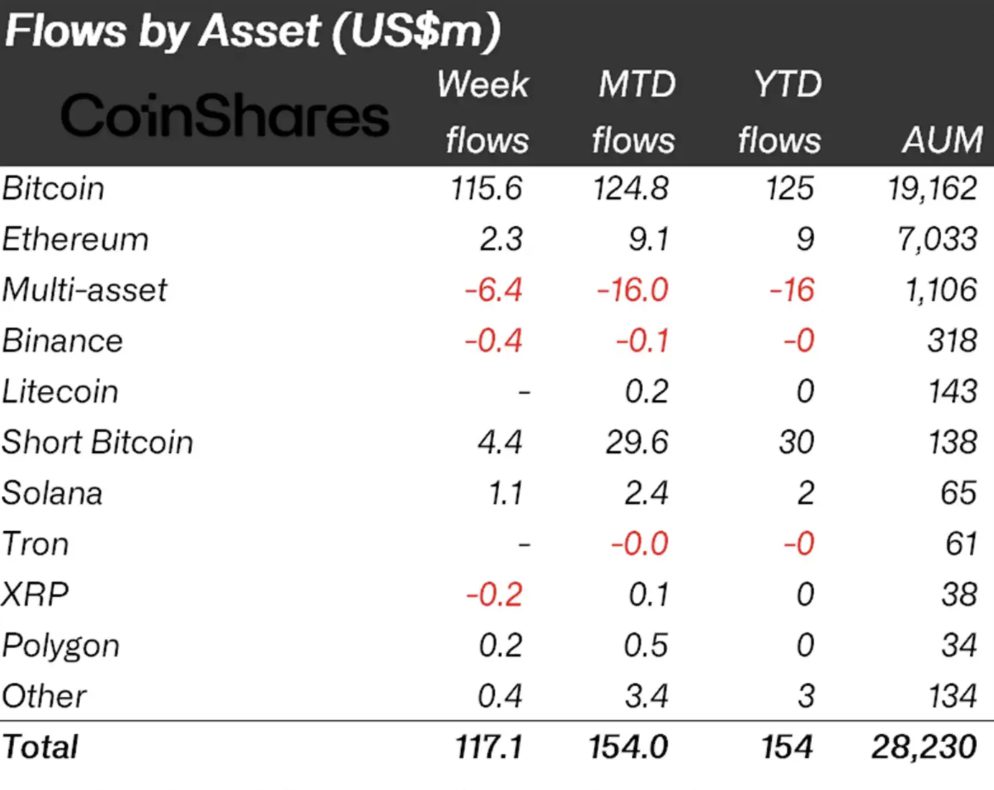

According to data curated by CoinShares, cryptocurrency investment products recorded weekly inflows of $117 million last week. It should be noted that this is the highest since July 2022. Bitcoin emerged as the star of the show accounting for $116 million in inflows. During the same time period, there were also a few dainty inflows into short Bitcoin totaling $4.4 million.

As seen in the chart, multi-asset crypto investment products have witnessed outflows for nine weeks now. These outflows were at $6.4 million. Bitcoin Cash [BCH], Stellar [XLM], and Uniswap [UNI] were also witnessing paltry outflows. However, Solana [SOL], Cardano [ADA], as well as Polygon [MATIC], were recording inflows.

In addition, the total assets under management [AuM] surged by 43% since its November lows. Currently, the AuM sits at $28 billion. The trading volume of these products also advanced, reaching $1.3 billion last week, up 17% from the average for the entire year. In contrast, the overall market saw an 11% increase in average weekly volumes.

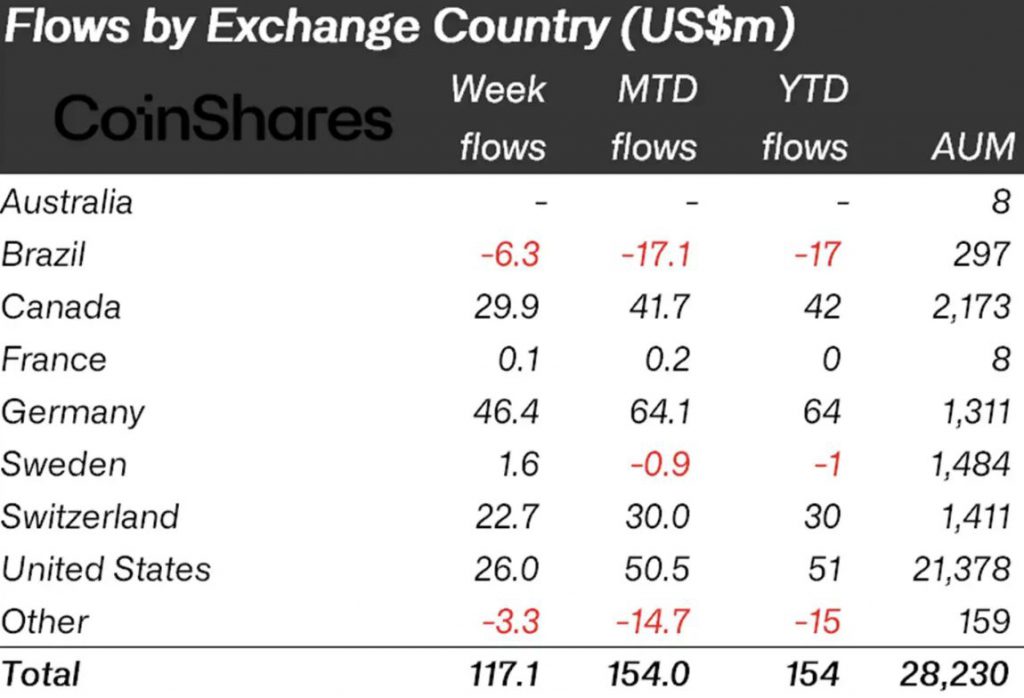

Germans veer into the crypto market

Moving over to geographical representation, Germany took the top spot in terms of inflows. The country accounted for $46 million of the total inflows. Canada, the United States, and Switzerland followed suit with $30 million, $26 million, and $23 million in inflows, respectively.

After a good week, the cryptocurrency market was undergoing correction. At press time, the world’s largest cryptocurrency was trading for $22,916.86 with a 2.88% daily drop. Nevertheless, since October 2021, Bitcoin markets have had their best monthly price performance.

According to Glassnode, this was mostly due to the increase in spot demand followed by a series of short squeezes. Furthermore, this induced profits into the market.