According to Arcane Research, futures premiums for cryptocurrency derivatives have grown over the last week. The 3-month basis for Binance is reaching highs not seen since April 2022. However, open interest in Binance futures, now at 6,600 BTC, is relatively low.

The CME basis has also made a significant comeback over the past two weeks and is now at 0.7%, the highest since September 2022. The development indicates that institutional trader sentiment is growing. Additionally, Arcane adds that for the first time since early November, CME’s near-term futures structure is no longer in backwardation. The implication is that institutional traders are more comfortable investing in longer-dated maturities for cryptocurrency derivatives.

However, from 2019 to November 2021, CME futures tended to trade at an annualized premium ranging from 5-15%. Therefore, even with premiums increasing, futures continue to trade at conservative levels compared to the usual before the disastrous bear market of 2022.

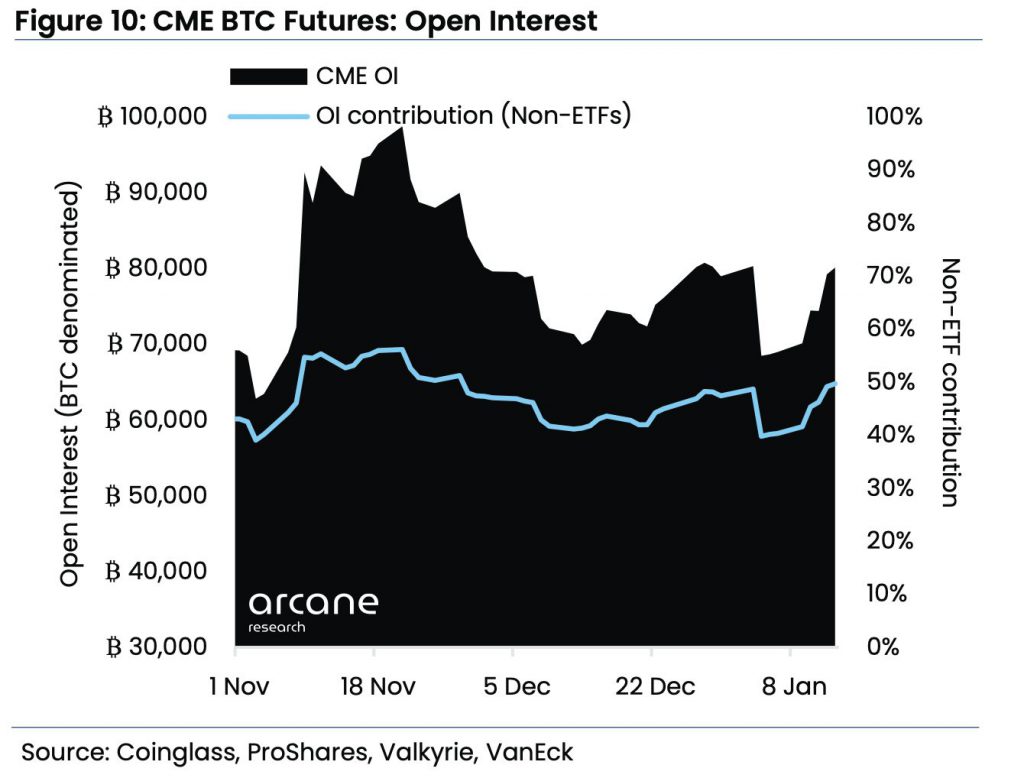

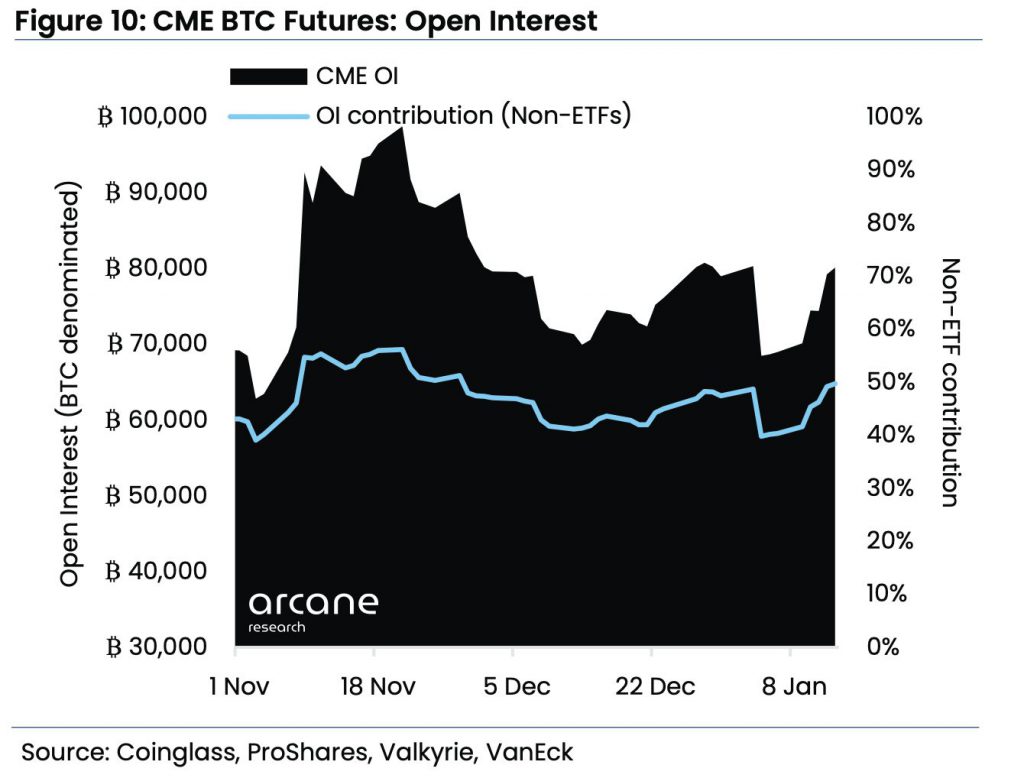

Last week, the ETFs offered by ProShares contributed a positive net flow. The main reason for this is the substantial withdrawals from the ProShares BITI short BTC ETF. The levels are now comparable to that from before FTX’s collapse. BITI presently owns an exposure equal to 4,435 BTC, and its short position has decreased by 27% YTD.

Growing active market participant activity on CME coincided with the previous week’s strong rally. Contribution to OI increased from 42% to 50%, while CME’s OI increased to 80k BTC.

