Meme coins have been taking over the market. Several meme-inspired cryptocurrencies have been stealing the limelight from increased adoption to their ever-surging holder count. Dogecoin [DOGE], the OG meme crypto, made big news throughout the last couple of months. The cryptocurrency was being dragged into Elon Musk’s Twitter acquisition all along. Despite the letdown, DOGE maintained its following and, in fact, managed to acquire a few new investors.

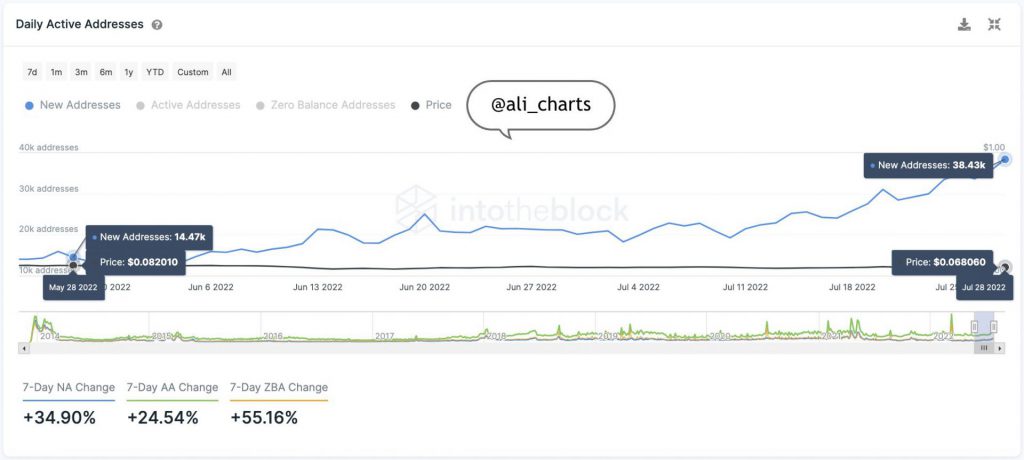

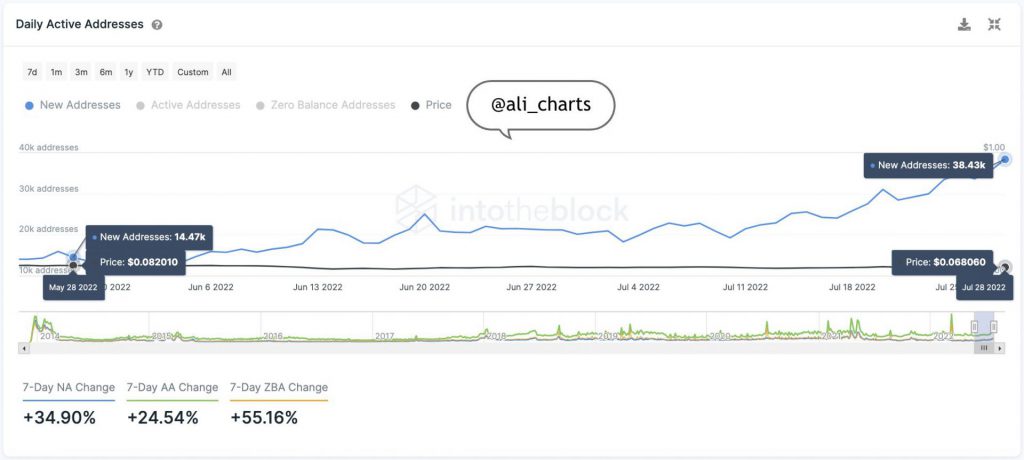

A recent chart revealed that Elon Musk’s favorite cryptocurrency had several enthusiasts, irrespective of its depleting price. Crypto trader Ali Martinez shared a tweet elaborating on the recent surge in daily Dogecoin addresses. It was noted that the network witnessed a whopping 265 percent surge in two months. The number of addresses ranged from 14,470 to 38,430, as per Martinez.

This network growth is not surprising as Dogecoin’s counterpart Shiba Inu has been experiencing a similar surge. The total number of Shiba Inu addresses stands at 1,214,637 as of 28th July. It should further be noted that this was the network’s all-time high.

Dogecoin has been experiencing quite a slump. The bear’s dominance caused immense damage to the cryptocurrency market, and billions of dollars were washed away. At press time, DOGE was trading for $0.06775. It should be noted that its current price is over 90 percent below its all-time high of $0.7376.

Additionally, this could soon change as its current network growth could spruce up the asset’s price. Martinez further tweeted,

“The increasing network growth is a positive sign, which could soon be reflected in #DOGE price.”

Binance onboard Dogecoin into its Liquid Swap program

The Binance Liquid Swap program allows users to swap between two crypto assets in a smart contract-based liquidity pool. This can be done by simply adding tokens into the pools to attain rewards for playing the role of liquidity providers.

Along with other assets like Shiba Inu, Chainlink [LINK], and Litecoin [LTC], Dogecoin made it to the list. Since liquidity pools often charge lower costs than centralized exchanges, traders are drawn to them.

Furthermore, since liquidity pools often charge lower costs than centralized exchanges, traders are drawn to them.