According to reports, crypto infrastructure firm Blockstream is seeking funds at a much lower valuation than earlier. Blockstream raised $210 million in August 2021 in a Series B investment round. At the time, the firm was valued at $3.2 billion. According to the report, the company’s worth has dropped by roughly 70% to less than $1 billion.

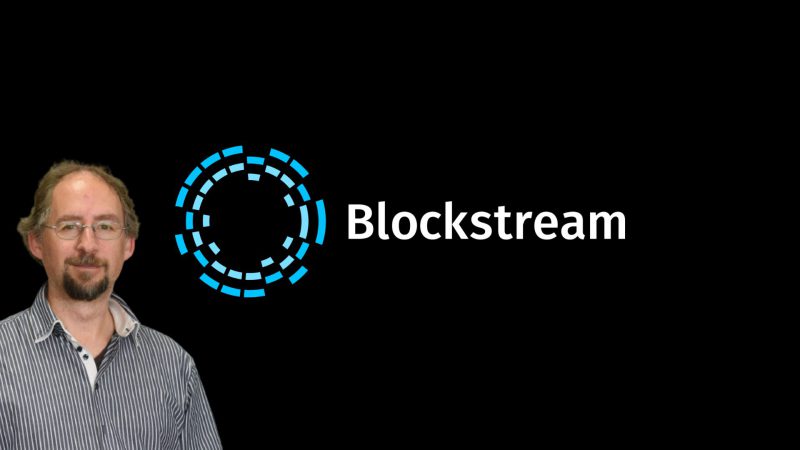

Adam Back, CEO of Blockstream, would not disclose the specifics of the investment round. However, he did say that the funds would be used to increase the company’s crypto-mining capacity. For those who do not know, Back is one of the suspected identities of Bitcoin creator Satoshi Nakamoto.

Back stated,

“We rapidly sold out all of the capacity and have a big backlog of existing and new customers with miners seeking large-scale hosting with us.”

Blockstream’s crypto-mining initiatives

The high difficulty, hash rates, high energy costs, and low BTC prices have put a lot of strain on bitcoin miners. Hashrate Index reported that, as a result, profitability, or hash price, has dropped to almost record-low levels of about $0.064 per TH/s per day.

Back noted that Bitcoin (BTC) prices and crypto mining profitability have taken a beating. However, he said that hosting fees had increased over the previous quarters. He further stated that “mining services are a rapidly expanding, high-margin enterprise business for us.”

To create a solar-powered Bitcoin mining facility, Blockstream is collaborating with Jack Dorsey’s Block (previously Square). Using Tesla’s solar technology and its 12 MWh lithium-ion “Megapack,” the mining farm will have an electricity capacity of 3.8 megawatts (MW).

Furthermore, Blockstream published its monthly newsletter on 5th December. The newsletter revealed that the Blockstream Mining Note (BMN) token generated a total return of about 5.37 BTC halfway through the three-year term. BMN is a security token that complies with EU regulations and gives authorized investors access to the Bitcoin hash rate at the company’s U.S. enterprise-grade mining.

At press time, Bitcoin (BTC) was trading at $16,995.37, down by 0.1% in the last 24 hours.