As seen in the last couple of days, the crypto industry was challenged by the collapse of the prominent crypto exchange, FTX. The entire market was bleeding which further caused immense fear among investors. Bitcoin [BTC] despite surviving the harsh bear market without slipping below $18K, reached a two-year low. Several analysts believe that this was just the start of a significant downward spiral.

A recent report noted the possibility of Bitcoin plummeting to a low of $13,000. Strategists from JPMorgan Chase & Co. pointed out that a “cascade of margin calls” could be in the making between FTX as well as Alameda Research along with the whole industry.

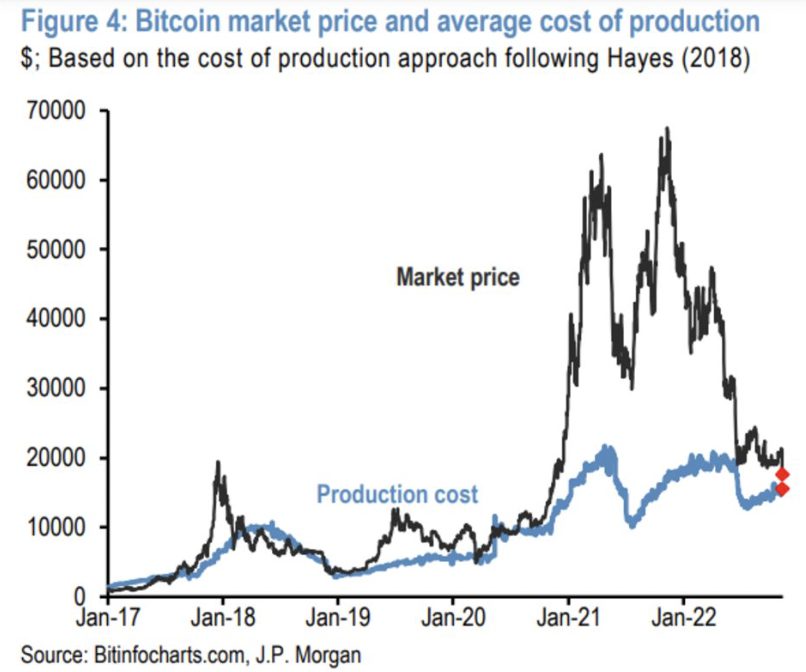

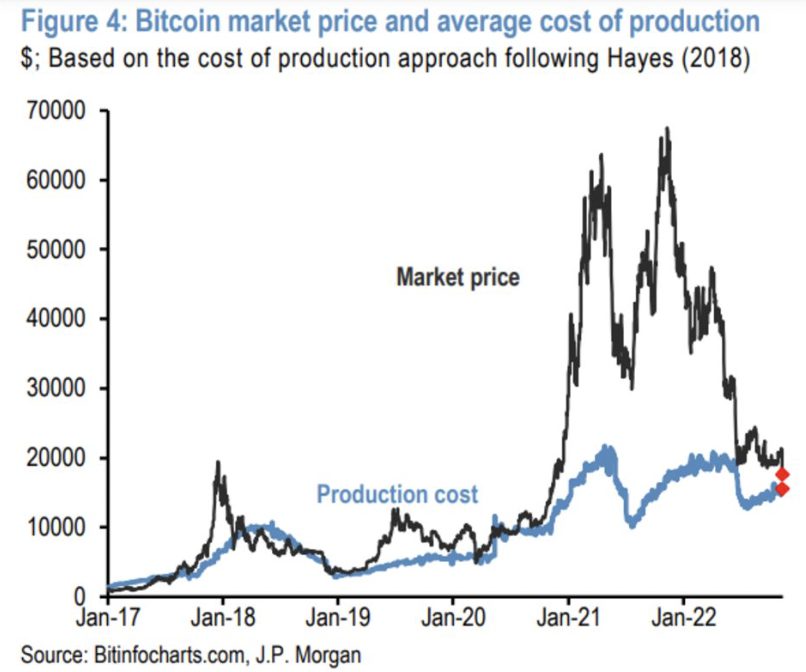

Taking into consideration Bitcoin’s production cost, these strategists noted that BTC entailed the chances of dropping to $13,000. Nikolaos Panigirtzoglou and his team wrote,

“At the moment, this production cost stands at $15,000, but it is likely to revisit the $13,000 low seen over the summer months.”

Elaborating on the same, the strategists said,

“What makes this new phase of crypto deleveraging induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets able to rescue those with low capital and high leverage is shrinking.”

It should be noted that this whole episode of FTX’s plummet caused havoc in the market. The world’s largest cryptocurrency had dropped to a low of $15,682.69 earlier today. As this FTX saga persists, the total BTC liquidated over the last 24 hours stood at $247.51 million.

Bitcoin hit achieved its all-time high exactly a year ago

On November 10, 2022, Bitcoin, the world’s largest cryptocurrency soared to an all-time high of $69K. At press time, however, BTC was trading for a low of $16,655.28 following a 9.46 percent daily drop. Certainly, a lot has changed in one year.

Considering the asset’s current price, BTC was 75 percent below its all-time high. If JP Morgan strategists’ prediction comes true, the market could be in for some more loss.