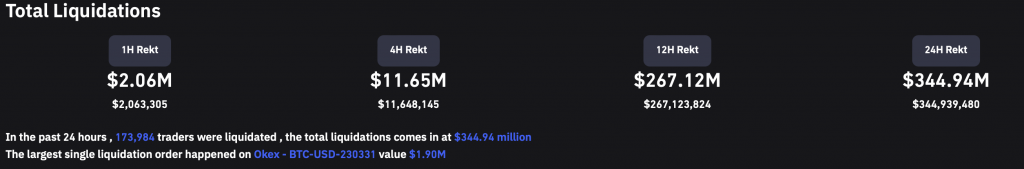

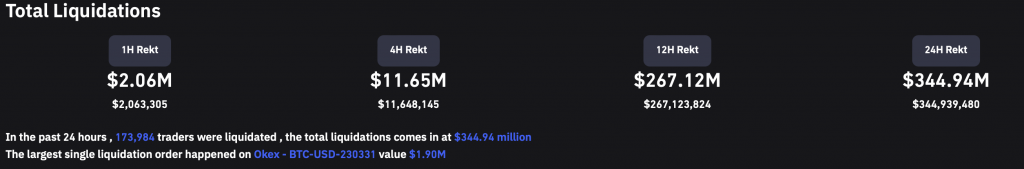

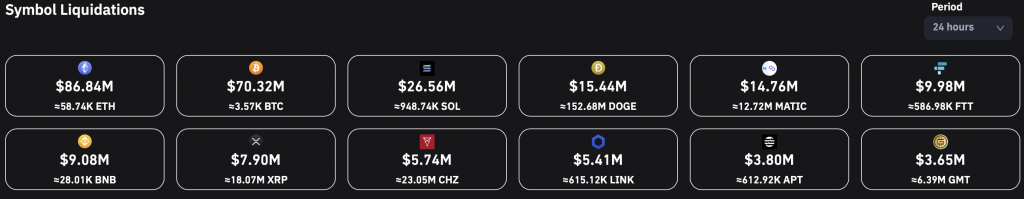

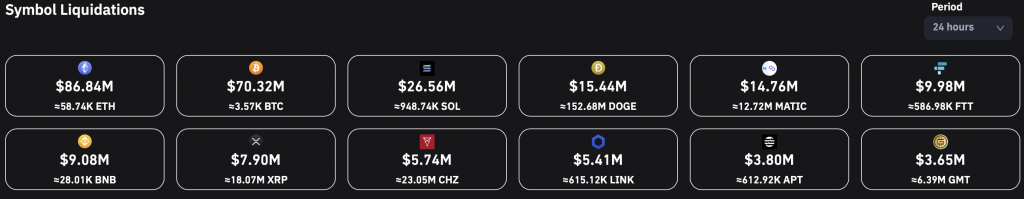

The crypto markets are entering another slump, as liquidations hit $344 million in the last 24-hours. Following the Binance-FTX situation, it is not surprising that the token pushing the liquidation is Ethereum (ETH).

After Binance decided to liquidate its FTT holdings, FTX began selling its ETH holdings to deploy as much capital as possible, leading to an increased selling pressure on ETH markets. FTX has removed almost 300,000 ETH from its coffers within the span of just a few days.

Following Ethereum is the original crypto, Bitcoin (BTC) at $70 million, followed by Solana (SOL), Dogecoin (DOGE) and Polygon (MATIC). Meanwhile FTT liquidations were at $9.98 million.

However the FTT liquidations are more likely due to the FUD that has surrounded the community. Many worry about the situation turning into another LUNA-like (now LUNC) collapse of the summer crypto market crash.

Binance CEO Changpeng Zhao (CZ) has accused FTX chief Sam Bankman-Fried of lobbying against other industry players. SBF has said that it is only a matter of a competitor going after them with “false rumors.”

What else is pushing crypto liquidations?

The Binance-FTX situation has taken over the market sentiment, but it is not the only thing worrying investors.

The U.S. mid-term elections are here, and like always, elections have the potential to bring in fresh volatility. Secondly, the U.S. Federal Reserve is set to release its inflation data for the month of October. Inflation is expected to hit 7.9%, 0.3% lower than September. Many are hopeful that the FED will go easy on interest rates once inflation shows signs of easing. However, it is unlikely to happen anytime soon, as FED chair, Jerome Powell, has stated that the body will do everything in its power to curb inflation.

At press time, the global crypto market cap stood at $1.03 trillion, down by 4.4% in the last 24-hours.