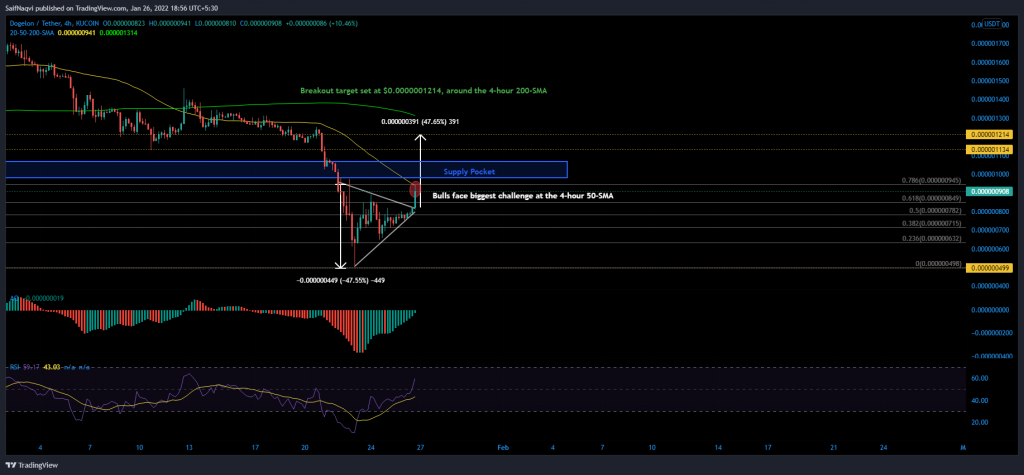

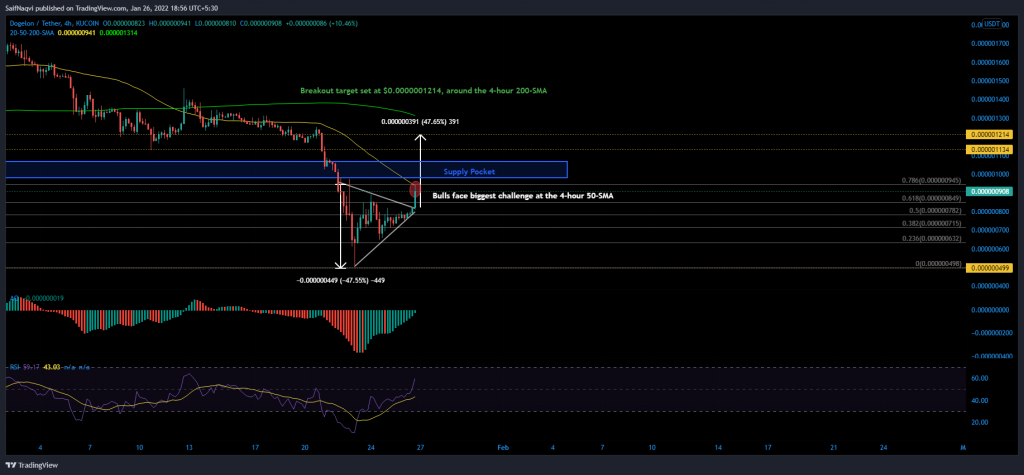

A symmetrical triangle breakout Dogelon Mar’s hourly chart presented chances of a 45% hike on the chart. However, bulls had to flip a number of price barriers to fully realize ELON’s target.

ELON 4-hour time frame

Two large green candles appeared on Dogelon Mars’ hourly chart after its price broke north from a symmetrical triangle. A 45% upside target was calculated by using the highest and lowest point within the pattern.

READ ALSO: Dogelon Mars Price Prediction: Investors should look to buy at this range

To fully realize its goal, ELON had to press forward with healthy volumes and flip some important resistance areas. Bulls faced their biggest test at the 78.6% Fibonacci Retracement level (identified through ELON’s dip from $0.0000001090 to $0.000000498). The region harbored the hourly 200-SMA (now shown) and 4-hour 50-SMA (yellow). From there, ELON had to challenge a supply pocket between $0.0000009772-$0.0000001065 to reach its target at $0.0000001214.

Should a large number of investors use either of the above-mentioned levels as take-profits, the price would be at risk of correction anywhere between 10%-17%. In fact, more pain can be expected in case an hourly candle closes below the crucial 50% Fibonacci level. The resulting breakdown would likely see bears extend losses to 23 January swing low of $0.000000500.

Indicators

Bullish breakouts are often backed by green signals on the indicators. Hence, it was no surprise to see the MACD and Awesome Oscillator side with the buying side. The RSI shifted above 55 for the first time in nearly two weeks while the Awesome Oscillator maintained a chain of green bars. However, price levels and volumes offer more insight when a breakout occurs and observers should not rely heavily on just the indicators alone.

READ ALSO: Binance Coin Price Prediction: Can bulls resist this bearish setup?

Conclusion

Those who have missed out on ELON’s breakout must hold back until a correction is observed. The price was up by 16% from its breakout point and a number of attractive take-profit zones would halt another 29% ascent to $0.0000001214. Instead, a better call would be too short if ELON closes below the 50% Fibonacci level.