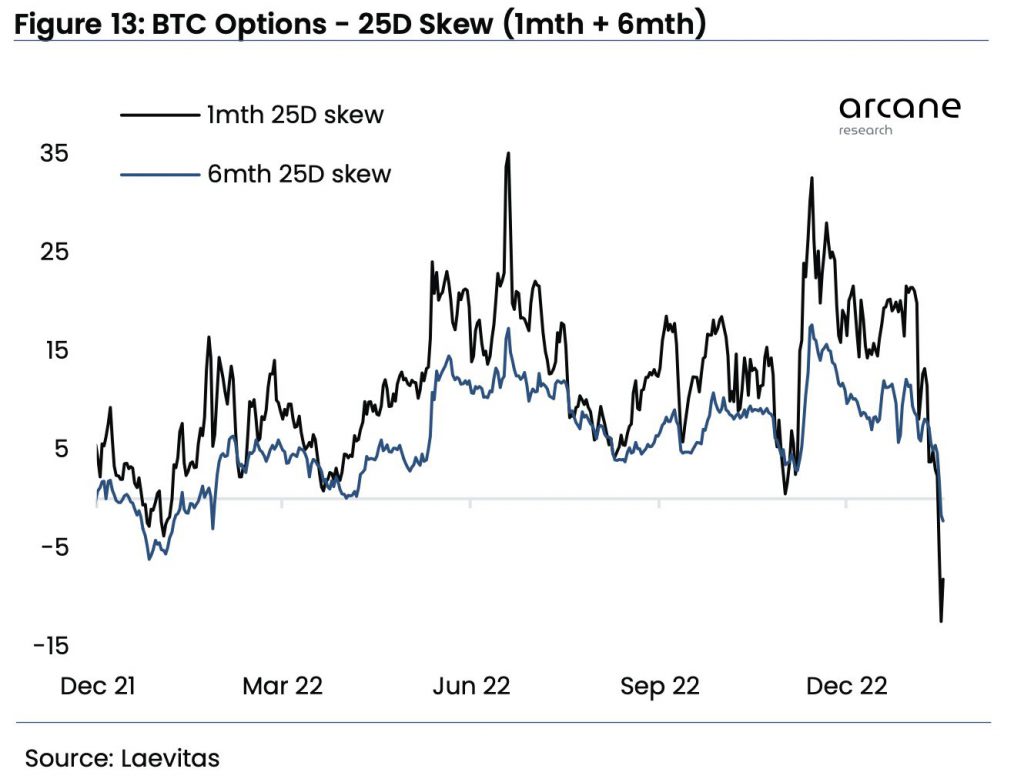

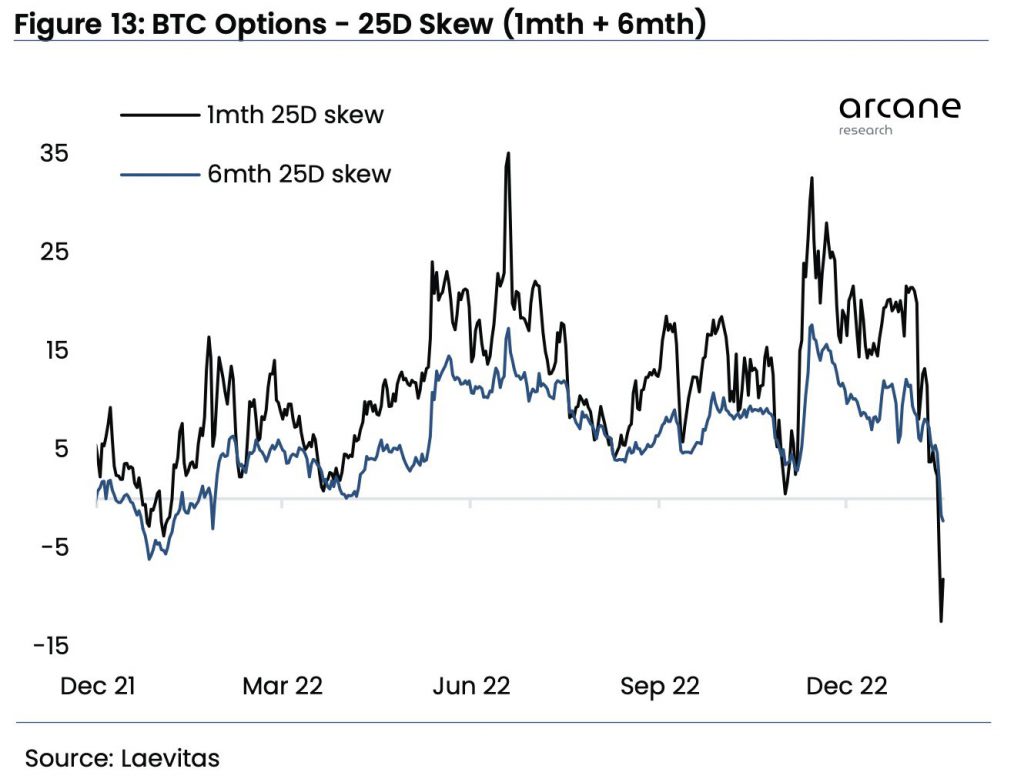

Cryptocurrency options traders bullish after a year?

Since January 2022, options traders are now pricing in a bullish premium for the first time. As calls are more in demand than puts, the 1mth 25D skew and the 6mth 25D skew are both negative.

After a year of drought, and with the help of strong momentum, we are finally seeing the indications of optimism in futures, options, and futures contracts as a result of last week’s price action. Short traders seem to have learned from the previous week’s movements.