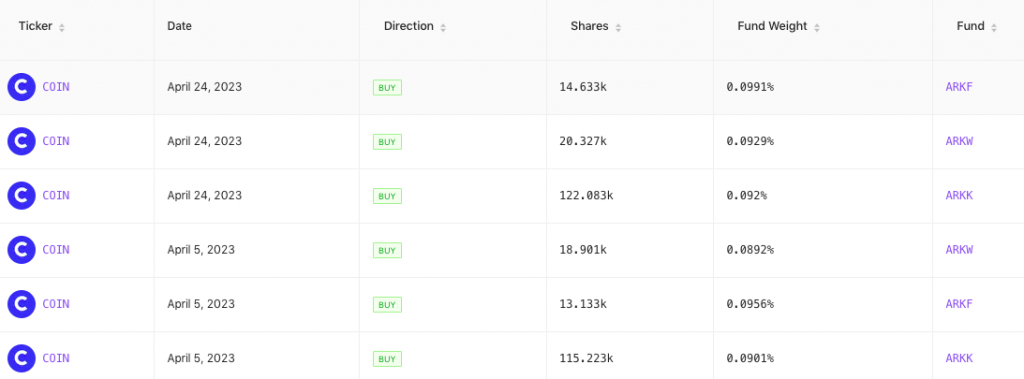

However now, ARK has already made up for it and replenished COIN shares. As tabulated below, the ARK Innovation ETF purchased 122.08k Coinbase on April 24, while the ARK Next Generation Internet ETF added 20.32k shares. The ARK Fintech Innovation ETF, on the other hand, bought 14.63 shares. In all, the purchase was worth about $8.6 million.

Also Read: Cathie Wood’s ARK, Coinbase CEO Dump Millions In COIN Shares

Well, this was not ARK’s first investment in Coinbase this quarter. On April 5, the investment management company bought another batch of shares via three separate transactions and added them to the same three funds. A total of 147.25k COIN shares were purchased at that time. ARK’s latest buy transactions come on the heels of Coinbase suing the SEC. As reported earlier today, Coinbase has requested the court to order the agency to reply to its demand for more clarity around crypto laws.

The exchange posed 50 specific concerns to the watchdog in a petition in July 2022. The same entailed questions regarding how particular digital assets should be regulated. Now, Coinbase has asked a federal court in the United States to order the SEC to respond “yes” or “no” to the petition.

Also Read: Coinbase Sues SEC, Seeking Regulatory Clarity For Crypto

Coinbase shares react

From the SEC suing a crypto company [Ripple] to a crypto company [Coinbase] suing the SEC, a full circle has been completed. In both cases, however, investors have been on their toes. With the ruling in the former case looming, participants have been accumulating XRP, and ARK’s latest purchase brings to light that smart money continues to flow into COIN. In mid-April, COIN was ranked one of the best-performing large-cap stocks of 2023. It has been able to achieve the feat by registering an 82% incline.

Over the past few days, however, COIN’s price has been on a downtrend. Over the past day alone, it has shed 7.27% of its value, while over the past five trading days, it’s down by around 22.2%. During the pre-market hours on Tuesday, April 25, COIN was priced at $54.4, a level lower than yesterday’s close.