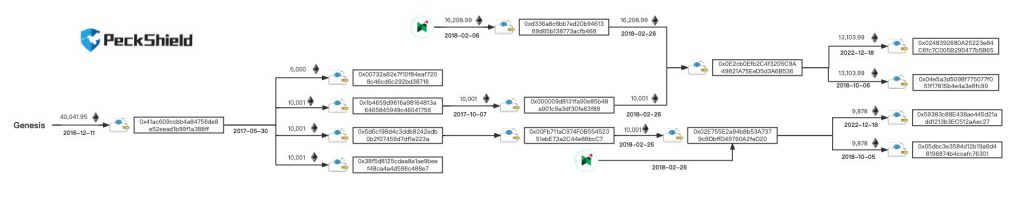

According to PeckShield, two dormant addresses have sprung back to life after almost four years to transfer Ethereum worth $27.2 million to two new addresses. As per the crypto analysis firm, two transfers of 13,103.99 ETH and 9,878 ETH were made from Genesis and Poloniex, respectively.

The ETH tokens in question have not moved since October 2018. Back then, the price of ETH was roughly between $190 to $230. However, on transfer day, ETH was priced at almost $1,200.

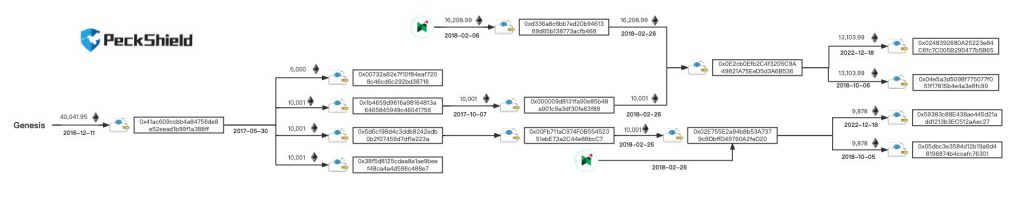

Additionally, PeckShield provided a flowchart outlining the historical movement of the assets. The chart shows how the assets moved from the trading platforms to the new locations over time. Although no information has been made public, the community theorizes that there may be connections to financial collateral for a project.

Investors in crypto frequently turn to Bitcoin (BTC) and Ethereum (ETH) to avoid temporary losses during bear markets. Therefore, the community is intrigued by the movement of such assets.

Why else could Ethereum have moved?

Ethereum’s profitability, according to IntoTheBlock, dropped below the 50% mark and hit 45%. In contrast to other assets, this is still seen as neutral. But it is below average for Ethereum, which has traditionally generated profits for most of its investors.

According to the data, the vast majority of Ethereum owners are experiencing unrealized losses. It will become progressively more difficult for Ethereum to succeed in the future if this trend persists. Investors who continue to retain assets despite unrealized losses are more likely to sell them after breaking even rather than waiting for them to turn lucrative.

The market price of Ethereum is significantly influenced by two factors: the burn rate and the declining trends in profitability. In the last 48 hours, Ethereum fell below the critical level of $1,200 and hit a two-week low.

At press time, ETH was trading at $1,181.52, down by 0.4% in the last 24 hours.