Top tokens in the DeFi market have had a mixed week of trade following Bitcoin’s resurgence above $38K. The likes of LUNA, AVAX, and UNI recorded distinct ROI’s and a quick technical analysis shows clear winners and losers in the week ahead.

Terra (LUNA)

Biggest DeFi loser of the week LUNA bagged a negative 30% Return on Investment after a symmetrical triangle breakdown turned into a disastrous sell-off. Its overall bullish narrative would now be tested at the daily 200-SMA (green), which was also responsible to flip LUNA’s successive chain of lower highs. The long-term moving average line last flipped bearish during extreme market FUD in May 2021. Although a good buy opportunity was present around $45, LUNA’s week ahead would largely depend on whether its price can rebound from this critical region.

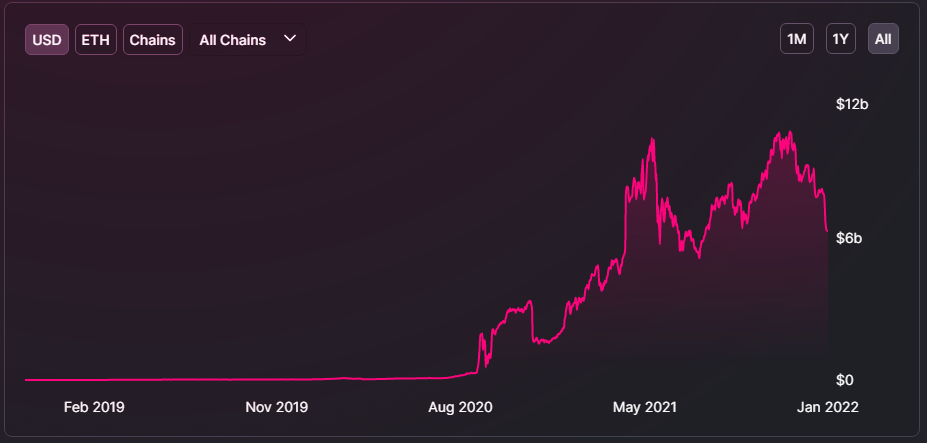

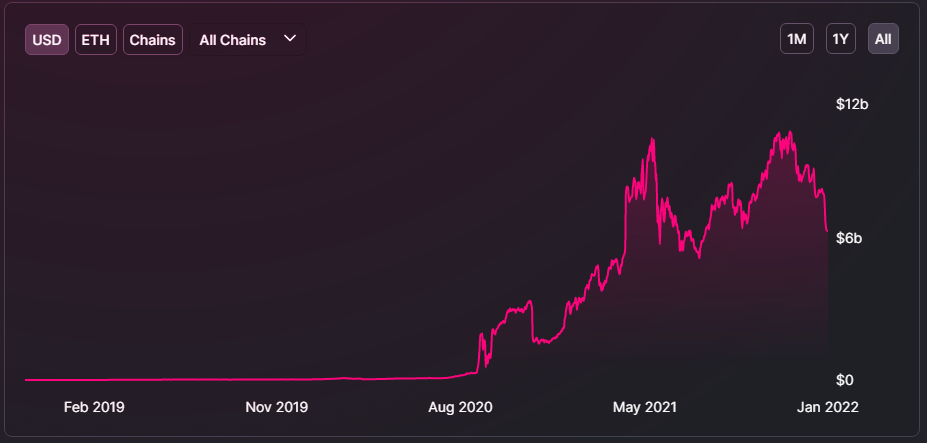

Meanwhile, LUNA’s decline has also coincided with a steady drop in Terra’s Total Value Locked. TVL represents the number of assets that are currently being staked in a specific protocol and is an important metric for judging the health of a DeFi platform. Data from Defipulse showed that Terra’s TVL began to decline soon after Bitcoin’s crash below $50K in late December. At the time of writing, the current TVL stood just above $13 Billion, down by 2.5% over the last 24 hours.

Avalanche (AVAX) Best of the DeFi?

Boasting a weekly return of 8%, Avalanche’s AVAX followed Bitcoin’s path to recovery this week. Bulls have established a base at the 23.6% Fibonacci level (calculated from AVAX’s decline from $88 to $53) and flipped the daily 200-SMA (green) to bullish. However, it’s worth noting that a bear flag was still active on its daily chart and a sell-off would be in effect if AVAX breaks its streak of higher lows below the 38.2% Fibonacci level. Conversely, a lot of pressure would be lifted once AVAX bulls continue to progress above a region of supply at $75. Overall, AVAX looked at a generally favorable week of trade.

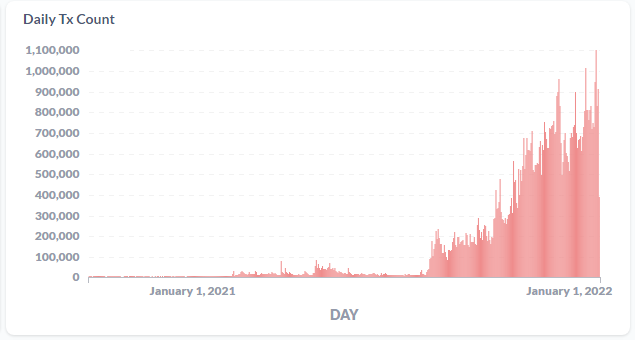

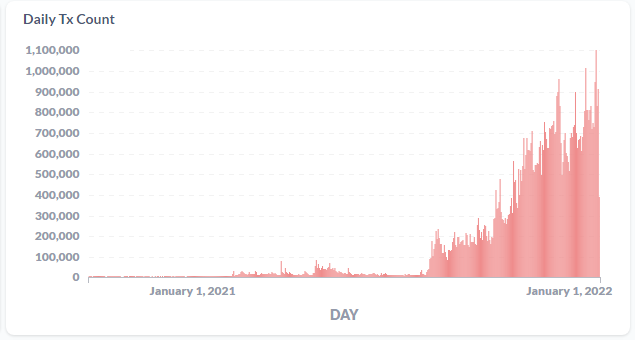

Meanwhile, the network’s growth was backed by rising daily transaction counts which peaked at over 1.1 Million on 27 January. There were some slight discrepancies with respect to monthly active addresses (not shown) but January’s count of 775,149 was not too far off from December’s peak of 797,894.

Uniswap (UNI)

At first glance, Uniswap’s weekly losses of 3% were not as terrible as some of its other counterparts in the DeFi market. However, the daily chart painted a rather dire picture. The candles have traded below their daily 200-SMA (green) for nearly 80 days now and short-selling was a major threat next week. Losses would particularly magnify if UNI fails to hold above $9.8-support. The next safe zone rested only at $7.14-$8.70. While bulls could put up a fight next week, a bull run would mostly be restricted below $13.8.

Similar to the Terra network, users were reluctant to lock their tokens in the Uniswap network amidst an uncertain broader market. In fact, at press time, its TVL clocked in at $10.5 Billion, down by an astounding 40% from a $10.7 Billion record in early December.

Conclusion

To sum it up, Avalanche was at a relatively safer level than its counterparts and was favored to beat its rivals next week. On the other hand, Uniswap investors could be in for a rough week unless the price recovers above $13.8.