Ethereum has had a woeful performance in April following a chain of Bitcoin corrections. Monthly losses of 20% indicate bearish sentiment among retail traders, who have dumped more Ethereum this month than Bitcoin. However, Ethereum’s proof-of-stake transition is drawing closer, and staking on the ETH2 deposit contract continues to reach new heights. Will this be enough to save Ethereum’s near-term price?

On Friday, the deposit contract for staking Ethereum (ETH2.0) on the Beacon chain touched a balance of 12 million ETH, bringing the total locked value of Ether in the contract to$34.5 billion. With Friday’s addition, the eth2 contract now holds an enormous 10% of ETH’s circulating supply.

Since a large number of users were staking their ETH tokens to earn passive rewards rather than risk trading them in the open market, the development suggested that confidence in Ethereum’s long-term success continues to remain high despite broader market fluctuations.

Ethereum’s transition to a proof-of-stake blockchain will take place in several stages, with the Beacon Chain identified as the first major step towards a new consensus model. The end of the final ‘merge’ phase would completely unite Ethereum’s old proof-of-work blockchain with the new proof-of-stake blockchain, called the ‘consensus layer’. The consensus layer holds the Ethereum 2.0 deposit contract on which validators stake their ETH tokens.

Ethereum 2.0 – March flashbacks?

With demand for Ethereum’s network rising each as a major change approaches, many expect that the near-term bearish bias would also quickly fade away. Right? Well, not exactly.

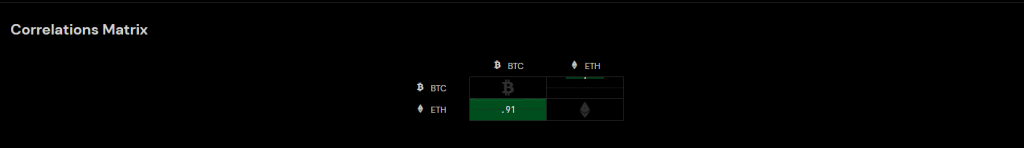

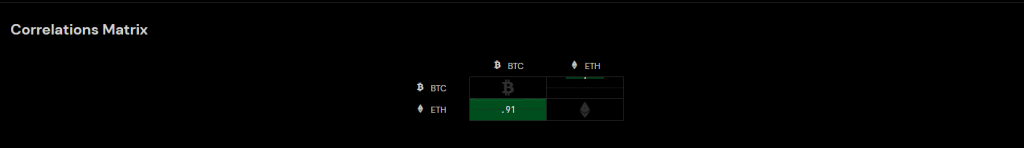

Currently, Ethereum shares a high 0.91 correlation with Bitcoin and is extremely susceptible to broader market changes. Bitcoin’s dominance index is also on the verge of a critical breakout that could strengthen its presence against altcoins. In short, there’s still some time to pass before Ethereum can detach from Bitcoin’s shadow and move on its own accord.

To understand this further, one must take a step back. Back in March, Ethereum’s 2.0 staking contract had hit a new high of $10 Million Ether, representing 8.3% of its circulating supply. Arcane Research had used the funding to suggest that investors believed in ETH’s future regardless of broader market uncertainties. While ETH did touch a local high at $3,500 weeks after the report, its downtrend in April showed that ETH was still mirroring Bitcoin’s movement.

Conclusion

It’s unlikely that healthy staking on ETH2.0 is a silver lining to Ethereum’s short-term narrative. The altcoin’s price is still lagging behind Bitcoin is very much dependent on it for its short-term movement. Will that change heading into the second quarter of 2022? That’s also doubtful, so long as Bitcoin’s dominance index becomes stronger in the days to come.