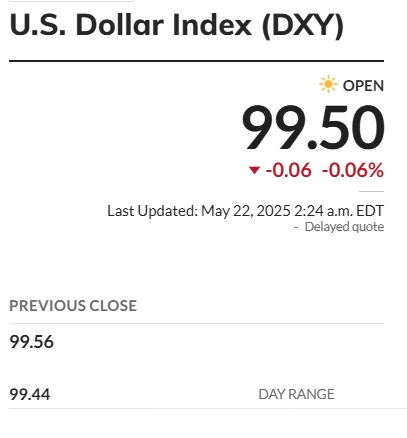

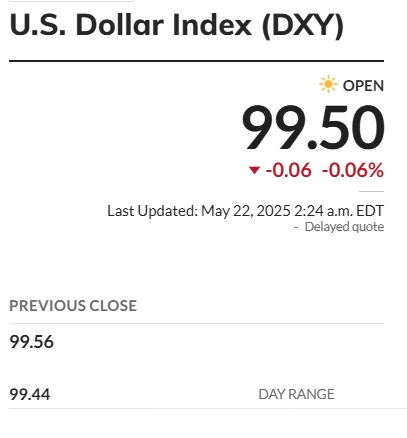

The DXY index, which tracks the performance of the US dollar, fell to the 99 level again on Thursday. The world’s reserve currency is being outperformed by local currencies on the global stage in Q2. The greenback is already down against eight out of nine leading currencies in the last two months. Despite repeated attempts by the Federal Reserve to get the USD on track, the currency is going off the rails.

Also Read: De-dollarization: Trump’s 10% Tariffs Fuel Fragile US Dollar Future in Asia

“There’s plenty of room for further depreciation, purely from a valuation perspective,” said George Vessey to Reuters, lead FX and Macro Strategist at payments firm Convera. The Trump administration’s US exceptionalism is making other countries cut ties with the dollar-backed assets. Many countries are diversifying their reserves with gold and other leading currencies by offloading US financial assets.

The long-term fiscal debt is also concerning many nations as it reached $36.2 trillion in 2025. Keeping the US dollar in central bank reserves is now a risky affair if the American economy enters a recession. Other nations will have to bear the brunt of the declining American economy, making their respective GDPs plunge. Holding American assets is now considered risky, but was once the bedrock of all global finances.

Also Read: Ripple Price Prediction: $5K in XRP Could Flip Your Future with 580% as ETF Launches

Currency: US Dollar Has More Room For Depreciation

Leading financial strategists from global banks remain bearish on the US dollar’s prospects. They are concerned about the fiscal picture of the American economy and the direction it is headed. “The dollar weakness story is not over,” said Steve Englander, the Global Head of FX Research at Standard Chartered.

Also Read: OKX Drops 1:1 Bitcoin Token on Solana, Sui & Aptos, DeFi Gamechanger

The diminishing appetite for the US-backed financial assets and the dollar could shake the American economy next. In addition, the rigid process of making trade policies with the Trump administration will add to the burden. Other analysts claim that Trump is deliberately trying to crash the US markets, read here to know why.